The Fed enters the 'acceptance stage' regarding its debt and market dominance monetary regime.The US Federal Reserve (Fed) is further reinforcing its stance on ceasing its balance sheet shrinkage before year end, essentially yielding to the demands of markets, which have been anxious about the potential for market liquidity shrinkage. Officially, the balance sheet question is still rooted primarily in the technical – commercial banks’ high demand for safe, liquid assets – rather than monetary policy reasons (i.e. buttressing growth and supporting inflation), but the lines are getting increasingly blurred, resulting in confused Fed communication about the reasons behind its recent abrupt change in balance sheet plans.This could lead to an ‘agenda clash’ between a dovish announcement

Topics:

Thomas Costerg considers the following as important: fed balance sheet, Fed dovishness, Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

The Fed enters the 'acceptance stage' regarding its debt and market dominance monetary regime.

The US Federal Reserve (Fed) is further reinforcing its stance on ceasing its balance sheet shrinkage before year end, essentially yielding to the demands of markets, which have been anxious about the potential for market liquidity shrinkage. Officially, the balance sheet question is still rooted primarily in the technical – commercial banks’ high demand for safe, liquid assets – rather than monetary policy reasons (i.e. buttressing growth and supporting inflation), but the lines are getting increasingly blurred, resulting in confused Fed communication about the reasons behind its recent abrupt change in balance sheet plans.

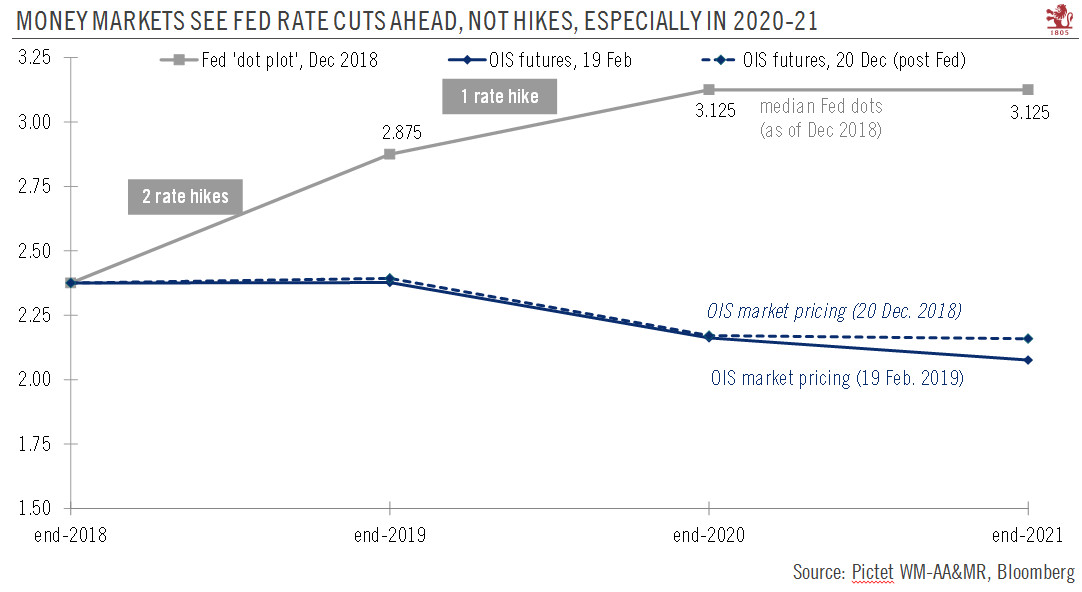

This could lead to an ‘agenda clash’ between a dovish announcement regarding the new balance sheet plan (likely by summer) and the more hawkish resumption of rate hikes after a period of “patience” and data watching. Beyond what the data may tell, it is increasingly likely that the next rate hike will be postponed, if not cancelled altogether, as the balance sheet debate takes prominence amid the increasing influence, if not dominance, of financial markets over the real economy in the Fed’s reaction function and thinking.

Looking at the bigger picture, the Fed now increasingly accepts that the end of the rate-hiking cycle is near, and that full rate ‘normalisation’, as per traditional metrics like the Taylor Rule, or just a return to the historical mean for the federal funds rate, is being kicked into the long grass. From a secular point of view, the pieces coming together assert that the Fed is now in a ‘debt dominance’ monetary regime, and that its recent dovish shift is mere confirmation of this, in our view. Monetary policy for the years to come is likely to remain accommodative and ‘market friendly’, albeit with the risk of fuelling financial instability. In other words, this new regime may be ‘too much of a good thing’.