China’s economy beat consensus growth forecasts in 2017 and we have revised up our own forecast for 2018.The Chinese economy ended 2017 on a strong note, rising 1.6% over the previous quarter and, growing by 6.9% in real terms over 2017 as a whole, thus beating the consensus forecast as well as our own estimate (both at 6.8%). The strong 2017 growth number marks the first full-year acceleration in the Chinese economy since 2010, and can be accredited to the synchronised global economic...

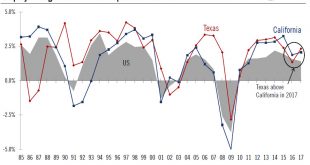

Read More »US chart of the week – Texas rebounds

Employment in Texas rose more quickly than in California in 2017 as recovering oil prices boosted the energy sector and associated industries in the Lone Star State.One of the major rivalries in the US is that between California and Texas, the country’s biggest and second-biggest states respectively in GDP terms. They have different growth drivers (most notably Silicon Valley in California and the energy industry in Texas), and they also have different political landscapes – and local...

Read More »Euro area business activity expanding at its fastest pace in nearly 12 years

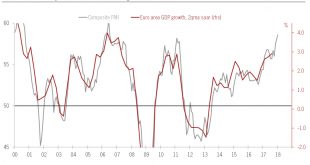

The euro area Flash PMI index surged well above expectations in January. The ECB’s communication could turn more hawkish.The flash composite Purchasing Managers’ index for the euro area increased to 58.6 in January from 58.1 in December, above consensus expectations (57.9). The services sector index rose, offsetting the decline in the manufacturing index . Companies also expressed growing optimism about this year’s outlook, with business expectations up to an eight-month high.The modest...

Read More »Euro area: Business activity expanding at its fastest pace in nearly 12 years

The flash composite Purchasing Managers’ index for the euro area increased to 58.6 in January from 58.1 in December, above consensus expectations (57.9). The services sector index rose, offsetting the decline in the manufacturing index . Companies also expressed growing optimism about this year’s outlook, with business expectations up to an eight-month high. The only piece of less positive news was a modest drop in...

Read More »Upside risks to wages from IG Metall negotiations

German wage negotiations are in full swing amid growing calls for strikes. This comes at a crucial time for the ECB as strong growth and falling unemployment are expected to feed into higher inflation. IG Metall is by far the most important union to watch, representing almost 4 million German workers and being seen as a benchmark, including in the car industry or the construction sector this year. Importantly, the...

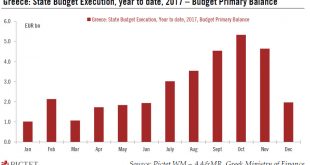

Read More »Light at the end of the Greek tunnel

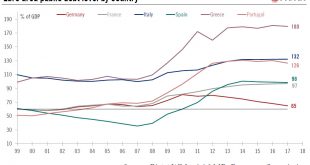

The Eurogroup is set to conclude its third review of Greece’s bailout programme. The country could exit the programme this summer.Eight years after it first requested financial assistance from its European and international partners in April 2010, Greece has never been so close to a ‘clean exit’ from its bailout programme(s). The economy has shown more convincing signs of improvement, with real GDP recovering since mid-2016 and fall in unemployment accelerating in 2017. Macro imbalances have...

Read More »ECB meeting preview: guide me if you can!

We see little incentive for the ECB to precipitate things at the beginning of the year, especially as core inflation continues to disappoint, but there could be hints at “gradual changes” in forward guidance.We expect no policy decision and no major change in the ECB’s communication at its 25 January meeting. There is no incentive for the ECB to fuel further hawkish market re-pricing at this stage, especially after core inflation disappointed again and the EUR has strengthened once more. The...

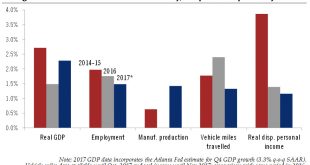

Read More »The US economy was not firing on all cylinders in 2017

The US economy was not firing on all cylinders in 2017, but this could change with the tax cuts.This is a good time to take stock of how well the US economy did in 2017. Assuming Q4 GDP is in line with the current estimate from the Atlanta Fed (which is close to our own), 2017 growth will be 2.3%. This would mark a step-up from annual growth of 1.5% in 2016 – when the sharp drop in oil prices hit investment and the wider economy hard – but would be close to the growth trajectory seen since...

Read More »Italy back in the spotlight

Italian elections are the next big political challenge facing the euro area. While near-term risks seem contained, medium-term ones remain.The Italian government confirmed 4 March as the date for the next parliamentary elections. The lower and upper houses will be elected under a new electoral law, but a hung parliament is the likely initial outcome of the elections given the fragmented political landscape in Italy.However, we do not think that, as things stand, political uncertainty will...

Read More »China: FX reserves rise again

According to the Chinese State Administration of Foreign Exchange (SAFE), China’s FX reserves amounted to USD3.14 trillion at end – December 2017, up USD20.7 billion from the previous month. This marks the 11th consecutive monthly increase in Chinese FX reserves since February 2017. In full – year 2017, Chinese FX reserves increased by USD129.4 billion, in contrast with a drop of USD512.7 billion in 2015 and USD320...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org