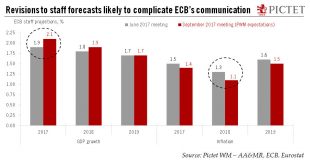

The ECB’s Governing Council meeting on 7 September may see the first tentative steps toward an unwinding of QE, with a firm announcement on policy to come in October.The ECB will likely prepare for a cautious, flexible, slow-motion exit at its Governing Council meeting on 7 September, tasking its committees to study all policy options for 2018. We continue to expect an announcement in October that quantitative easing (QE) will be extended for six months, but at a reduced pace of EUR40bn per...

Read More »Chinese PMI point to continued expansion

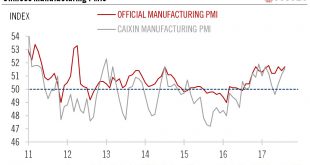

August manufacturing PMI showed solid industrial activity, while domestic demand is holding up well. We are keeping our Chinese GDP forecast unchanged.China’s official manufacturing PMI in August came in at 51.7, rising slightly from July (51.4), and remaining firmly in expansionary territory. The Markit PMI extended its ascendance for the third consecutive month to reach 51.6 in August.Domestic demand seems to be holding up well. The production, new orders and imports sub-indices of the...

Read More »Upward momentum in euro area inflation is building

A close look at recent data suggest that core inflation in the currency area is edging higher, supporting the ECB ‘s plans for policy normalisation.Euro area flash HICP inflation rose to 1.5% y-o-y in August from 1.3% in July, while core inflation remained stable at 1.2% year on year. In our opinion, modest upward price momentum has started to build over the past few months, with core inflation likely to edge slightly higher from here.Euro area core inflation has broken out of the tight...

Read More »Profits are strong, but investment is still sluggish

US companies are showing little propensity to use healthy profits to increase their investments. We remain prudent about the outlook for US capex in the coming months.A major feature of the US growth recovery since mid-2009 has been the significant improvement in corporate profits. But improvement has been mostly achieved at the expense of investment (capex) and wage growth, which have been kept on a tight leash. This has puzzled policymakers, including the Federal Reserve, which has been...

Read More »Income growth supports recovery of Japanese consumption

The growth in retail sales slowed slightly in July, but a strong labour market and the rise in aggregate wages should continue to boost consumer spending.Following a strong rebound in Q2, the momentum behind consumer spending in Japan seems to have moderated somewhat in July. Retail sales in Japan grew by 1.9% y-o-y, down slightly from 2.2% in June and 2.5% in Q2.Despite the softer momentum, the recovery in Japan’s consumer sector, which started roughly in the second half of 2016, may...

Read More »Positive margin dynamics, but stretched equity valuations

Second-quarter results were well above estimates, but average earnings surprises were modest in the US and consensus estimates for 2018 have stalled.The Q2 2017 reporting season demonstrated that corporate results dynamics remain robust across developed economies. Sales and profit figures came in well above estimates in the US, Europe and Japan. The trend for profit growth has sustained equity markets’ total returns year to date. But due to the weakness of the US currency, returns in that...

Read More »Japan’s economy delivers a positive surprise

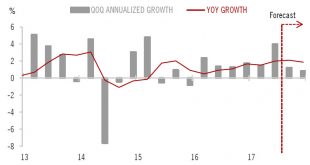

The first estimate for GDP in the second quarter surprised on the upside, pushing us to revise our full-year forecast. But we still believe the Bank of Japan will stick to current monetary policy.The first estimate of Japan’s Q2 GDP showed growth of 1.0% quarter over quarter (q-o-q) in real terms, or 4.0% annualised, beating the consensus estimates (1.6% annualised) by a wide margin. We have therefore decided to revise up our 2017 GDP forecast for Japan to 1.9% from 1.3%.Unlike previous...

Read More »Business survey points to continued euro area strength

Flash PMI suggests GDP growth may cool slightly in the third quarter, but dynamics of the euro area economy remain strong and broadly stable.Markit’s composite flash purchasing managers index (PMI) for the euro area remained broadly stable at 55.8 in August, slightly above consensus expectations (55.5). By sector, the manufacturing PMI increased to 57.4, from 56.6 in July, offsetting a decline in the services PMI (-0.5 points to 54.9).The euro area composite PMI is now consistent with GDP...

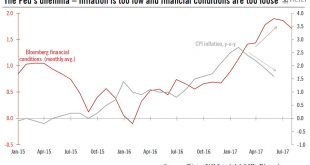

Read More »US economy: Too-loose financial conditions versus too-low inflation

In spite of dilemma, we still think the Fed will announce plans to shrink balance sheet in September and will hike rates again in December.Several Federal Reserve (Fed) officials, and a few foreign central bankers, will meet for their traditional August gathering in Jackson Hole, Wyoming, on 24–26 August. Fed Chair Janet Yellen will give the opening speech on Friday (08:00 local time, 16:00 Geneva), but with neither a Q&A session, nor a scheduled media briefing. Unlike her predecessor,...

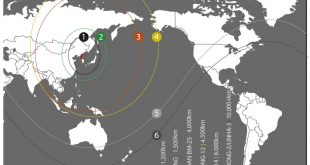

Read More »North Korea: Spikes in tensions look set to continue

Tensions over North Korea’s nuclear programme look set to continue, but we believe the chances of a military conflict are low in the near term.The tensions between North Korea and the US that rose a notch in early August are rooted in the deep sense of insecurity of the regime of Kim Jong Un. A significant new stage in North Korea’s nuclear programme has now been reached, and the regime appears to believe that developing a credible nuclear deterrent is necessary to guarantee its...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org