At yesterday’s FOMC meeting, the Fed finally decided to hike rates by 25bp, adding that the path of future rate hikes would be gradual. We continue to expect a very slow pace of tightening next year (only two additional 25bp hikes). In line with what almost every forecaster was expecting, at its meeting yesterday, the Federal Open Market Committee (FOMC) decided to hike interest rates, and raised the target range for the Fed funds rate by 25bp from 0%-0.25% to 0.25%-0.5%. The Fed fund rate had been at virtually zero for exactly seven years and the last hike happened in June 2006, almost 10 years ago. As yesterday’s hike was well telegraphed, of most importance were the messages and tone of the statement, the projections and the press conference. Observers were particularly interested to hear how chair Yellen would describe the expected path for the Fed funds rate in the future. As far as the economic situation is concerned, in its statement the Fed upgraded its assessment of the labour market situation and raised slightly its GDP growth forecast for 2016. The median projection – a measure introduced in September in economic projections – for y-o-y GDP growth in Q4 was revised up from 2.3% to 2.4%. Meanwhile, the projection for core PCE inflation in Q4 2016 was slightly reduced from 1.7% to 1.6%. This figure actually appears quite low.

Topics:

Bernard Lambert considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

At yesterday’s FOMC meeting, the Fed finally decided to hike rates by 25bp, adding that the path of future rate hikes would be gradual. We continue to expect a very slow pace of tightening next year (only two additional 25bp hikes).

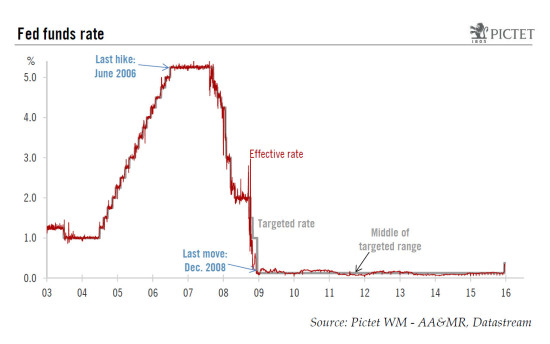

In line with what almost every forecaster was expecting, at its meeting yesterday, the Federal Open Market Committee (FOMC) decided to hike interest rates, and raised the target range for the Fed funds rate by 25bp from 0%-0.25% to 0.25%-0.5%. The Fed fund rate had been at virtually zero for exactly seven years and the last hike happened in June 2006, almost 10 years ago.

As yesterday’s hike was well telegraphed, of most importance were the messages and tone of the statement, the projections and the press conference. Observers were particularly interested to hear how chair Yellen would describe the expected path for the Fed funds rate in the future.

As far as the economic situation is concerned, in its statement the Fed upgraded its assessment of the labour market situation and raised slightly its GDP growth forecast for 2016. The median projection – a measure introduced in September in economic projections – for y-o-y GDP growth in Q4 was revised up from 2.3% to 2.4%. Meanwhile, the projection for core PCE inflation in Q4 2016 was slightly reduced from 1.7% to 1.6%. This figure actually appears quite low. Although core PCE inflation is currently as low as 1.3%, base effects should lead to a pick-up to 1.5% in January 2016. So, the Fed seems to expect only a very mild pick-up in core inflation during 2016. We agree, as our own forecast is for core PCE inflation to end 2016 at around 1.7%. Also worth noting, the FOMC at last acknowledged in its statement the fact that “some survey-based measures of longer-term inflation expectations have edged down”.

