While expects debate the effects of the Trump tax reforms, it is probably the most important economic policy decision of recent decades.Since the sub-prime crisis 10 years ago, the US economy has been stuck in a growth regime that is modest by past standards, with deflationary pressures persisting in spite of an historically low unemployment rate. It is against this backdrop that the tax reform finally ratified in the last days of 2017 was greeted as a ‘Christmas present’ by financial...

Read More »Europe chart of the week – underemployment

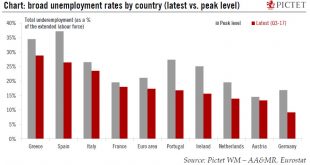

Improvement in labour market conditions is not only cyclical but also structural.This week, Eurostat published a set of very important indicators of euro area labour market conditions, the so-called U6 ‘broad unemployment’ rates for Q3 2017. The database includes several metrics of underemployment which the ECB considers as a good proxy for labour market slack.The main underemployment series includes total unemployment as well as underemployed part-time workers (i.e. people working fewer...

Read More »When will the SNB start the process of policy normalisation?

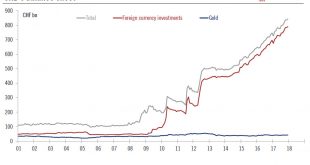

When the Swiss National Bank (SNB) scrapped its currency floor three years ago, its monetary policy strategy was clear: to fight Swiss franc appreciation. It did so verbally, by calling the currency “significantly overvalued”, and physically, by implementing a negative interest rate and intervening in the foreign exchange market as necessary. Three years on, the interest rate on sight deposits at the SNB remains...

Read More »China: PMIs suggest moderation in momentum in Q1

China’s official manufacturing purchasing manager index (PMI) came in at 51.3 in January, down slightly from December (51.6). The Markit PMI (also known as the Caixin PMI) stayed at 51.5, the same as in the previous month (Chart 1). The official non – manufacturing PMI rose slightly to 55.0 in January from 44.8 the previous month. The official composite index, which is a weighted average of the manufacturing and non –...

Read More »China: PMIs suggest moderation in momentum in Q1

[unable to retrieve full-text content] Macroview China: PMIs suggest moderation in momentum in Q1 China’s official manufacturing purchasing manager index (PMI) came in at 51.3 in January, down slightly from December (51.6).

Read More »Strong growth and Abenomics mean Japanese equities continue to provide opportunities

Momentum in the Japanese economy remains strong Japanese growth momentum is at its strongest in over a decade, with the quarterly Tankan survey of business conditions and sentiment strengthening to an 11 – year high in Q4 2017. The economy may have expanded by 1.8% in 2017, up from 0.9% in the previous year. In 2018, the growth rate may moderate slightly to 1.3%, but should remain well above Japan’s potential growth,...

Read More »US dollar: down but not out

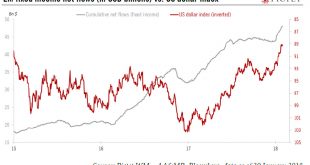

Recent US dollar weakness has many causes—but the Trump tax cuts and a more hawkish Fed should boost the greenback’s attractiveness in the coming months.Given the boost to US growth from the tax cuts, one might ask why, between the ratification by the US Congress of the Trump tax cuts on 19 December and 26 January, the US dollar index lost roughly 4.6%.We see two key drivers behind recent dollar weakness: the growth differential between the US and the rest of the world and monetary policy...

Read More »US chart of the week – Alter egos

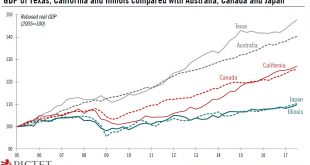

The contrasting growth trajectories of Texas, California and Illinois find echoes in other countries.US growth has been solid lately. However, drilling down into state-level data, we can see wide discrepancies in growth from one US state to the next. Indeed, a lot of the growth ‘heavy lifting’ in recent years has been done by Texas, propelled by oil production, and by California, propelled by the tech boom. More recently, we have seen a increased contribution to US growth from Florida too,...

Read More »When will the SNB start the process of policy normalisation?

The SNB may soon start to normalise its monetary policy. We expect a first rate hike of 25bp in December 2018.There are several reasons to believe that the SNB may soon start to normalise its monetary policy. First, the Swiss macroeconomic outlook has improved: Swiss growth is picking up and becoming broader-based across a range of sectors, while inflation is also gradually rising. Second, the Swiss franc has weakened and the pressure on the currency has become somewhat softer. Third, other...

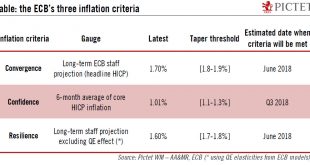

Read More »Core inflation still “some distance” from ECB’s criteria

Euro area core inflation rebounded in December. We expect a more sustained adjustment in core prices to start in H2 2018, and to continue in 2019.Euro area core inflation rebounded to 1.0% in January, from 0.9% in the previous month, in line with expectations. There is no escaping the fact that the ECB remains “some distance” from meeting its inflation criteria, as Peter Praet said this week.Our inflation forecasts are consistent with a delayed normalisation in the ECB’s stance as core...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org