Recent US dollar weakness has many causes—but the Trump tax cuts and a more hawkish Fed should boost the greenback’s attractiveness in the coming months.Given the boost to US growth from the tax cuts, one might ask why, between the ratification by the US Congress of the Trump tax cuts on 19 December and 26 January, the US dollar index lost roughly 4.6%.We see two key drivers behind recent dollar weakness: the growth differential between the US and the rest of the world and monetary policy divergence. The growth differential peaked in the US’s favour in 2015 but has been weighing on the greenback since. Monetary policy divergence has been playing less in favour of the US dollar as other major central banks have already started to tighten their monetary policy or a looking to normalise it

Topics:

Luc Luyet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Recent US dollar weakness has many causes—but the Trump tax cuts and a more hawkish Fed should boost the greenback’s attractiveness in the coming months.

Given the boost to US growth from the tax cuts, one might ask why, between the ratification by the US Congress of the Trump tax cuts on 19 December and 26 January, the US dollar index lost roughly 4.6%.

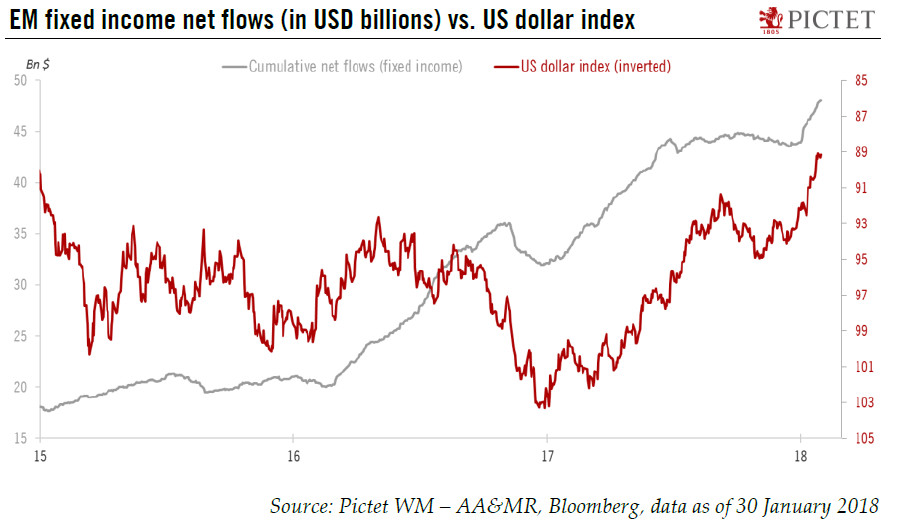

We see two key drivers behind recent dollar weakness: the growth differential between the US and the rest of the world and monetary policy divergence. The growth differential peaked in the US’s favour in 2015 but has been weighing on the greenback since. Monetary policy divergence has been playing less in favour of the US dollar as other major central banks have already started to tighten their monetary policy or a looking to normalise it (most notably the European Central Bank). Dollar weakness against other currencies could also be due to concerns about the US’s twin current account and budget deficits. Another reason might be continuing strong capital flows into emerging-market asset classes, thanks to strong risk appetite. Low US rates throughout 2017 favoured flows into higher-yielding asset classes elsewhere, such as into emerging market bonds, at the expense of funding currencies such as the US dollar.

However, the strong US growth we see ahead and higher funding costs could make emerging-market investments less attractive in the period ahead. Our baseline scenario that the Trump tax cuts will provide a significant boost to US growth should help the USD rebound. This boost, which is not being fully priced in by markets, will, in our view, lead to a more hawkish Fed (with an increase in its ‘dot plot’ projections for rates due in March). All in all, factors that point to a strengthening of US growth should help the attractiveness of US assets, including the dollar.

Looking at the EUR/USD rate, our forecast for strong US data in the months ahead should pave the way for a rebound of the USD, pushing the value of the euro slightly below USD1.20. But the USD’s rebound should be temporary, in our view, with the euro rising back towards USD1.24 by the end of the year as US growth becomes fully priced in and the focus shifts back to the ECB’s rate normalisation.