Unchanged median projection for Fed funds by end-2016

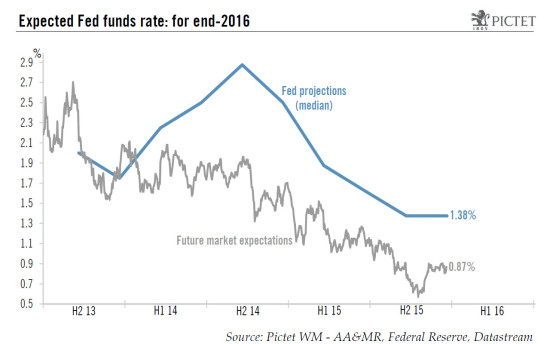

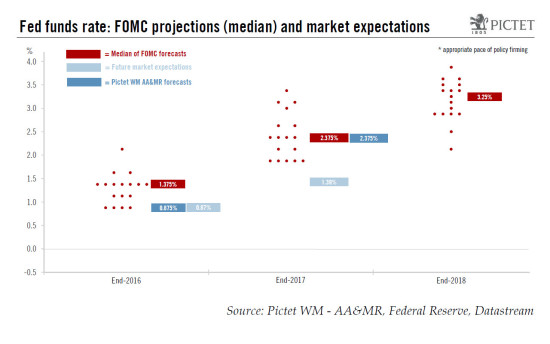

Turning to the projections for the Fed funds rate, the median forecast for the end of 2016 was unchanged at 1.375%, which implies four hikes of 25bp during the course of next year. However, a number of participants cut their forecasts and although the median remained unchanged the mean of individual projections fell by 19bp to 1.29%. Actually, 7 participants out of 17 expect less than four 25bp hikes in 2016.

Looking beyond 2016, median projections were trimmed by 25bp, to 2.375% for end-2017 and 3.25% for end-2018, reinforcing the idea the Fed wants to tread very carefully in the tightening process.

In any event, these rate forecasts are strange beasts (see chart above). On the one hand, they are nothing more than the sum of several forecasts (17 yesterday) from voting and non-voting Fed members. These projections can change fairly quickly depending on which FOMC members attend the meeting. Moreover, although it was thinner in yesterday’s projections, the breadth of the range of forecasts looks wide. For the end of 2016, the lowest projection is 0.875% and the highest 2.125%. As a result, the significance of the median forecast is limited. On the other hand, Fed rate forecasts increasingly form part of its forward guidance. In any case, it is worth remembering that exactly one year ago, the median of projections was for four 25bp hikes in 2015. We ended with just one…

Normalising interest rates a ‘gradual’ process

Unsurprisingly, at the press conference Chair Yellen emphasised that the path of policy tightening is likely to be gradual and will depend on how economic data and the outlook evolve. She said, echoing what was included in the statement, that “the Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate”. Regarding the timing and size of future hikes, it was also added that “in light of the current shortfall of inflation from 2 per cent, the Committee will carefully monitor actual and expected progress toward its inflation goal”. This confirmed what Chair Yellen has said in recent speeches, i.e. that future hikes will be much more dependent on inflation, and not only on the outlook for inflation, but also on actual developments. Overall, the tone of the press conference was probably ‘not so dovish’. However, when a central bank is hiking rates, it must sound justified. Therefore, it is difficult to send a really ‘dovish’ message about the future at the same time.

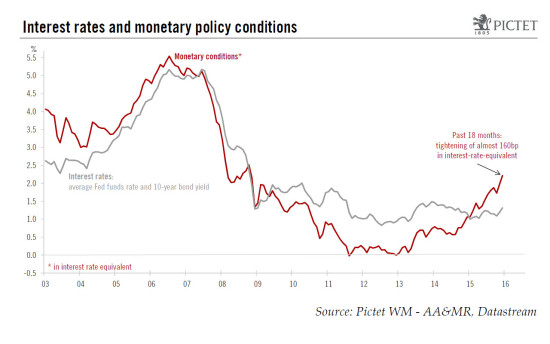

Nevertheless, monetary and financial conditions have tightened noticeably over the past few weeks. The trade-weighted dollar has just reached a new 12-year high, 2-year Treasury yields have just topped 1.0% for the first time since 2010, and credit spreads have jumped up. Moreover, economic data have been rather soft recently, and the additional fall in oil prices means that inflation will probably remain low for longer.

In that context, we are sticking to our view that the pace of rate tightening after the initial hike will be very pedestrian. We continue to believe that the FOMC will likely wait until June before hiking again, and our forecast that the target range on the Fed funds rate will end 2016 at 0.75%-1.00% (‘only’ two 25bp hikes in 2016) remains unchanged. In any event, the trajectory of monetary policy will be highly data-dependent, and the Fed will act very carefully in trying to avoid any unwanted tightening of monetary conditions.

