Better-than-expected Flash PMI numbers in September mean that the quarter is ending on a strong note, with some upside risks ahead.Flash PMI surveys for the euro area ended the third quarter on a strong note. The composite flash PMI increased to 56.7 in September from 55.7 in August against consensus expectations for a stable print (55.6).The breakdown by sub-indices showed pretty strong signals in most forward-looking components, with the sole weak spot manufacturing new export orders. Importantly, Markit mentioned that the survey showed some signs of capacity being stretched.At 56.0 on average in Q3, the composite PMI is consistent with GDP growth of 0.62% quarter-on-quarter in Q3, cooling down from what business surveys suggest was the level in Q2 (0.70% q-o-q). Even after the latest

Topics:

Nadia Gharbi considers the following as important: euro area composite PMI, Euro area GDP growth, Euro area PMI, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Better-than-expected Flash PMI numbers in September mean that the quarter is ending on a strong note, with some upside risks ahead.

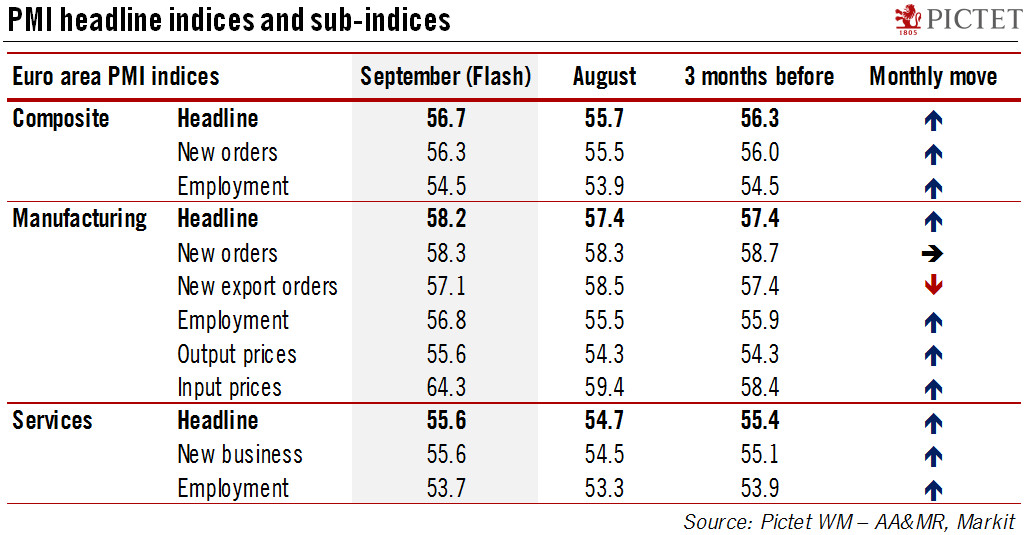

Flash PMI surveys for the euro area ended the third quarter on a strong note. The composite flash PMI increased to 56.7 in September from 55.7 in August against consensus expectations for a stable print (55.6).

The breakdown by sub-indices showed pretty strong signals in most forward-looking components, with the sole weak spot manufacturing new export orders. Importantly, Markit mentioned that the survey showed some signs of capacity being stretched.

At 56.0 on average in Q3, the composite PMI is consistent with GDP growth of 0.62% quarter-on-quarter in Q3, cooling down from what business surveys suggest was the level in Q2 (0.70% q-o-q). Even after the latest revisions to past GDP data and to our forecasts (currently at 2.1% for the euro area for 2017 as a whole), we continue to see a number of upside risks.