The PBoC's policy easing is gaining traction but growth deceleration may continue in H1.China’s credit numbers for January surprised on the upside. The figures show strong credit creation in the first month of the year, especially in corporate bonds and bank bill financing. The contraction in the shadow banking sector has also moderated. This suggests that the PBoC’s monetary easing measures, which started in Q2 2018, are gaining traction.Although this is an encouraging development, we recognise that a significant part of the surge in new credit was due to an increase in short-term credit, while growth in long-term corporate credit is not as strong as the aggregate numbers suggest. In our view, long-term corporate credit is more directly related to real economic activity, especially

Topics:

Dong Chen considers the following as important: China economy, china fiscal stimulus, China monetary policy, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The PBoC's policy easing is gaining traction but growth deceleration may continue in H1.

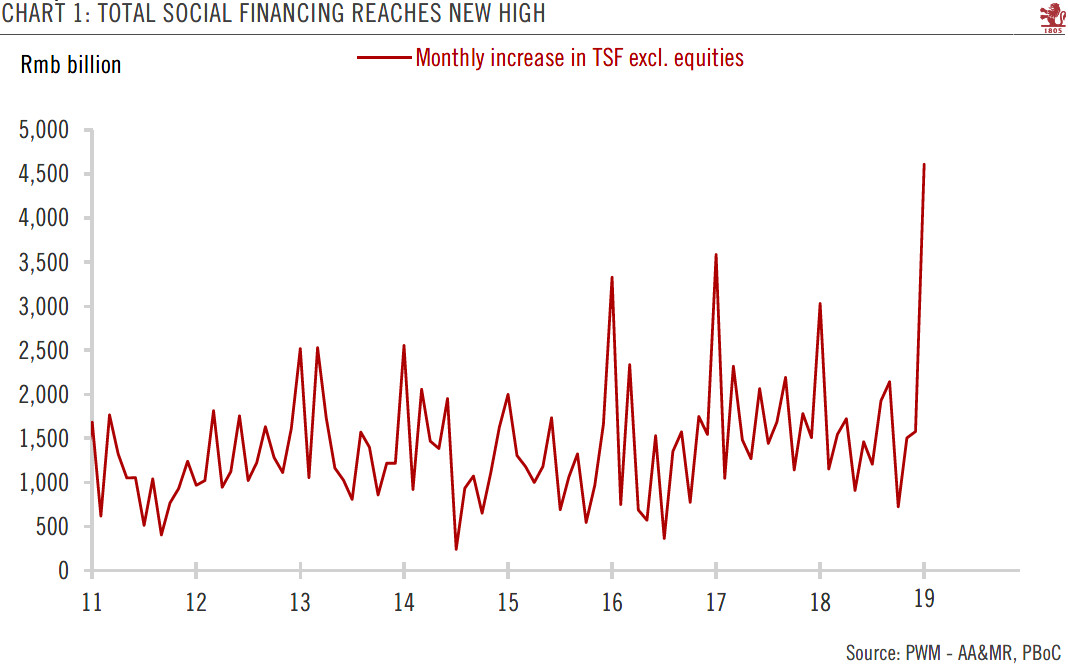

China’s credit numbers for January surprised on the upside. The figures show strong credit creation in the first month of the year, especially in corporate bonds and bank bill financing. The contraction in the shadow banking sector has also moderated. This suggests that the PBoC’s monetary easing measures, which started in Q2 2018, are gaining traction.

Although this is an encouraging development, we recognise that a significant part of the surge in new credit was due to an increase in short-term credit, while growth in long-term corporate credit is not as strong as the aggregate numbers suggest. In our view, long-term corporate credit is more directly related to real economic activity, especially fixed-asset investment, while short-term credit is driven more by operational or even speculative demand. While the new long-term corporate credit still exhibits a notable increase compared with last year (up 31% y-o-y), it is less dramatic than the aggregate credit figure suggests.

Overall, we believe the expansion in credit creation in January sends a positive signal about the effect of policy easing. We expect to see further cuts to banks’ required reserve ratios in H1 2019 and additional liquidity injection measures. However, given the time lag between credit growth and improvement in growth momentum, we maintain our view that the economy will likely continue decelerating in H1 2019 before it stages a modest rebound in the second half. Our full-year China GDP growth forecast of 6.1% remains unchanged at this point.