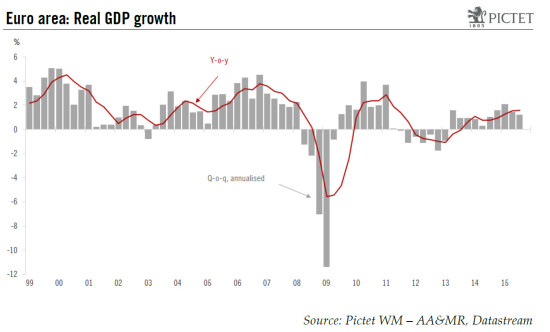

Euro area real GDP grew by 0.3% q-o-q in Q4, in line with consensus expectations. Based on evidence from core countries, private consumption was once again the main driver of GDP growth. According to Eurostat’s preliminary estimate, euro area real GDP grew by 0.3% q-o-q in Q4 (1.1% q-o-q annualised; 1.5% y-o-y), in line with consensus expectations and at the same pace as in Q3. No breakdown is available at this stage, but evidence from core countries suggests that private consumption was once again the main growth driver in Q4 while investment contributed positively as well. Foreign trade probably acted as a drag on GDP growth for the second consecutive quarter, albeit less so than in Q3. From a geographical perspective, economic growth disappointed in Italy (+0.1% q-o-q compared with +0.3% expected) and Portugal (+0.2% q-o-q; expected +0.4%), while headline GDP figures were in line with expectations in most other countries, including Germany (0.3%), France (0.2%, along with encouraging details), Spain (0.8%) and the Netherlands (0.3% along with weak details). Euro area GDP grew by 1.5% for 2015 as a whole, up from 0.9% in 2014 and -0.4% in 2013. As for 2016, we continue to forecast a gradual pick-up in the pace of economic expansion, largely led by domestic demand.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Euro area real GDP grew by 0.3% q-o-q in Q4, in line with consensus expectations. Based on evidence from core countries, private consumption was once again the main driver of GDP growth.

According to Eurostat’s preliminary estimate, euro area real GDP grew by 0.3% q-o-q in Q4 (1.1% q-o-q annualised; 1.5% y-o-y), in line with consensus expectations and at the same pace as in Q3. No breakdown is available at this stage, but evidence from core countries suggests that private consumption was once again the main growth driver in Q4 while investment contributed positively as well. Foreign trade probably acted as a drag on GDP growth for the second consecutive quarter, albeit less so than in Q3.

From a geographical perspective, economic growth disappointed in Italy (+0.1% q-o-q compared with +0.3% expected) and Portugal (+0.2% q-o-q; expected +0.4%), while headline GDP figures were in line with expectations in most other countries, including Germany (0.3%), France (0.2%, along with encouraging details), Spain (0.8%) and the Netherlands (0.3% along with weak details).

Euro area GDP grew by 1.5% for 2015 as a whole, up from 0.9% in 2014 and -0.4% in 2013. As for 2016, we continue to forecast a gradual pick-up in the pace of economic expansion, largely led by domestic demand. While private consumption is likely to remain robust, we expect a credit-led rebound in investment to support aggregate demand and our forecast for euro-area GDP growth is unchanged at 1.8%.

That said, downside risks have intensified, including weaker external demand, a 6% appreciation in the trade-weighted EUR, and rising concerns over European banks’ profitability. We will monitor those risks very closely in the next few weeks to assess the need to adjust our forecasts. Either way, we continue to expect the ECB to ease at its meeting on 10 March, hopefully fuelling a rebound in risk assets in the process.

Germany: Moderate growth continued in Q4

German real GDP rose by 0.3% q-o-q in Q4, in line with consensus expectations (0.3%), stable compared with the 0.3% posted in Q3. This points to a GDP growth of +1.4% for the whole year of 2015, after +1.6% posted in 2014.

Germany’s Federal Statistics Office (Destatis) has not yet provided any figures on the breakdown of expenditure for Q4. Nevertheless, based on its press release and on monthly indicators, positive contributions were again made by domestic demand. In more detail, general government consumption increased markedly, while the rise in private consumption was more moderate. A positive development was also observed in investment, in particular thanks to a rebound in construction. In contrast, the development of foreign trade had a negative impact on GDP growth as exports were down. Imports also decreased albeit less strongly.

Portugal and Italy: Disappointed in Q4

The disappointment came from Italy and Portugal. In the case of Italy, Q4 GDP (+0.1% q-o-q) came in weaker than expected (0.3%). The disappointing performance came from negative domestic demand according to the ISTAT statistics office. For 2015 as a whole, GDP increased by 0.6%, a marked improvement after three years of contraction (2014: -0.4%; 2013: -1.8%; 2012: -2.9%).

Meanwhile, Portuguese GDP expanded by 0.2% q-o-q in Q3 (expected at +0.4%), but marking an acceleration after stagnating in Q3. For 2015 as a whole, the economy expanded by +1.4% in 2015, after a figure of +0.9% in 2014.

Netherlands: Acceleration at the end of the year

The Dutch economy expanded by 0.3% q-o-q in Q4, also in line with consensus expectations and an improvement on Q3’s +0.1%. As a result for 2015 as a whole, the Dutch economy posted GDP growth of 1.9%, almost twice what it achieved in 2014 (+1.0%).

The breakdown by expenditure component showed that only investment contributed positively to GDP growth in Q4. Looking ahead, leading indicators point to robust annual growth, but the economy remains particularly vulnerable given its exposure to global trade.

Greece: Contracted for the second quarter in a row

The Greek economy contracted less than expected. Indeed, Greek GDP shrank by 0.6% q-o-q in Q4 (expected -0.8%), after a contraction of -0.9% in Q3. As a result, for 2015 as a whole, the economy fell by 0.2%, after a GDP growth of 0.7% in 2014.

Lastly, French and Spanish Q4 GDP figures were already released on January 29.