According to the Swiss Federal Statistical Office (FSO), the headline consumer price index (CPI) inflation eased to 0.7% y-o-y in January from 0.8% y-o-y in December, in line with consensus and our own expectations. Core inflation (CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) also eased, from 0.7 % y-o-y in December to 0.5% y-o-y in January (see Chart 1), back to the level of October...

Read More »Switzerland: inflation edged lower in January

Core inflation fell back to the same level as last October. Our scenario for monetary policy remains unchanged.Headline consumer price index (CPI) inflation eased to 0.7% y-o-y in January from 0.8% y-o-y in December, in line with consensus and our own expectations. Core inflation fell from 0.7% y-o-y in December to 0.5% y-o-y in January.Our inflation outlook remains unchanged. We expect headline inflation to firm up gradually as 2018 progresses, averaging 1.0% in 2018, but with risks tilted...

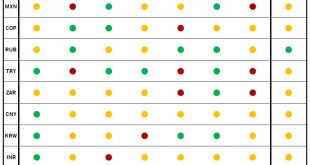

Read More »Our emerging market currencies scorecard gives good marks to real and rouble

Our EM currencies scorecard suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.Our Emerging Market (EM) FX scorecard, designed to assess the attractiveness of a given currency over the coming 12 months, ranks 10 EM currencies according to key criteria. The indicators we singled out to analyse the relative attractiveness of EM currencies are growth, inflation, valuation, carry, vulnerability to external shocks, trade and idiosyncratic...

Read More »Euro area inflation: the Phillips curve and the ‘broad unemployment’ hypothesis

This year is all about the Phillips curve: the extent to which wage growth and inflation respond to falling unemployment will shape the ECB’s monetary tightening cycle.We agree with the ECB that the euro area Phillips curve is alive, albeit “flatter and non-linear”. In particular, structural changes in the labour market have resulted in larger slack than implied by standard unemployment figures, including a large number of workers marginally attached to the labour force.Our analysis confirms...

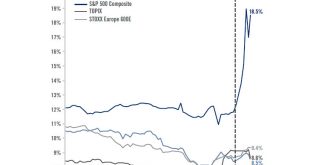

Read More »Equity markets in a new regime

The recent ‘flash crash’ in equities was unusual by several measures. After ‘goldilocks’, equity markets have entered a new regime.The global equity market sell-off of late January and early February was rather unusual in a number of respects.Equity and bond prices declined simultaneously in the recent market sell-off, a pattern that has only occurred in a quarter of the last 25 equity market sell-offs.The recent sell-off is far above the levels seen in the past two years, because the...

Read More »Europe chart of the week – Italian productivity

Among the main challenges facing Italy, stagnant labour productivity is one of the most important.With less than 30 days to go, the Italian general election remains highly unpredictable. The new electoral system and the fact that 37% of seats are to be allocated on a ‘first-past-the-post’ system make projecting seats from voting intentions particularly hard.Importantly, Italy is going into this election with an economy that is performing relatively strongly relative to recent history....

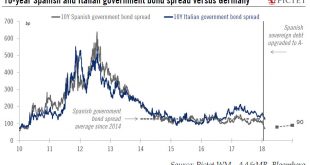

Read More »Robust outlook supports low Spanish sovereign bond spreads

Strong metrics mean we expect the 10-year Spanish government bond spread over Bunds to widen less than we thought before.Strong, relatively broad-based economic recovery and the limited economic impact of the Catalan crisis pushed Fitch to upgrade Spanish sovereign debt by one notch to A-/Stable in January. The upgrade triggered a significant rally, with the spread on Spanish 10-year bonds versus Bunds dropping below 70 basis points (bp) on February 1 for the first time since 2009.The...

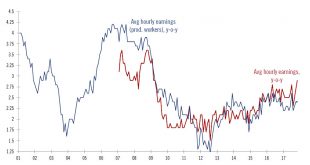

Read More »US chart of the week – Low macro vol

Volatility in US payroll data has remained low lately. We see limited signs of imminent overheating or slowing in the US.Volatility has picked up significantly on US equity markets lately. But does it reflect higher volatility in US macroeconomic data?So far, not really. Take US payroll data. If one looks at the one-year rolling standard deviation of the monthly data, one can see volatility is still subdued: it now stands at 68,000 (new payrolls/month), which is close to the average since...

Read More »House View, February 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationCurrent conditions vindicate our continued bullish stance on equities in developed markets and emerging markets (Asia more than Latam). Valuations are high, but they are justified by upwards adjustments to expected earnings growth.But with long-term rates rising, we are expecting a rise in volatility from their low current levels. This should benefit active managers.We remain generally...

Read More »Wages on the rise as US maintains cyclical momentum

Solid US wage growth could lead to a more hawkish tone at the Federal Reserve.The January employment report showed that the US economy started 2018 on a strong footing, with particularly robust momentum in cyclical sectors such as construction and manufacturing. This supports our scenario that US growth will step up to 3% in 2018, from 2.3% in 2017, driven by an uptick in investment. With January’s increase of 200,000, the 3-month average growth in payrolls stands at 192,000/month, well...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org