Macroview In our 2016 and secular outlook scenarios, we stressed that emerging markets are a source of risks for global markets as they transition over several years from an export-based model to one with a greater role for domestic demand. The recent Chinese equity market jitters are a new manifestation of the uncertainty surrounding the shift in China’s economic model, which implies a slowdown in growth and volatility in economic and financial data. The fear of a rise in these risks exacerbates investor sentiment, leading to the kind of market movements observed in the first trading days of this year. All emerging economies contribute to volatility and economic risks. The Saudi-Iran diplomatic clash has added to the nervousness and, because of falling oil prices, producing countries such as Brazil remain a source of financial stress for international markets. Consequently, emerging markets are likely to continue to exhibit lacklustre investment prospects. Furthermore, the following observations can be made: The China’s CSI 300 Stock Index’s 7.2 percent drop last night (the second drop of this magnitude this year) triggered a trading halt by automatic circuit-breakers. The Chinese sell-off is not related to any major change in China’s economic fundamentals.

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In our 2016 and secular outlook scenarios, we stressed that emerging markets are a source of risks for global markets as they transition over several years from an export-based model to one with a greater role for domestic demand.

The recent Chinese equity market jitters are a new manifestation of the uncertainty surrounding the shift in China’s economic model, which implies a slowdown in growth and volatility in economic and financial data. The fear of a rise in these risks exacerbates investor sentiment, leading to the kind of market movements observed in the first trading days of this year.

All emerging economies contribute to volatility and economic risks. The Saudi-Iran diplomatic clash has added to the nervousness and, because of falling oil prices, producing countries such as Brazil remain a source of financial stress for international markets. Consequently, emerging markets are likely to continue to exhibit lacklustre investment prospects. Furthermore, the following observations can be made:

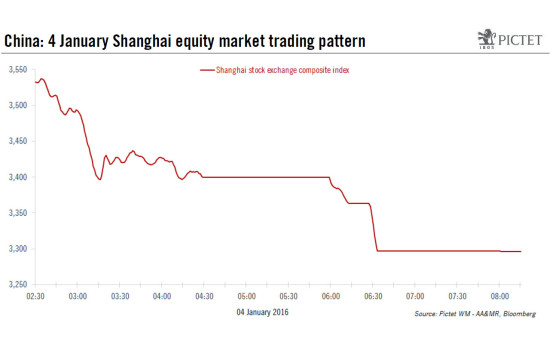

- The China’s CSI 300 Stock Index’s 7.2 percent drop last night (the second drop of this magnitude this year) triggered a trading halt by automatic circuit-breakers.

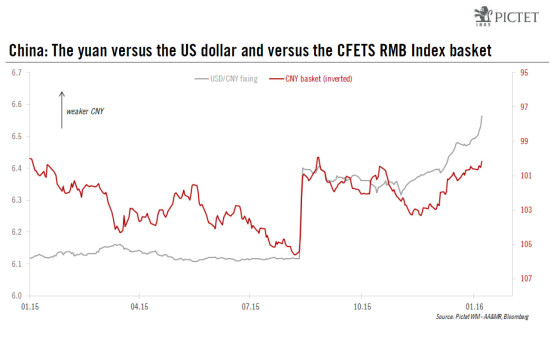

- The Chinese sell-off is not related to any major change in China’s economic fundamentals. Manufacturing and services PMIs published earlier this week were somewhat below consensus expectations, but not enough to trigger such a sell-off. Market observers have focused on the devaluation of the yuan against the US dollar. Year-to-date, the currency has depreciated by 1.61% against the greenback, but only by an estimated 0.4% against the recently launched basket of currencies – China Foreign Exchange Trade System (CFETS) RMB Index – that includes the euro (see chart below).

- As the PBoC has stressed, focusing on the CFETS RMB Index basket seems more sensible, as the monetary policy divergence between the US (in tightening mode) and China (in easing mode) exacerbates the devaluation observed against the US dollar.

- Chinese trading halt mechanisms have been operational since 1 January in the wake of last August’s market jitters. The circuit-breaker halts exchanges for 15 minutes after a 5% loss in the CSI 300 Index and then halts them for the rest of the day after a 7% drop. In both instances this year (4 and 7 January), the first halt was quickly followed by the market being shut down, as accumulated sell-orders and margin calls are processed when trading resumes (See charts below for the Shanghai Composite).

- US Treasuries and German Bunds remain the best assets for protection against shocks in equity markets. Over the last five trading days, yields of 10-year US Treasuries have decreased from 2.3% to 2.15%.

- Stress measures in global financial markets are not as elevated as one might have expected. The VIX, measuring implied volatility of the S&P 500, has not spiked and, at 20%, remains in the regime that we define as medium (between 15% and 25%). Moreover, US high-yield markets have remained stable year-to-date.

- Nevertheless, if energy prices were to recede further, this development would be likely to reverse. In this case, renewed tensions would emerge with energy, cyclical and materials high-yield issues, potentially triggering stress in other risk assets.

Owing to recent market developments, we expect the Chinese authorities to take action under their ‘stop & go’ budget and monetary policies framework. Immediate monetary action could entail further deposit rate cuts and/or a decrease in the reserve requirement ratio (RRR) for banks.