The latest signs that wages are picking up together with drops in unemployment should help push the ECB along the road of policy normalisation.Wage growth is an important input in the ECB’s reaction function, and so far it has failed to respond to the narrowing of the output gap. It could be the normal behaviour of a lagging indicator, especially as labour market slack is likely to be larger than what the drop in headline unemployment would suggest. Or, it could be that “the slope of the Phillips curve may steepen again when the economy reaches and surpasses full potential”, as Mario Draghi said in Sintra. ECB’s work suggests that wage and price setting behaviour have changed during the crisis in ways that slow the responsiveness of inflation.This week’s indicators were consistent with a

Topics:

Frederik Ducrozet considers the following as important: ECB inflation, ECB policy normalisation, Euro area wage growth, Macroview, Phillips Curve

This could be interesting, too:

Dirk Niepelt writes The New Keynesian Model and Reality

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

The latest signs that wages are picking up together with drops in unemployment should help push the ECB along the road of policy normalisation.

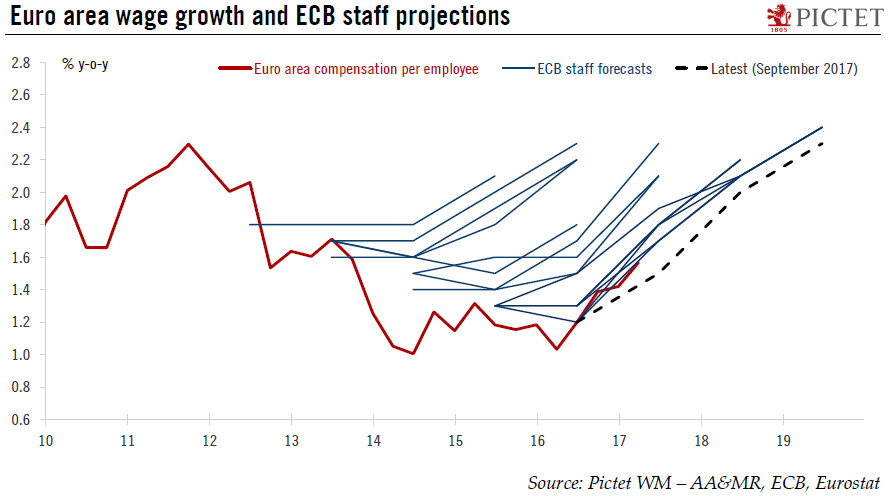

Wage growth is an important input in the ECB’s reaction function, and so far it has failed to respond to the narrowing of the output gap. It could be the normal behaviour of a lagging indicator, especially as labour market slack is likely to be larger than what the drop in headline unemployment would suggest. Or, it could be that “the slope of the Phillips curve may steepen again when the economy reaches and surpasses full potential”, as Mario Draghi said in Sintra. ECB’s work suggests that wage and price setting behaviour have changed during the crisis in ways that slow the responsiveness of inflation.

This week’s indicators were consistent with a gradual pick-up in wage growth, from low levels. Euro area compensation per employee rose from 1.4% to 1.6% y-o-y in Q2 (its highest level since Q4 2013), alongside with upward revisions which pushed quarterly annualised growth rates close to 2% at the turn of the year. Meanwhile, hourly wage growth in the private sector (excluding construction) increased to from 1.4% to 2.2% y-o-y in Q2, its highest level since Q1 2015.

For the first time since QE started, the ECB staff could be in a position to revise its wage growth projections higher at the December policy meeting. Any further improvement in wage growth, alongside a pick-up in core inflation, will help the ECB to justify an exit from unconventional measures. We still expect asset purchases to be scaled down to EUR40bn for between January and June 2018, with risks tilted towards a ‘slower for longer’ extension.