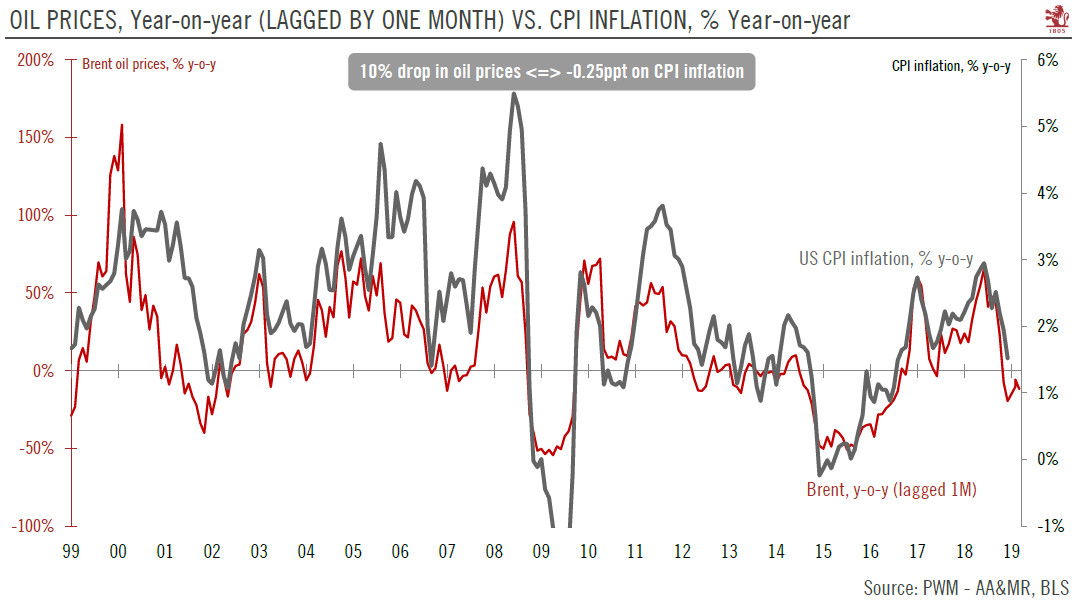

Latest data released confirm our expectations of modest US inflation this year.CPI inflation in January moderated to 1.6% y-o-y, from 1.9% in December (and versus 2.4% on average over the past twelve months).The biggest driver of this moderation was the sharp drop in global oil prices; given recent oil movements, we estimate that headline inflation could slide towards 1% y-o-y in coming months.Excluding energy and food, core CPI inflation remained at 2.2% y-o-y in January.There are signs that demand-driven price pressures are building as seen in the sharp pick up in haircut prices (our favourite proxy for domestic price pressures), but these are offset by even stronger dampeners: (1) structural drivers such as technology (bringing the price of tech gadgets down) (2) government policy,

Topics:

Thomas Costerg considers the following as important: Macroview, US CPI inflation, US inflation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Latest data released confirm our expectations of modest US inflation this year.

CPI inflation in January moderated to 1.6% y-o-y, from 1.9% in December (and versus 2.4% on average over the past twelve months).

The biggest driver of this moderation was the sharp drop in global oil prices; given recent oil movements, we estimate that headline inflation could slide towards 1% y-o-y in coming months.

Excluding energy and food, core CPI inflation remained at 2.2% y-o-y in January.

There are signs that demand-driven price pressures are building as seen in the sharp pick up in haircut prices (our favourite proxy for domestic price pressures), but these are offset by even stronger dampeners: (1) structural drivers such as technology (bringing the price of tech gadgets down) (2) government policy, such as the ongoing moderation in medical prices (3) idiosyncratic factors like rents, which may start to erode as the housing market slows.

Overall, we still believe that inflation will remain moderate this year, despite the ongoing labour market tightening.

A key uncertainty pertains to President Trump’s tariff policy. Our core scenario sees a ‘pretend and extend’ scenario for the US-China trade deal deadline of 1 March, but more tariffs could lead to higher inflation in the US.

The January CPI data is not sufficient for the Fed to reconsider its dovish guidance and pre-commitment to pausing its rate hiking cycle for a few months. The Fed is now mostly focused on headline (oil-driven) inflation and the still uncertain growth outlook in China and Europe. The Fed has also subtly signalled that it is content with letting core inflation move up a bit; in addition, it is abandoning its former belief in the link between wage growth and future inflation.