New US auto tariffs may impact the economy significantly more than the previous tariffs on steel and aluminium. Among the key risks for our euro area outlook, the threat of US auto tariffs is of major importance. The US Commerce Department’s investigation on national security threats posed by auto imports is due to be concluded on 17 February. Given the complexity of the global auto supply chain, it is very complicated to isolate the effect of a one-off increase in US tariffs on European cars. Using simple trade, elasticities and investment metrics, we try to gauge what could be the potential impact of auto tariffs on euro area growth. We find that autos tariffs would reduce our annual euro area GDP growth by at

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, euro area, Featured, Macroview, newsletter, Pictet Macro Analysis, US tariffs

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

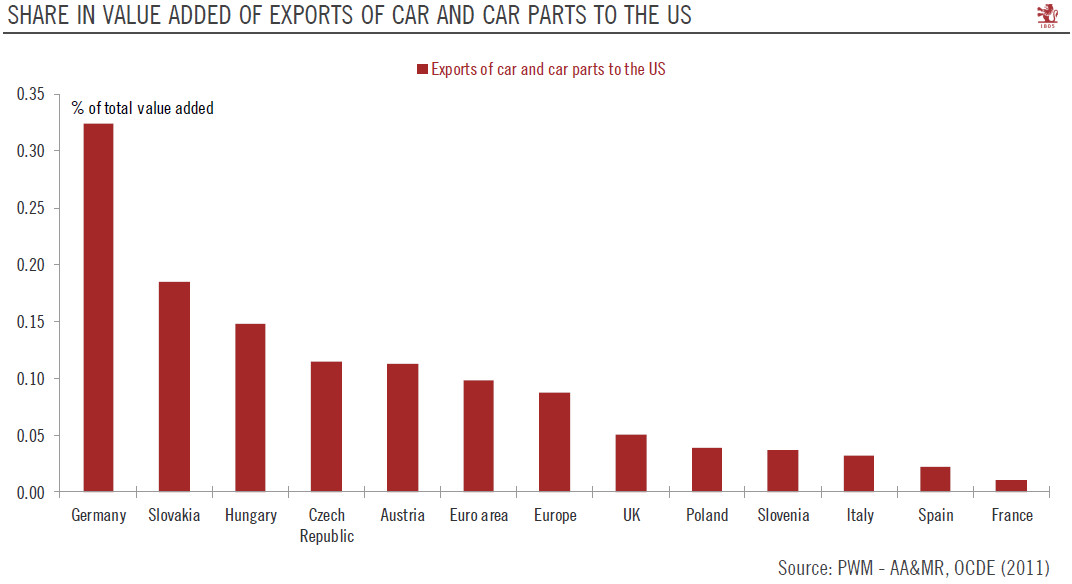

New US auto tariffs may impact the economy significantly more than the previous tariffs on steel and aluminium. Among the key risks for our euro area outlook, the threat of US auto tariffs is of major importance. The US Commerce Department’s investigation on national security threats posed by auto imports is due to be concluded on 17 February. Given the complexity of the global auto supply chain, it is very complicated to isolate the effect of a one-off increase in US tariffs on European cars. Using simple trade, elasticities and investment metrics, we try to gauge what could be the potential impact of auto tariffs on euro area growth. We find that autos tariffs would reduce our annual euro area GDP growth by at least 0.2-0.3 percentage points. Consequences on the very exposed European car industry (Germany’s and some eastern European countries’ in particular) would be even more significant. As a result, against our baseline (without higher tariffs) for 2019 euro area GDP growth of 1.4%, such a scenario would suppress our growth forecasts to close to 1.0%. A key question is whether the US administration will also impose tariffs on car parts and what retaliatory measures the EU would take. |

Share in value added of Exports of car and car parts to the US |

Tags: Euro area,Featured,Macroview,newsletter,US tariffs