In this post, we provide a rough assessment of the reflationary impact of the newly-announced ECB’s measures through a simple framework. Ahead of the December 2015 meeting, we used a simple method based on the ECB’s leaked models in the German press in order to guestimate the impact of QE on inflation, and thus the potential for additional easing based on the ECB’s own forecasts. We use the same framework to assess the potential macro impact of the new measures announced by the ECB last...

Read More »The ECB delivers a bigger-than-expected package to support bank lending

The ECB announced measures that exceeded expectations, targeting the refi rate, its monthly asset purchases, a new corporate bonds purchase programme, new TLTROs and a negative rate. The deposit rate was cut as expected, but Draghi said that “no more cuts” were anticipated at this stage. The ECB’s Governing Council delivered a comprehensive policy package that exceeded market expectations by a large margin. The 10bp deposit rate cut to -0.40% was expected but other measures were not,...

Read More »Corporate bonds: February marked by singularly high volatility

Macroview US HY corporate bonds have benefited from the rise in the oil price, whereas European HY corporates are still looking for reassurance from the banking sector. Spreads on corporate bonds widened quite noticeably in February: those on US high-yield issues hit highs not seen since 2011 before narrowing again as China-related fears, worries over the oil price and concern about banks' profitability diminished. The energy and mining sectors were both boosted by the rise in the oil...

Read More »Hedge funds: risk-off mode in equities

Macroview Macro managers have reduced their equity exposure amid modest positive returns year-to-date, while long/short equity managers have been challenged by sharp market rotations. Equity risk in macro managers' portfolios is below the historical average. Many expect stock markets to trend lower – not necessarily because of a coming recession but because of peak margins and outflows from petrodollar-dependent sovereign wealth funds. The effectiveness of QE programmes is also being...

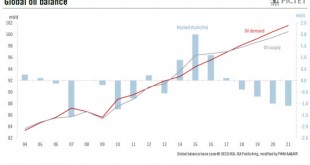

Read More »Oil price likely to be back to $50/barrel in 2017

The influence of the oil price on financial markets has grown in importance recently. The dampening effect of low oil prices on import prices makes the work of central bank work more difficult as they are already struggling to bring back low inflation closer to their targets. The fall in the oil price has increased concerns about deflation and exacerbated investors’ sentiment that monetary authorities are running out of effective tools to reflate economies. We have argued in the past few...

Read More »United States: Better-than-expected job gains in February

February’s employment report showed strong job gains and further reduction in labour market slack. Wage numbers were noticeably lower than expected and the average workweek fell markedly. Nevertheless, the US labour market remains quite healthy overall. Non-farm payroll employment rose by a robust 242,000 m-o-m in February, well above consensus expectations (195,000). Moreover, January’s figure was revised up (from 151,000 to 172,000), as was December’s number (from 262,000 to 271,000)....

Read More »United States: ISM Manufacturing index bounces back slightly in February

Even though the ISM Manufacturing index remains stuck at quite low levels, we continue to expect GDP growth to reach 2.0% q-o-q annualised in Q1 and 2.0% as well on average in 2016. The ISM Manufacturing index bounced back a little in February, but its Non-Manufacturing counterpart eased marginally. We don’t see any reason to alter our growth scenario. Our forecast that GDP will grow by 2.0% in Q1 and 2.0% overall in 2016 remains unchanged. ISM Manufacturing index bounced back in...

Read More »ECB monetary policy: same player, different target, shoot again

Our baseline scenario remains for the ECB to announce a comprehensive policy package including a 10bp deposit rate cut (along with a tiered deposit system), a EUR20bn increase in the pace of asset purchases to EUR80bn per month (along with changes to QE modalities), as well as more attractive TLTRO operations. This time is different – it’s no longer about oil At first glance it feels as though market participants have gone all the way back to three months ago, when they were expecting a...

Read More »Spain: new elections increasingly likely

If Pedro Sanchez loses tomorrow's confidence vote, and if political parties fail to form a new government over the next two months, new general elections would be called. Risks to the recovery may surface if political uncertainties remain entrenched. Yesterday, Pedro Sanchez, the PSOE leader, lost the first investiture vote. A second vote will take place on Friday, 4 March. The threshold will be less demanding as only a simple majority is needed. Even so, Sanchez’s chances of winning the...

Read More »Switzerland: Fourth quarter GDP surprises on the upside

According to SECO’s estimate, Swiss real GDP expanded by 0.4% q-o-q (1.7% q-o-q annualised, 0.3% y-o-y) in Q4, much better than consensus expectations (0.1%). Swiss GDP surprised on the upside in Q4, driven by robust consumption. Looking ahead, our scenario for the Swiss economy remains unchanged. For 2016, we expect Swiss GDP to expand by 1.1% and headline inflation to average -0.6%. The 0.4% q-o-q rise in the Q4 figure came after a downwardly revised Q3 figure of -0.1% q-o-q. For 2015...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org