Improvement in labour market conditions is not only cyclical but also structural.This week, Eurostat published a set of very important indicators of euro area labour market conditions, the so-called U6 ‘broad unemployment’ rates for Q3 2017. The database includes several metrics of underemployment which the ECB considers as a good proxy for labour market slack.The main underemployment series includes total unemployment as well as underemployed part-time workers (i.e. people working fewer hours than they would like), persons available for work but not seeking, and persons seeking work but not immediately available. The euro area U6 dropped to 17.3% in Q3, consistent with a steadily declining trend that started in early 2015. In relative terms, the improvement is most visible in Portugal,

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Improvement in labour market conditions is not only cyclical but also structural.

This week, Eurostat published a set of very important indicators of euro area labour market conditions, the so-called U6 ‘broad unemployment’ rates for Q3 2017. The database includes several metrics of underemployment which the ECB considers as a good proxy for labour market slack.

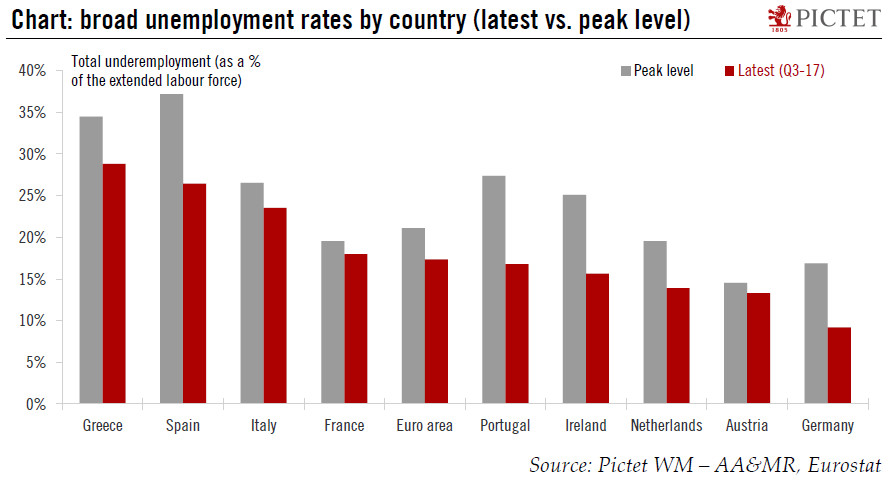

The main underemployment series includes total unemployment as well as underemployed part-time workers (i.e. people working fewer hours than they would like), persons available for work but not seeking, and persons seeking work but not immediately available. The euro area U6 dropped to 17.3% in Q3, consistent with a steadily declining trend that started in early 2015. In relative terms, the improvement is most visible in Portugal, Ireland, Spain and Germany, while Italy and France have lagged.

These developments are important on many levels. Along with other measures of long-term unemployment, the drop in U6 rates suggests that the euro area expansion is fuelling an improvement in labour market conditions which is not only cyclical but also structural. Moreover, the ECB has been highlighting broad unemployment as a proxy for hysteresis and a key driver of a flatter Phillips curve. Notably, in his ‘scars or scratches’ speech, ECB board member Benoît Coeuré showed how using U6 rates instead of standard unemployment helped improve the explanatory power of classic Phillips curve models.

To be sure, euro area core HICP inflation has remained frustratingly low, preventing the ECB from adjusting its communication too quickly. But the decline in underemployment should further strengthen the ECB’s confidence that inflation will eventually converge towards its 2% target.