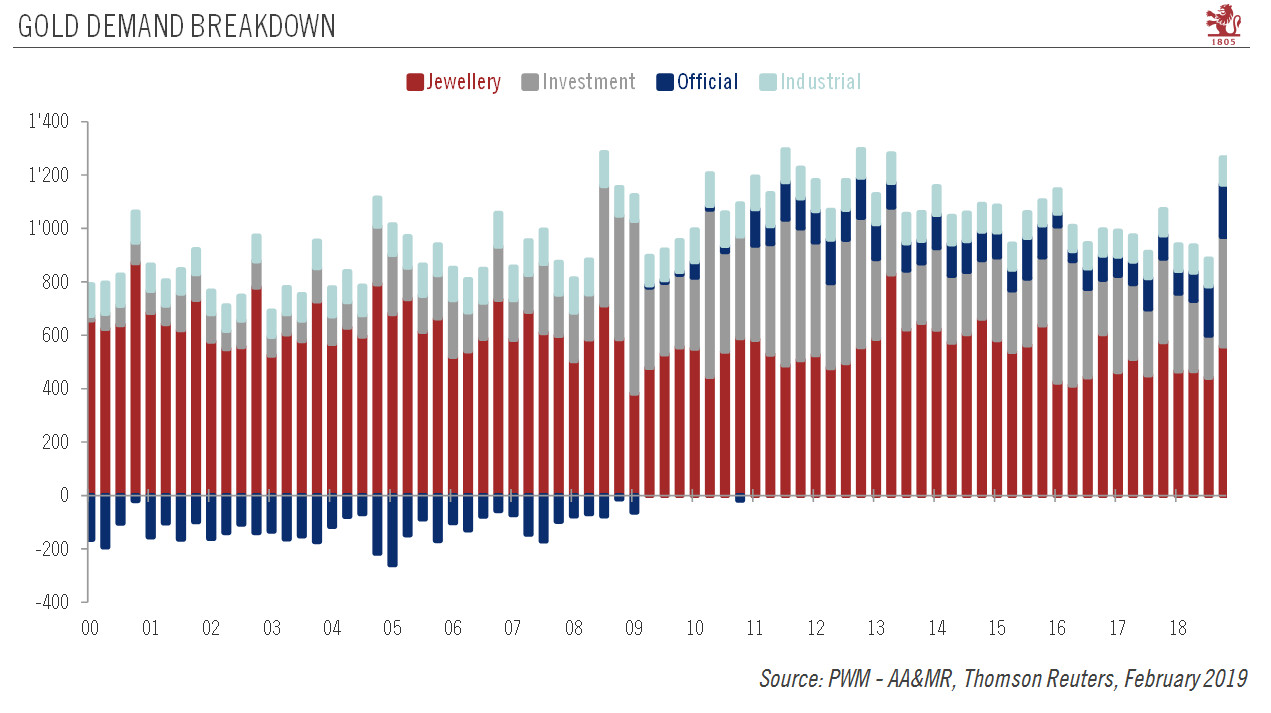

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better. Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018, continuing a structural trend in place for the past decade. It is worth stressing that US dollar movements were not an important factor in gold’s performance. Indeed, the US dollar index appreciated slightly in Q4 (by around 1%) and gold also performed very well in other currencies during the same period

Topics:

Luc Luyet considers the following as important: 2) Swiss and European Macro, Featured, gold forecast, gold price projection, gold prices, gold trends, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better.

Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018, continuing a structural trend in place for the past decade. It is worth stressing that US dollar movements were not an important factor in gold’s performance. Indeed, the US dollar index appreciated slightly in Q4 (by around 1%) and gold also performed very well in other currencies during the same period (8.8% in euros and 7.7% in Swiss francs). Overall, while concerns about the global growth picture could continue to provide some tailwind, the level of investment and jewellery demand for gold seen in Q4 is unlikely to last, pointing to some moderation in gold price in the short term, especially given its recent uninterrupted appreciation. In addition, investors’ risk appetite swiftly returned at the end of last year (the S&P500 rebounded 18% from 24 December to 15 February), which would normally mean that safe-haven demand for gold falters. In light of the strong rise in Q4, the gold price therefore looks vulnerable in the short term. This is particularly true given that gold looks expensive both relative to the Japanese yen (another defensive asset, see chart 3) and to US real rates. |

Gold Demand Breakdown 2000-2019 |

We continue to see a consolidation in the gold price in the next few months, explaining our three-month projection of USD1,270 per troy ounce and our six-month projection of USD1,240. In the medium term, moderating global growth, the approaching end of Fed policy ‘normalisation’ and our scenario for US dollar weakening should prove supportive of investment demand for gold, so any near-term price weakness should precede another leg higher. Our 12-month forecast for gold stands at USD1,280 per troy ounce.

Tags: Featured,gold forecast,gold price projection,Gold prices,gold trends,Macroview,newsletter