Job creation was strong in December. However, wage statistics were disappointing and most other economic data released recently were rather soft. December’s employment report showed strong job gains, with noticeable upward revisions for the previous two months. However, the unemployment rate remained stable at 5.0% for the third month in a row and wage increases were surprisingly soft (+0.0% m-o-m). Non-farm payroll employment rose by a strong 292,000 m-o-m in December 2015, well above consensus expectations (200,000). Moreover, November’s figure was revised up (from 211,000 to 252,000), as was October’s number (from 298,000 to 307,000). Cumulative net revisions thus worked out at a noticeably positive 50,000. Job creations are very volatile in the short run (see chart above). They are often significantly revised, and unusually warm weather quite possibly provided temporary support to job creation in both November and December. Nevertheless, in Q4, job creation averaged 284,000, well above the pace recorded in Q3 (174,000 per month). Between Q4 2014 and Q4 2015, employment grew by 1.9%, a pretty solid rate considering GDP probably grew at around 2.0% over the same period. With the economy approaching full employment, a gradual slowdown in job creation should occur in 2016, hopefully accompanied by some improvement in productivity growth. Unemployment rate stable at 5.

Topics:

Bernard Lambert considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Job creation was strong in December. However, wage statistics were disappointing and most other economic data released recently were rather soft.

December’s employment report showed strong job gains, with noticeable upward revisions for the previous two months. However, the unemployment rate remained stable at 5.0% for the third month in a row and wage increases were surprisingly soft (+0.0% m-o-m).

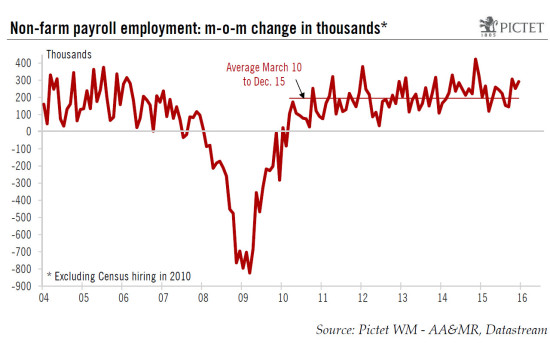

Non-farm payroll employment rose by a strong 292,000 m-o-m in December 2015, well above consensus expectations (200,000). Moreover, November’s figure was revised up (from 211,000 to 252,000), as was October’s number (from 298,000 to 307,000). Cumulative net revisions thus worked out at a noticeably positive 50,000. Job creations are very volatile in the short run (see chart above). They are often significantly revised, and unusually warm weather quite possibly provided temporary support to job creation in both November and December. Nevertheless, in Q4, job creation averaged 284,000, well above the pace recorded in Q3 (174,000 per month). Between Q4 2014 and Q4 2015, employment grew by 1.9%, a pretty solid rate considering GDP probably grew at around 2.0% over the same period. With the economy approaching full employment, a gradual slowdown in job creation should occur in 2016, hopefully accompanied by some improvement in productivity growth.

Unemployment rate stable at 5.0%

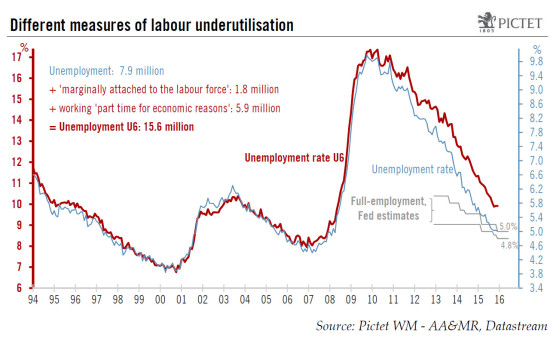

Meanwhile, the unemployment rate remained stable at 5.0% in December (5.01% before rounding), in line with consensus expectations. A more in-depth look at the household survey (the basis for calculating the unemployment rate) reveals that – as in November – this stability reflects both strong employment growth and robust growth in the labour force. Employment as measured in the household survey – an often very volatile statistic – increased by a massive 485,000 m-o-m in December whilst, at the same time, the size of the labour force rose by slightly less (466,000). The end-result was that the number of unemployed declined by a marginal 20,000 (466,000 minus 485,000) while the participation rate increased from 62.5% in November to 62.6% in December. The fact that the unemployment rate remained stable was therefore linked to a rebound in the participation rate, not to a soft employment number. In any case, at 5.0%, the unemployment rate is at the top of the range that the Fed feels corresponds to full employment (4.8%-5.0%). Moreover, it is worth remembering that this latter range was lowered from 4.9%-5.2% as recently as three weeks ago.

