December core retail sales came in below consensus expectations. Nevertheless, we remain sanguine about the prospects for consumption in 2016. Today’s retail sales report was without a doubt quite disappointing. Although consumption growth seems to have slowed noticeably in Q4 (probably to slightly less than 2.0%, after 3.0% in Q3), we remain sanguine on consumption growth in 2016. Nominal total retail sales fell by 0.1% m-o-m in December, in line with consensus expectations. Total sales were dented by a 1.1% m-o-m fall in nominal sales at gasoline stations (on the back of lower gasoline prices). Nominal auto sales were flat m-o-m, a relatively positive surprise as already published data on unit car sales (real) had shown a 4.7% decline m-o-m from the high level recorded in November. Meanwhile, sales of building materials rose by a solid 0.7%. Control sales: surprisingly weak numbers in December As usual, it is important to look at what has happened to control (core) sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, December’s results were clearly very disappointing. Control sales declined by 0.3% m-o-m, well below consensus expectations for a 0.3% rise. Moreover, November’s figure was revised down from +0.6% m-o-m to +0.5% and October’s number from +0.

Topics:

Bernard Lambert considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

December core retail sales came in below consensus expectations. Nevertheless, we remain sanguine about the prospects for consumption in 2016.

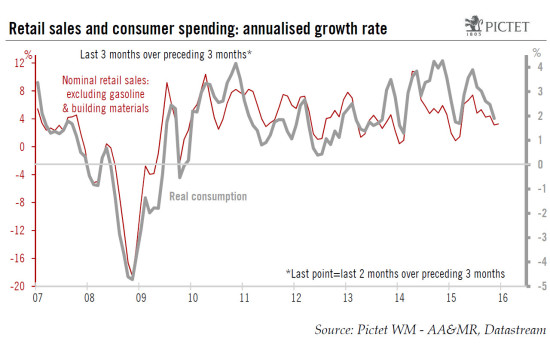

Today’s retail sales report was without a doubt quite disappointing. Although consumption growth seems to have slowed noticeably in Q4 (probably to slightly less than 2.0%, after 3.0% in Q3), we remain sanguine on consumption growth in 2016.

Nominal total retail sales fell by 0.1% m-o-m in December, in line with consensus expectations. Total sales were dented by a 1.1% m-o-m fall in nominal sales at gasoline stations (on the back of lower gasoline prices). Nominal auto sales were flat m-o-m, a relatively positive surprise as already published data on unit car sales (real) had shown a 4.7% decline m-o-m from the high level recorded in November. Meanwhile, sales of building materials rose by a solid 0.7%.

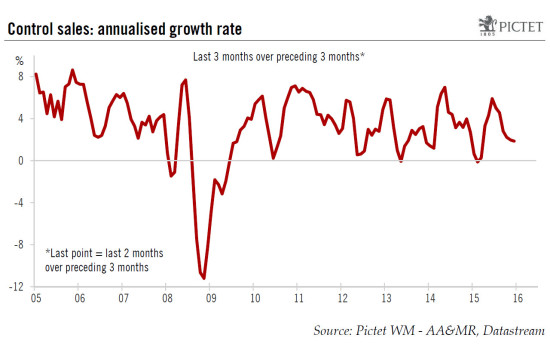

Control sales: surprisingly weak numbers in December

As usual, it is important to look at what has happened to control (core) sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, December’s results were clearly very disappointing. Control sales declined by 0.3% m-o-m, well below consensus expectations for a 0.3% rise. Moreover, November’s figure was revised down from +0.6% m-o-m to +0.5% and October’s number from +0.2% to +0.1%. The end result is that core retail sales grew by only a modest 1.5% q-o-q annualised, following +4.6% q-o-q in Q3 and +4.3% in Q2.

Today’s retail sales numbers suggest that real consumption growth was lacklustre in December, following a relatively healthy number in November but a flat monthly reading in October. However, retail sales are measured in nominal terms; they can be very volatile on a monthly basis and they are often revised substantially. In any case, core retail sales account for only around 25% of total consumption and they have often given a poor indication of overall consumption growth.

Nevertheless, with overall consumption up only by 1.9% annualised between Q4 and October-November, a sharp downward correction m-o-m in real car sales in December, and now downbeat retail sales data for December, our forecast that consumption would grow by 2.4% q-o-q annualised in Q4 (after +3.0% in Q3) looks clearly too high. Something slightly below 2.0% seems more plausible. In a context of solid job creation and falling oil prices, this slowdown appears a bit surprising, to say the least.

This soft data on consumption clearly put our forecast for Q4 GDP (+1.5% q-o-q annualised) at risk, and potentially also our yearly forecasts for 2015 (+2.4%) and 2016 (+2.2%). However, as official GDP data for Q4 will be published in just two weeks’ time (29 January), we will wait for this set of statistics before adjusting our forecasts.

We remain sanguine on consumption in 2016

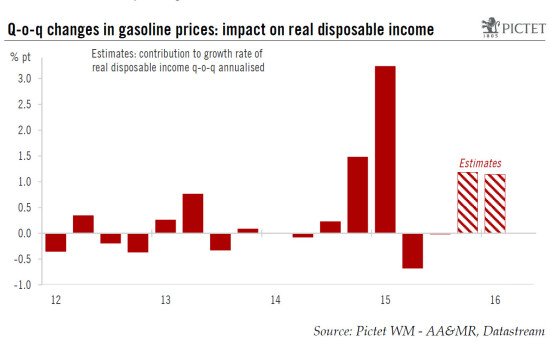

Consumption growth seems to have slowed noticeably in Q4. However, we believe this will prove a temporary phenomenon. We remain sanguine on consumption for 2016. Admittedly, employment growth should slow somewhat and the massive boost to real income that the fall in gasoline prices has implied in 2015 will not be repeated this year, at least not to the same extend. However, job creation should remain healthy, while wage increases are likely to pick up gradually. And regarding the beneficial effect from the fall in oil prices, two important points must be mentioned. First, a substantial part of last year’s windfall was not spent. In other terms, the saving rate is currently relatively high (5.5% in November), and may well fall back next year. Also supportive on that front is the fact that house prices are rising markedly, supporting household wealth. Secondly, although the oil windfall should be lighter this year compared with 2015, it should nevertheless be sizeable, particularly in Q1. Following the recent supplementary fall in crude oil prices, we estimate that the positive impact on real disposable income growth should top one point of percentage q-o-q annualised in both Q4 2015 and Q1 2016 (see chart above).

The consequence of all this is that we continue to expect healthy consumption growth in 2016, although it is likely to slow somewhat from the high rate recorded on average in 2015. On a yearly average basis, we expect consumption growth to settle at a robust 2.7% in 2015, following 3.1% in 2015.