We revise our forecast for Q4 GDP growth from 2.0% to 1.5% as both ISM indices dropped further m-o-m in December. Both ISM indices dropped further m-o-m in December. However, while the Manufacturing index fell to a fresh cycle-low, its Non-Manufacturing counterpart remained pitched at a still relatively healthy level. Nevertheless, most other economic data published recently were surprisingly soft. We revise our forecast for Q4 GDP growth from 2.0% to 1.5%. ISM Manufacturing index fell further in December The ISM Manufacturing survey for December 2015 was published on Monday. The headline reading fell further from 48.6 in November to 48.2 in December, well below consensus expectations (49.0). As a result, this yardstick reached its lowest level since the recession ended in June 2009.As things stand, the Markit Manufacturing PMI (reflecting results from the other main survey on manufacturing activity) remains well above its ISM counterpart. However, it dropped as well m-o-m, from 52.8 in November to 51.2 in December. The details of the Manufacturing ISM report showed the Employment sub-index fell by a large 3.2 points m-o-m to 48.1. However, more encouragingly, the Production sub-index bounced back from 49.2 in November to 49.

Topics:

Bernard Lambert considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We revise our forecast for Q4 GDP growth from 2.0% to 1.5% as both ISM indices dropped further m-o-m in December.

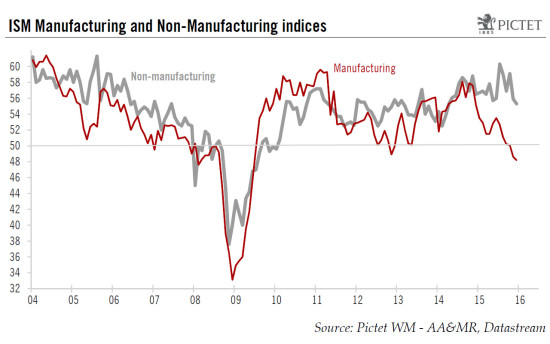

Both ISM indices dropped further m-o-m in December. However, while the Manufacturing index fell to a fresh cycle-low, its Non-Manufacturing counterpart remained pitched at a still relatively healthy level. Nevertheless, most other economic data published recently were surprisingly soft. We revise our forecast for Q4 GDP growth from 2.0% to 1.5%.

ISM Manufacturing index fell further in December

The ISM Manufacturing survey for December 2015 was published on Monday. The headline reading fell further from 48.6 in November to 48.2 in December, well below consensus expectations (49.0). As a result, this yardstick reached its lowest level since the recession ended in June 2009.As things stand, the Markit Manufacturing PMI (reflecting results from the other main survey on manufacturing activity) remains well above its ISM counterpart. However, it dropped as well m-o-m, from 52.8 in November to 51.2 in December.

The details of the Manufacturing ISM report showed the Employment sub-index fell by a large 3.2 points m-o-m to 48.1. However, more encouragingly, the Production sub-index bounced back from 49.2 in November to 49.8 in December, whilst the New Orders sub-index – which is supposed to be the most forward-looking component of the survey – rebounded slightly from 48.9 in November to 49.2 in December.

After recording its second month in a row below the 50-point threshold, the ISM manufacturing index is increasingly pointing to a recession in the US industrial sector. As we have noticed repeatedly, the combined effect of lower oil prices, soft foreign demand and a higher dollar was – and will over the coming months continue to be – a clear, sharp negative factor for the manufacturing sector, which is much more dependent on exports and the oil-extraction sector than the whole services-oriented economy. Moreover, the downward correction in inventories has probably amplified the downturn in manufacturing activity over the past few months. Fortunately, the manufacturing sector represents only some 12% of the overall US economy.

ISM Non-Manufacturing index dropped further as well

The ISM Non-Manufacturing survey was published today. It dropped back further as well, slipping from 55.9 in November to 55.3 in December, below consensus expectations (56.0). However, December’s reading remains pitched at still relatively healthy levels by historical standards.

Last month’s decline was caused by a sharp fall in the supplier Deliveries sub-index. Other sub-indices actually rebounded m-o-m. This was notably the case for the New Orders sub-index, which bounced back from 57.5 in November to 58.2 in December, and for the employment sub-index, which increased from 55.0 in November to 55.7 in December.

