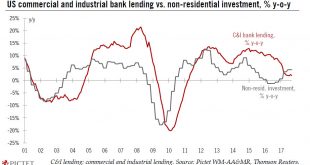

US business sentiment is solid, yet bank lending remains muted, making us cautious about the outlook for investment growth.US business activity seems to be continuing apace and all forward-looking indicators, in particular sentiment surveys, are flashing green. But there is an important blemish in this otherwise rosy picture: bank lending has been soft, and recent data is not showing any signs of an uptick. In September, commercial and industrial (C&I) bank lending was up 2.0% y-o-y,...

Read More »Chinese growth forecast remains intact

Q3 growth figures were in line with our expectations and confirmed ongoing changes in the structure of the Chinese economy. Our forecast for Chinese GDP growth remains unchanged.Chinese GDP for Q3 2017 came in at Rmb21.2 trillion (USD3.2 trillion), growing by 6.8% y-o-y in real terms, slightly below the pace of expansion in the first half of the year (6.9%).Several points are worth highlighting.First, China’s economic transition is well underway. The tertiary sector, mainly services,...

Read More »ECB preview: slower, longer, stronger

Recent signals suggest that the ECB is likely to announce next week the extension its asset purchases for nine months, at a reduced pace of EUR30bn. We expect corporate bonds to form a bigger part of total purchases.Recent ECB communication has been remarkably consistent in signalling a ‘slower for longer’ QE extension into 2018. In light of these signals, we expect the ECB to announce at its 26 October meeting that asset purchases will be extended for nine months, until at least September...

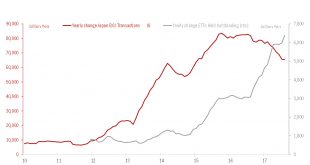

Read More »The BoJ’s ETF purchases mark a major shift for Japanese equity market

Through its asset purchase programme, the Bank of Japan owns 4% of the TOPIX’s market capitalisation and two-thirds of Japanese equity ETFs.Although it has made no major monetary policy announcement since September 2016, the Bank of Japan (BoJ) has actually been tapering its government bond purchases ever since. As a result, equity ETF purchases have steadily increased over the past year from 3% of total BoJ purchases to 9% recently, above the initial implicit target of 7%.The central bank...

Read More »Suspense in Catalonia

There are increasing chances that Madrid will impose direct rule on Catalonia. A prolonged stand-off could end up depressing activity, but for now we are not revising our growth outlook for Spain.This morning, the Catalan president failed to answer clearly whether Catalonia had declared independence or not. He reiterated that he had placed last week’s unilateral declaration of independence on hold in order to open up a “two-month process” to try to reach a deal with the central...

Read More »Euroscepticism is making less of a splash

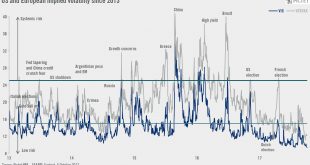

Renewed political risks are leading to very limited repricing of the sovereign risk premiums.A Catalan crisis, a Dutch eurosceptic-leaning government coalition, the return of Austrian populists, difficult German coalition talks… Eurosceptics have had plenty of opportunities to make a comeback, and yet the market continues to trade each event as largely idiosyncratic in nature.Explanations abound for the resilience of peripheral markets to political risks, including a stronger and broad-based...

Read More »Are French reforms for real?

Macronomics could well accelerate the closing of the growth gap with Germany and improve the outlook for French equities.The first major piece of President Emmanuel Macron’s agenda, the business- friendly labour market reform, was signed into law last month. Some Macron measures may have adverse effects in the short term and some others are not fully financed and difficult to quantify, but overall they should boost purchasing power, investment and productivity. The government has been...

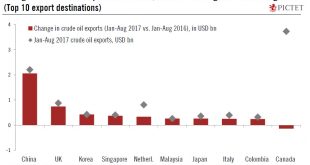

Read More »China is gobbling up US crude oil exports

While US oil production continues to grow, the increase in oil sales to China could help moderate Trump administration invectives against China.The ‘revolution’ in tight oil production means that US oil production is about to break the annual record of 9.6 million barrels per day (mb/d) reached in 1970. Under rising pressure from oil producers, the Obama administration significantly loosened rules on crude oil exports, which have boomed. But where is all this oil going?China has accounted...

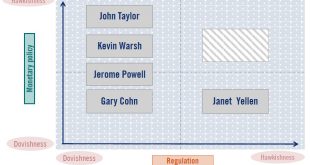

Read More »New Fed Chair—Change or Continuity?

Markets are speculating about the potential hawkishness of the Fed’s next chairperson, but we doubt there will be any ‘regime change’ in monetary policy.The Trump White House has reportedly narrowed the list of candidates for the role of Fed Chair to five people, and a decision could be announced in the coming days.The initial market reaction could be guided by the perceived hawkishness of any nominee compared with Janet Yellen. John Taylor and Kevin Warsh are perhaps the most hawkish of the...

Read More »House View, October 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationHeadline volatility on equity markets remains low, and given robust economic and earnings growth we are still constructive on equities, particularly the euro area and Japan. We are neutral on the US, selective on Swiss stocks, and underweight the UK.However, there are signs of pressure, notably in forex markets, and headline volatility could rise in the coming months. Moreover, geopolitical risk remains...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org