With important decisions on the future of its bond-buying programme looming, what are the ECB’s options?The European Central Bank (ECB) is expected to announce the bulk of its decisions on quantitative easing (QE) at its 26 October meeting. We would expect a broad commitment to extend QE beyond 2017 at a reduced pace, but several options are possible and additional technical details could be postponed to the 14 December meeting. Our baseline scenario remains that asset purchases will be scaled down to EUR40bn per month from the current rate of EUR60bn per month between January and June 2018, before being wound down to zero in the course of H2 2018. But the risks are being tilted towards a ‘slower for longer’ extension. But the final decision will depend on the ECB’s assessment of two

Topics:

Frederik Ducrozet considers the following as important: ECB asset purchases, ECB exit strategy, ECB exit strategy scenarios, ECB policy normalisation, ECB quantitative easing, ECB tapering, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

With important decisions on the future of its bond-buying programme looming, what are the ECB’s options?

The European Central Bank (ECB) is expected to announce the bulk of its decisions on quantitative easing (QE) at its 26 October meeting.

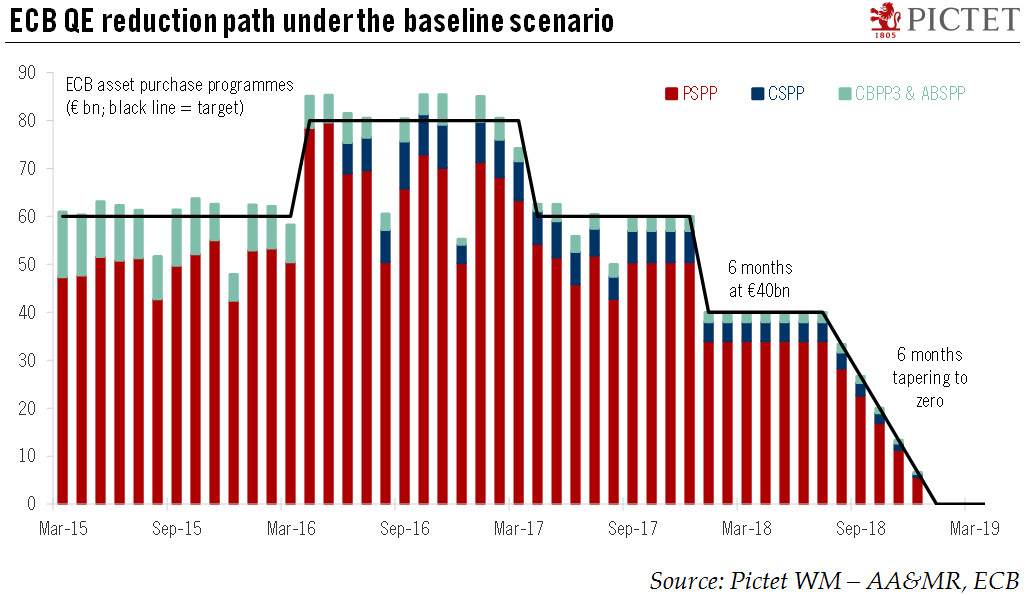

We would expect a broad commitment to extend QE beyond 2017 at a reduced pace, but several options are possible and additional technical details could be postponed to the 14 December meeting. Our baseline scenario remains that asset purchases will be scaled down to EUR40bn per month from the current rate of EUR60bn per month between January and June 2018, before being wound down to zero in the course of H2 2018. But the risks are being tilted towards a ‘slower for longer’ extension.

But the final decision will depend on the ECB’s assessment of two conflicting signals: the pick-up in underlying price and wage dynamics, and the tightening of financial conditions driven by the exchange rate. We therefore believe it is worth looking at alternative scenarios for the ECB’s monetary strategy, including changes in the composition and parameters of QE that we think will be necessary given the bond scarcity constraints the central bank is facing.

All in all, we have long argued that the ECB can, should, and will increase QE flexibility within the current framework, i.e. maintaining existing rules for issuer limits and capital keys. Specifically, we expect the ECB to change the composition of asset purchases, including a higher share of corporate and supranational debt purchases, while tolerating larger deviations from capital keys as a fair price to pay for a credible QE extension.