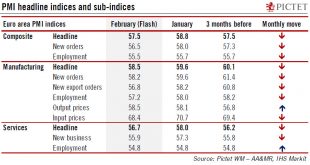

In spite of some cooling in forward indicators, euro area growth should remain robust this year.Flash PMI indices eased in February, but remain consistent with continuing solid growth in the euro area.The flash composite purchasing managers’ index (PMI) for the euro area fell to 57.5 in February from 58.8 in January, below consensus expectations. Activity in both services and manufacturing cooled in February.While the average composite PMI is pointing to an acceleration in growth in Q1, the...

Read More »Frankfurt, we have a gender problem

Increasing expectations that Germany’s Jens Weidmann will become the next ECB president are opening up gender equality issues. Change in the ranks of the central bank’s top brass is in the air.The Eurogroup has designated Spanish finance minister Luis de Guindos as candidate for the position of Vice President of the European Central Bank to succeed Vítor Constâncio in June 2018, for a non-renewable eight-year term. This nomination has increased expectations that Bundesbank President Jens...

Read More »US federal budget update—free hugs

Nudged by the White House, Congress is in fiscal easing mode in the belief that the US economy needs further stimulus. Meanwhile, some medium-term debt issues remain unaddressed.Washington DC is in fiscal easing mode. Having voted for bold tax cuts in December, Congress is now increasing the theoretical spending limits for this year and next, by USD 300bn. This comes even though budget data for the past two years have been disappointing notwithstanding a solid labour market.From a growth...

Read More »Our emerging market currencies scorecard gives good marks to real and rouble

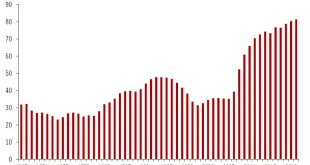

The scope of this note is to present a score card for Emerging Market (EM)currencies, designed to assess the attractiveness of a given currency over the coming 12 months. The scorecard (see chart), constructed using a rules – based methodology, suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies. EM FX scorecard - Click to enlarge Construction of the EM FX...

Read More »Europe chart of the week – French unemployment

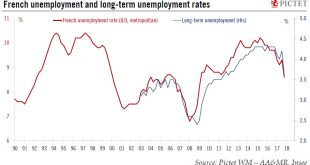

French unemployment fell surprisingly fast in Q4 2017, to a new cyclical low. France registered the largest drop in unemployment in about ten years in Q4 2017. In metropolitan France, the number of unemployed fell by 205,000 to 2.5 million people, pushing the ILO unemployment rate down to 8.6% of the labour force (-0.7pp), its lowest level since Q1 2009. The improvement was broad based across age groups and worker...

Read More »Europe chart of the week – French unemployment

French unemployment fell surprisingly fast in Q4 2017, to a new cyclical low.France registered the largest drop in unemployment in about ten years in Q4 2017. In metropolitan France, the number of unemployed fell by 205,000 to 2.5 million people, pushing the ILO unemployment rate down to 8.6% of the labour force (-0.7pp), its lowest level since Q1 2009. The improvement was broad based across age groups and worker categories.It would be tempting to relate this spectacular drop in unemployment...

Read More »Euro area inflation: the Phillips curve and the ‘broad unemployment’ hypothesis

Monetary policy in 2018 is all about the Phillips curve. The extent to which wage growth and inflation respond to falling unemployment will shape the monetary tightening cycle. If recent price action is any guide, any surprise on that front could result in market overreaction and volatility spikes. The most elegant description of the current state of research was provided by ECB Executive Board member Benoît Coeuré...

Read More »US CPI update: Costlier T-shirts

But the underlying pick-up in inflation in January was not as severe as it seems.January core CPI inflation was firm, as the index rose 0.35% month-on-month (m-o-m). The year-on-year print was unchanged at 1.8%.Was inflation that bad? Probably not. The sharp increase in apparel prices (1.7% m-o-m, the biggest monthly increase since February 1990) appears particularly suspicious and may fall back again next month. Some notoriously volatile sub-indices, such as leased cars, provided a further...

Read More »Europe chart of the week – Italian productivity

With less than 30 days to go, the Italian general election remains highly unpredictable. The new electoral system and the fact that 37% of seats are to be allocated on a ‘first-past-the-post’ system make projecting seats from voting intentions particularly hard. Importantly, Italy is going into this election with an economy that is performing relatively strongly relative to recent history. However, cyclical strength is...

Read More »US chart of the week – Tax base

Some northern US states face the challenge of a shrinking tax base.A worry persists about many US states and municipalities’ finances, especially due to rising pension costs. The recent volatility in financial markets has raised fears the situation might worsen. The need to add to the pension pot is also affecting states and municipalities’ ability to fund infrastructure investment, or even basic maintenance.A shrinking tax base is aggravating the problem in some areas. A good proxy for the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org