Swiss Franc The Euro has risen by 0.05% to 1.0737 EUR/CHF and USD/CHF, January 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new week is off to a quiet start as the US celebrates Martin Luther King’s birthday, and investors look for a fresh focus. Hong Kong and Indian markets were suffered modest declines while most of the other large Asia Pacific markets edged higher. European stocks are trading a...

Read More »“The seeds have been sown for unrest in 2020 in Europe”

Interview with Godfrey Bloom The latest election in the UK promised to bring about a long-overdue end to the Brexit story. Getting out the EU has been a long and winding road for Britain and the multiple delays and setbacks have both infuriated and disappointed the millions of citizens who voted to Leave, by now three times already. Ever since the referendum, all (at least, foreign) eyes have been fixed on the latest Brexit updates, however, there have been other important shifts...

Read More »FX Daily, January 13: Dismal Data Undercuts Sterling and Boosts Chances of a Rate Cut

Swiss Franc The Euro has fallen by 0.08% to 1.080 EUR/CHF and USD/CHF, January 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There are two big stories today. The first is the large scale protests in Iran after the government admits to accidentally shooting down the commercial airliner amid the fog of war. The market impact seems minimal but fueling speculation that this, coupled with the economic hardship...

Read More »FX Weekly Preview: Back to Macro?

The US-China trade conflict and then US-Iran confrontation distracted investors from the macroeconomic drivers of the capital markets. It is not that there is really much closure with the exogenous issues, but they are in a less challenging place, at least on the surface. A Chinese delegation, led by the Vice-Premier Liu He, who spearheaded the negotiations, will participate in the signing ceremony on January 15.. While China has agreed to buy $200 bln more of US...

Read More »FX Daily, December 20: Sterling Trades Higher after Test on $1.30

Swiss Franc The Euro has fallen by 0.04% to 1.0875 EUR/CHF and USD/CHF, December 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The holiday mood has tightened its grip on the capital markets, and global investors have nearly completely ignored the impeachment of the US President as it has little economic or policy significance. US equities reached new record highs yesterday with the S&P 500 moving above...

Read More »FX Daily, December 19: Whiff of Inflation in the Air

Swiss Franc The Euro has risen by 0.01% to 1.0893 EUR/CHF and USD/CHF, December 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is risky to read too much into the price action in holiday-thin markets, but inflation fears are beginning to surface. The price of January WTI is around $61, having tested $50 a barrel in Q3. The CRB Index made new highs for the year yesterday and is up almost 9% for the year....

Read More »FX Weekly Preview: Central Bank Meetings and Flash PMI Reports, but its Over except for the Shouting

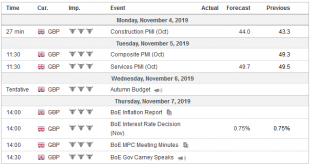

After last week’s flurry of events, market activity is set to slow over the next three weeks. But what a flurry of events it was. A new NAFTA apparently has been agreed, and it is set to be approved by the US House of Representatives next week and the Senate early next year. The US and China struck an agreement that will get rid of the immediate tariff threat and unwind half of the punitive tariffs in exchange for a commitment to buy twice the amount of agriculture...

Read More »FX Weekly Preview: Synchonized Emergence from Soft Patch?

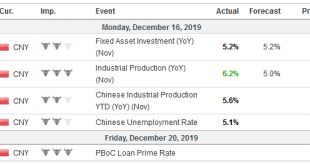

There have been plenty of developments warning of a global economic slowdown. Yet, seemingly to justify the continued advance in equity prices, there has begun to be talk of possible cyclical and global rebound. That is the new constellation, connecting the better than expected Japanese, South Korean, and Chinese September industrial output figures, a slightly stronger than expected Q3 GDP reports from the US and the eurozone. Ahead of the weekend, China reported...

Read More »FX Daily, September 19: Investors Looking for New Focus

Swiss Franc The Euro has fallen by 0.22% to 1.0975 EUR/CHF and USD/CHF, September 19(see more posts on EUR/CHF, USD/CHF, ) - Click to enlarge FX Rates Overview: Central bank activity is still very much the flavor of the day, but investors are looking for the next focus. The Bank of Japan and the Swiss National Bank stood pat, while Indonesia cut for the third consecutive time and the Hong Kong Monetary Authority and Saudi Arabia quickly followed the Fed. Brazil...

Read More »The Bank of England’s “Future of Finance Report”

Huw van Steenis’ summarizes his report as follows (my emphasis): A new economy is emerging driven by changes in technology, demographics and the environment. The UK is also undergoing several major transitions that finance has to respond to. What this means for finance Finance is likely to undergo intense change over the coming decade. The shift to digitally-enabled services and firms is already profound and appears to be accelerating. The shift from banks to market-based finance is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org