[unable to retrieve full-text content]As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »Does the UK Need Even More Stimulus?

AEP Speaks for Himself “We are all Keynesians now, so let’s get fiscal.” This is one view according to Ambrose Evans-Pritchard from The Telegraph who believes the time is right for the UK government to loosen its fiscal stance. He suggests that the “Bank of England has done everything possible under the constraints of monetary orthodoxy to cushion the Brexit shock. It is now up to the British government to save the...

Read More »FX Daily, August 19: Dollar Recovers into the Weekend

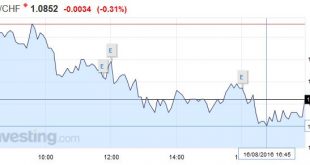

Swiss Franc: In the real effective exchange rate calculation, the PPI plays an important role. The Swiss producer price index fell by 0.8% YoY, while the German one is down 2.0%. Thismeans that in 2016 the CHF overvaluation is rising, when compared to the major Swiss trading partner Germany. The values for 2015 were -6% for the Swiss and -2.5% for Germany, the CHF overvaluation was reduced. Click to enlarge. Source...

Read More »Two More Banks Start Charging Select Clients For Holding Cash

Last weekend, when we reported that Germany’s Raiffeisenbank Gmund am Tegernsee – a community bank in southern Germany – said it would start charging retail clients a fee of 0.4% on deposits of more than €100,000 we said that “now that a German banks has finally breached the retail depositor NIRP barrier, expect many more banks to follow.” Not even a week later, not one but two large banks have done just that....

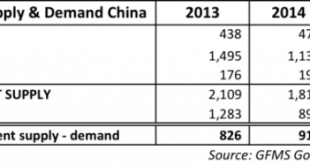

Read More »Spectacular Chinese Gold Demand Fully Denied By GFMS And Mainstream Media

Submitted by Koos Jansen of BullionStar In the Gold Survey 2016 report by GFMS that covers the global gold market for calendar year 2015 Chinese gold consumption was assessed at 867 tonnes. As Chinese wholesale demand, measured by withdrawals from Shanghai Gold Exchange designated vaults, accounted for 2,596 tonnes in 2015 the difference reached an extraordinary peak for the year. In an attempt to explain the 1,729...

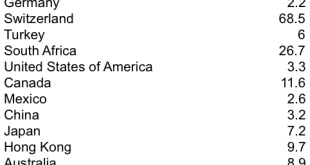

Read More »UK Imported Net 152 Tonnes of Gold in June, 68 from Switzerland

On a firmly rising gold price the UK is one of the largest net importers of gold in 2016. The gold price went up 25 % from $1,061.5 dollars per troy ounce on January 1 to $1,325.8 on June 31. Over this period the UK net imported 583 tonnes and GLD inventory mushroomed by 308 tonnes. In the month of June the UK gross imported 154.2 tonnes, up 22 % from May, and gross export was 1.9 tonnes, down 37 % from the previous...

Read More »FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

Swiss Franc Click to enlarge. FX Rates The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think. However, we are a bit skeptical. It is not that the US data has been strong, or that...

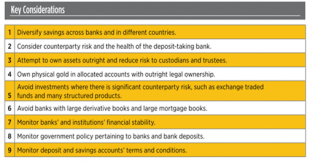

Read More »Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland’s largest insurance companies, have been moving cash out of Irish bank deposits and into bonds. Revelations regarding deposit bail-in risks came in the wake of warnings of a new property crash centred on the housing market in Ireland. The former deputy governor of the Central Bank warned in an op-ed in a...

Read More »Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland's largest insurance companies, have been moving cash out of Irish bank deposits and into bonds. Revelations regarding deposit bail-in risks came in the wake of warnings of a new property crash centred on the housing market in Ireland. The former deputy governor of the Central Bank warned in an op-ed in a leading international financial publication, Project...

Read More »FX Weekly Preview: Thoughts on the Significance of Ten Developments

Summary: The GDP deflator may be just as important as overall growth for BOJ considerations and the possibility of fresh action next month. Falling UK rates and a weaker pound are desirable from a policy point of view. Dudley’s press conference may be more important than FOMC minutes. Two German state elections that will be held next month comes as Merkel’s popularity has waned. Japan Japan’s Q2 GDP: The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org