One consequence of this is that the FOMC will probably continue to reinvest principal payments on its securities portfolio in 2016. We expect the tapering of reinvestments to start at the beginning of 2017. Yesterday, Chair Yellen had a word on that. She said that the Committee “anticipate continuing this policy [of reinvesting proceeds from maturing Treasury securities and principal payments from agency debt and mortgage-backed securities] until normalization of the level of the federal funds rate is well under way”.

The mechanics of lift-off

In the context of massive excess reserves of USD 2,500bn (up from almost nothing before the crisis), raising short-term rates is not an easy task for the Fed. To help to normalise its monetary policy stance when the time has come, the Fed has developed and tested some new tools. Unfortunately, the mechanics of lift-off appear quite complex with uncertain side-effects, actually complex enough that the Fed yesterday published an additional statement with the operational details. We do not want to go too deep into the Fed’s plumbing, but some of the most important elements around the specific mechanics of lifting rates are worth highlighting.

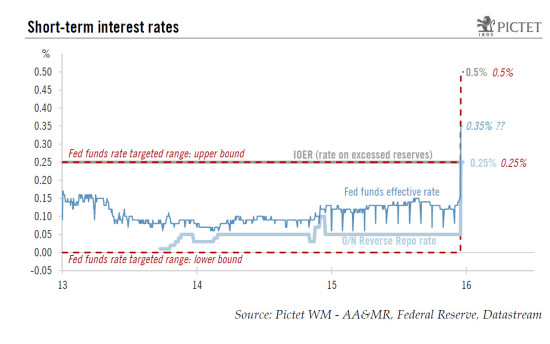

(1) As has been the case since end-2008, the Fed will continue to target a 25bp-large range on the Fed funds rate. Yesterday, this range was raised from 0%-0.25% to 0.25%-0.5%.

(2) To raise the effective Fed funds rate, the main tool the Fed will use is to adjust the IOER (interest rate on excess reserves). The IOER was set at the top of the target range for the Fed funds rate (0.25% before lift-off), and therefore yesterday it was raised to 0.5%.

(3) To help to control the level of the effective Fed funds rate, the Fed will continue to use an overnight reverse repurchase agreement facility (RRP), which drains reserves. Before lift-off, overnight RRP were offered at a fixed rate of 5bp and the maximum size of the programme was capped at USD 300bn. As pre-announced, yesterday the overnight RRP rate was settled at the bottom of the Fed funds range, i.e. it was raised from 0.05% to 0.25%.

(4) To help control the Fed funds rate, the Fed may also choose to use other tools if needed, mainly a term deposit facility and term RRP.

(5) The exact level of the effective Fed funds rate will continue to be determined by “market forces”. It should remain volatile, particularly at the end of the month, the end of the quarter and the end of the year. However, the aim of the Fed is that on average this rate will also move up by around 25bp, when the target range is raised by 25bp.

In a context of such massive excess reserves, raising the effective Fed funds rate well inside the new target range may prove difficult. There is a lot of uncertainty about the demand for overnight RRP after lift-off. Yesterday, the Fed has also announced that it would raise the USD 300bn cap on the overall size of overnight RRP to around USD 2,000bn (the value of Treasuries held by the Fed and available for such operations). This amount was well above what was generally expected. The decision of the Fed on that front was very uncertain because the Fed has repeated that it fears very large RRP in a prolonged way may distort money markets and generate financial stability risks. In short, the Fed is worried that offering deposits with itself as an ultra-safe counterparty in an almost unlimited fashion may attract huge flows in the event of ‘flight to quality’ moments, and therefore drying up other wholesale funding. So, although the Fed is ready to “allow aggregate capacity of the ON RRP facility to be temporarily elevated to support policy implementation”, it clearly stated that it would like to reduce this capacity as soon as possible.

To help effective Fed funds rate moving higher, the Fed can increase the size of RRP, or use its term deposit facility. It can also increase the RRP interest rate and/or the IOER. So, the potential problem is not so much that the Fed would fail to push Fed funds rate higher, it is the market distortions that could occur in the process. So, in conclusion, what remains to be seen is how much reserves the Fed needs to drain to control the effective Fed funds rate, if after the early stage of the hiking cycle it can reduce substantially the size of the RRP facility, at what levels the effective Fed funds rate will settle at the beginning of next year, and how other short-term interest rates will react to the whole process.