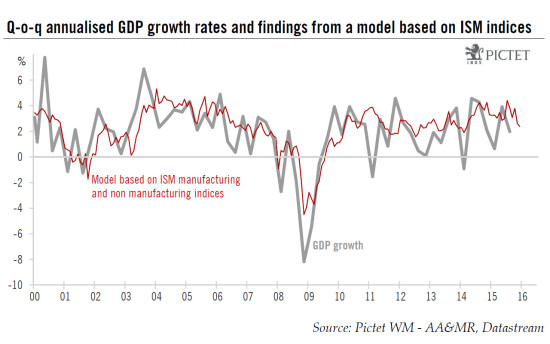

Taken together, the two ISM indices suggest that overall economic growth has remained healthy overall in Q4, although it did slow noticeably from Q3. If we use historical correspondence to try to calibrate what the ISM indices are pointing towards in terms of GDP growth (see chart above), we arrive at 2.4% in December and an average of 2.9% in Q4, following an average reading of 3.8% in Q3. Nevertheless, although ISM surveys are timely and useful indicators of the strength in the economy, they are not very reliable at forecasting GDP growth in the short run.

Economic data published recently were disappointing

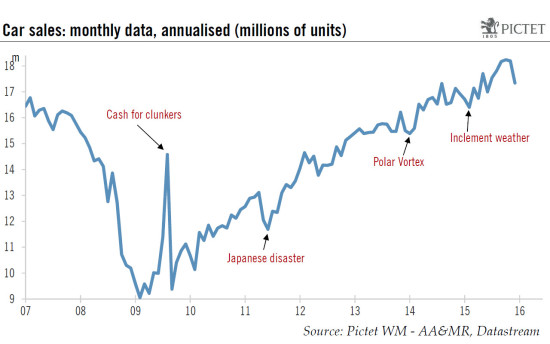

Some other important economic data have been published over the past 2-3 weeks, and most of them were softer than expected. November data for core capital goods orders and shipments, as well as home sales were disappointing, whilst construction spending numbers for November, published last Monday, were surprisingly weak. Construction spending fell by 0.4% m-o-m, whereas consensus estimates were heading for a 0.6% increase. And figures for the previous two months were revised sharply down. Moreover, December car sales – published yesterday – showed a sharp monthly pullback. The decline should be put into its proper context though (see chart below). Car sales had surged in October-November and overall in Q4 they reached a record high. Nevertheless, they grew by ‘only’ 1.8% q-o-q annualised in Q4, following +17.2% in Q3 and +9.8% in Q2. Today’s trade data were slightly more encouraging for Q4 GDP. Real exports of goods dropped m-o-m in November, but imports fell by even more. However, October’s trade deficit was revised higher.

Altogether, the economic data published recently suggest that GDP growth in Q4 should prove softer than what we were expecting. As a consequence, we revise our forecast from 2.0% q-o-q annualised to 1.5%.

However, we don’t see much reason to alter our expectations for 2016. On the one hand, the dollar’s sharp increase will continue to weigh heavily on economic growth, with the peak for the drag probably occurring only in Q3 2016. Moreover, the oil sector is likely to weaken further. However, the negative impact on overall economic growth should be much less pronounced than in 2015. And, on the other hand, important supportive factors will remain in place: the credit cycle is still buoyant, the housing recovery has bright prospects, household wealth has risen unmistakably on the back of higher house prices and growth in jobs and income is likely to remain healthy. Moreover, public spending is at last growing more solidly, and the upturn should continue. On that front, the fact that Congress has recently reached an agreement on important budget issues is encouraging. Overall fiscal policy will at last turn modestly supportive in 2016.

In conclusion, we continue to expect relatively healthy growth in 2016, but with no quickening compared with 2015. Our forecast that GDP should grow by around 2¼% between Q4 2015 and Q4 2016 remains unchanged. However, following the reduction of our growth estimate for Q4 2015, our forecasts on a yearly average basis are ‘mechanically’ reduced from 2.5% to 2.4% for 2015 and from 2.3% to 2.2% for 2016.