The Fed has repeated many times that the unemployment rate probably underestimates the amount of resources available in the labour market. However, even if we consider a wider measure of unemployment, i.e. the U6 measure – which includes (1) employees working part-time, but who would prefer a full-time job, and (2) people who want a job, are available for work, have looked for a job sometime over the past 12 months, but did not do so during the current survey week and were therefore not counted as unemployed – it has fallen heavily last year. Admittedly, it remained stable at 9.9% in December. However, the decline recorded overall last year was certainly quite marked (1.3 point) and, on this yardstick too, full employment does not look all that far away (see chart above).

Stagnant wages m-o-m in December

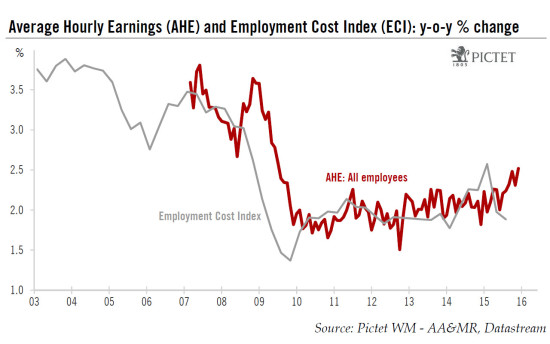

Meanwhile, average hourly earnings remained flat m-o-m in December, a result well below consensus estimates (+0.2%). However, due to a very favourable base effect (a monthly decline of 0.24% in December 2014), on a y-o-y basis wage increases still managed to bounce back from 2.3% in November to 2.5% in December. However, the base effect will play in the other direction in January 2016. Average hourly earnings had bounced back by a large 0.6% m-o-m in January 2015. Nevertheless, although this series is quite volatile (see chart on next page), according to these statistics, it seems that the pace of wage increases picked up modestly during the course of last year. Meanwhile, the quarterly Employment Cost Index (ECI) – the most reliable measure of wages and salaries – is pointing to no noticeable acceleration in wage increases. However, data for Q4 2015 have not yet been published. In any case, we continue to expect wage increases to gradually pick up over the coming few quarters.

The average workweek remained stable at 34.5 hours in December. As a consequence, the index of ‘aggregate weekly payrolls’ (calculated as a product of aggregate hours worked and average hourly earnings) rose ‘only’ by 0.2% m-o-m in December, after +0.1% in November. However, it followed a massive 0.9% increase in October. The end result was that this index – which is a good proxy for nominal household income coming in the form of private wages and salaries – grew by a solid 4.8% q-o-q annualised in Q4, after +5.1% in Q3 and +3.4% in Q2. This remains a supportive development for growth in household income in Q4, and for consumer spending.

The Fed is concerned by the lingering low level of inflation

Today’s employment report showed strong payroll gains, an unchanged unemployment rate for the third month in a row, and weak wage increases. Strong employment suggests solid economic growth, while stable unemployment and weak wage increases mean less pressure on the Fed to hike again soon. This combination is probably a relatively supportive one for risk appetite.

Although job creation was strong, most other economic data released recently were rather soft, stress is high in the financial markets, oil prices have fallen further and the broad trade-weighted dollar has already risen by around 1% so far this year, reaching a fresh thirteen-year high. Moreover, minutes from the December 15-16 FOMC meeting – published on Wednesday – reinforced the impression that the Fed was concerned by the lingering low level of inflation. In this overall context, we feel relatively comfortable with our out-of-consensus forecast that the Fed will hike ‘only’ twice this year. We continue to believe that the pace of rate tightening after the initial hike will be particularly pedestrian. Our forecast that the target range on the Fed funds rate will end 2016 at 0.75%-1.00% remains unchanged.