Swiss Franc The Euro has fallen by 0.04% to 1.0875 EUR/CHF and USD/CHF, December 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The holiday mood has tightened its grip on the capital markets, and global investors have nearly completely ignored the impeachment of the US President as it has little economic or policy significance. US equities reached new record highs yesterday with the S&P 500 moving above 3200. Asia Pacific equities were mixed, leaving the MSCI Asia Pacific Index consolidating recent gains that carried it to the (61.8%) retracement objective of the decline that began at the start of 2018. Europe’s Dow Jones Stoxx 600 is moving broadly sideways after setting record highs at the beginning of

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of England, Currency Movement, Featured, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.04% to 1.0875 |

EUR/CHF and USD/CHF, December 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

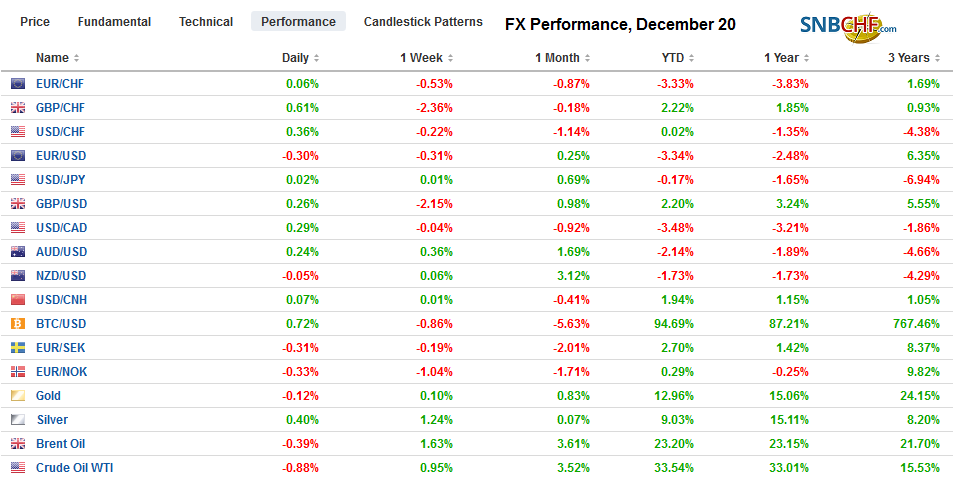

FX RatesOverview: The holiday mood has tightened its grip on the capital markets, and global investors have nearly completely ignored the impeachment of the US President as it has little economic or policy significance. US equities reached new record highs yesterday with the S&P 500 moving above 3200. Asia Pacific equities were mixed, leaving the MSCI Asia Pacific Index consolidating recent gains that carried it to the (61.8%) retracement objective of the decline that began at the start of 2018. Europe’s Dow Jones Stoxx 600 is moving broadly sideways after setting record highs at the beginning of the week. It is poised to gain more than 1% for the second consecutive week. It has fallen only three weeks here in Q4 compared with two weeks of declines for the S&P 500. The sell-off in bonds continues, and yields are up 1-2 basis points today, though Italian and Greek yields are up a bit more. The foreign exchange market is becalmed. Sterling has stabilized after falling two percent in the past three sessions. For the most part, the major currencies are hugging little changed levels. The Dollar Index is poised to snap a two-week drop. Against the emerging market currency complex, the dollar is mixed, but the JP Morgan Emerging Market Currency Index has firmed by about 0.3% this week, making it the third weekly gain after falling every week in November. Gold is little changed on the day and week, while February WTI is nursing a small loss to trim this week’s gains, the third consecutive weekly rise. During the run, the price of crude has risen by more than 10%. |

FX Performance, December 20 |

Asia Pacific

Japan reported November CPI rose 0.5% year-over-year, up from 0.2% in October. It has finished 2018 at 0.3% and 2017 at 1.0%. The measure the BOJ targets exclude fresh food. By this metric, core inflation rose to 0.5% from 0.4%. It stood at 0.7% at the end of last year and 0.9% at the end of 2017. Excluding fresh food and oil, Japan’s CPI rose to 0.8%, the highest in three years. Japan’s sales tax increase (Oct 1) and the free pre-school initiative have distorted the data, and when adjusted for core inflation is closer to 0.2%. The BOJ cannot be content with the results but appears to out of runway, and the government’s fiscal stimulus buys it time.

After cutting the reverse repo rate by 5 bp earlier this week, the PBOC left its Loan Prime Rate unchanged at 4.15% (one-year), which surprised the market. Many economists expect further easing next year to support the economy, which is expected to hover around 6% growth next year. Separately, China’s media reported that President Xi will not attend Davos next month. There had been some ideas that Xi and Trump could meet there.

The dollar recorded an outside down day against the yen yesterday by trading on both sides of the previous day’s range and then closing below its low. However, there has been no follow-through selling today, and the greenback has been confined to about JPY109.25-JPY109.40. The dollar has traded above JPY109.70 a few times this month and meet sellers each time. There is a roughly $430 mln option there that expires today, but more notable are $3.2 bln in options, struck between JPY109.45 and JPY109.50 that also are expiring. The Australian dollar is firm as it closes in on its third consecutive weekly gain. It is flirting with $0.6900 and testing the 200-day moving average (~$0.6905), which it has toyed with several times this year but failed to close above it once. The dollar set the week’s high against the Chinese yuan today near CNY7.0160. Today is the first session in seven that the dollar did not trade below CNY7.0.

EuropeTwo developments in the UK dominate the European session. First, the head of the Bank of England’s Financial Conduct Authority, Andrew Baily has been picked to succeed Carney at the end of next month as Governor of the Bank of England. Recently, former deputy governor, Shafik had been seen as the front-runner, though Baily was always seen as a safe choice. He will serve an eight-year term. Some reports suggest Shafik was more critical of Brexit. Baily may be an old hand at the Bank of England, but he has not served on the Monetary Policy Committee, and his views are not clear. Note that Carney has agreed to extend his term (for a third time) from the end of January to mid-March to allow for a smooth transition. |

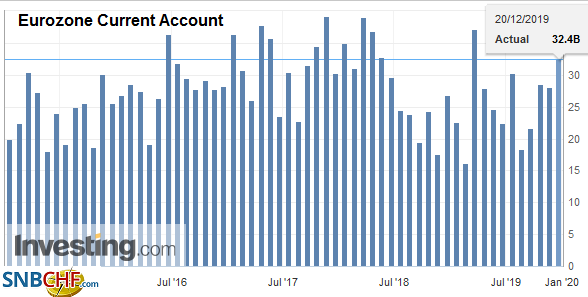

Eurozone Current Account, October 2019(see more posts on Eurozone Current Account, ) Source: investing.com - Click to enlarge |

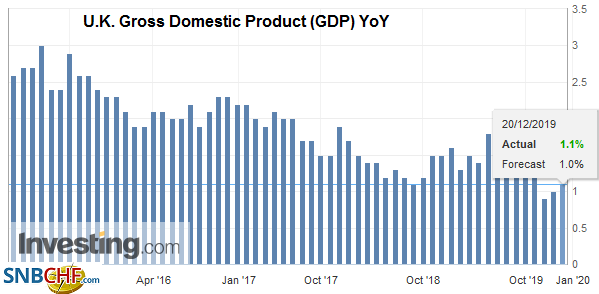

| Second, Q3 UK GDP was revised to 0.4% from 0.3% on the back of stronger services. Private consumption was shaved to 0.3% from 0.4%, while government spending fell by 0.6% instead of increasing by 0.3%. The net export function improved as export growth was revised to 7.9% from 5.2% and a 4.1% contraction in Q2. Imports fell by 0.3% rather than rise by 0.8% as it was previously estimated. The result was a sharp improvement in the Q3 current account deficit from a shortfall of GBP24.2 bln in Q2 to GBP15.9 bln in Q3, which is the smallest deficit in seven years. |

U.K. Gross Domestic Product (GDP) YoY, Q3 2019(see more posts on U.K. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

The euro is consolidating in about a ten tick range near the week’s lows. It reached almost $1.1105 yesterday after having been turned back from nearly $1.12 at the end of last week. It met sellers today near $1.1125, and there are 3.5 bln euro in options that will be cut today that are struck between $1.1130 and $1.1150. Sterling was pushed briefly and narrowly through $1.30 yesterday and is holding above there today. There is an option for about GBP690 mln struck there and another for around GBP385 mln at $1.3016 that expires today. There are also $1.3040-$1.3050 options for almost GBP925 mln that will be cut as well. The next hurdle is near $1.3100. Sterling’s 2% decline would be the largest weekly decline in seven months.

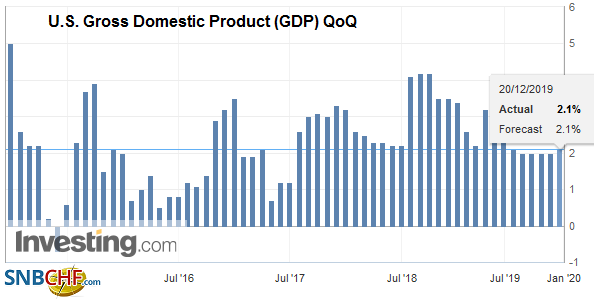

AmericaYesterday’s US economic data disappointed. The Philly Fed survey for December was weaker than expected. Weekly jobless claims did not retrace as much of the previous week’s spike as anticipated. The decline in existing home sales was more than forecast, and the November Leading Economic Indicator defied expectations for an increase. It has not posted a gain since July. The highlight today is not so much revisions to Q3 GDP, which is too historical to matter traders, but the November income and consumption figures. Income is expected to rise by 0.3% after a flat reading in October, and the risk is for a slightly smaller increase. But consumption is understood to be more important, and the market anticipates a robust 0.4% increase after 0.3% in October. After the disappointing retail sales report, the risk here too is on the downside. The PCE deflator, which the Fed targets may edge up to 1.4% from 1.3%, but the core deflator that is often discussed, may slip to 1.5% from 1.6%. |

U.S. Gross Domestic Product (GDP) QoQ, Q3 2019(see more posts on U.S. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

Canada reports October retail sales, and a 0.5% increase is expected after the disappointing 0.1% fall in September. The average monthly gain this year is 0.3%, the same as in 2018. The risk is on the downside as economists have been more often than not expecting stronger than actual data. Mexico also reports October retail sales. There is likely to be some payback from the 0.9% surge in September retail sales, and the median forecast in the Bloomberg survey is for a 0.3% decline.

The US dollar’s losing streak against the Canadian dollar will extend to its fourth consecutive week if it cannot resurface above CA1.3165. There is a $700 mln option at CAD1.3150 that expires today. It has met some selling in front of there in the European morning. As widely expected, Mexico delivered its fourth 25 bp rate cut of the year yesterday (to 7.25%), and the peso strengthened. The dollar has traded as high as MXN19.04 early yesterday before sliding to the session low after the cut to about MXN18.9165. Unable to get above MXN18.95 today, the greenback remains in this week’s trough. Meanwhile, the bounce in the Dollar Index is bumping along the 91.50 resistance area. The 50-day moving average is set to cross below the 200-day moving average (golden or deadman’s cross) next week. It would be the first time since June 2018.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of England,Currency Movement,Featured,newsletter,U.K.