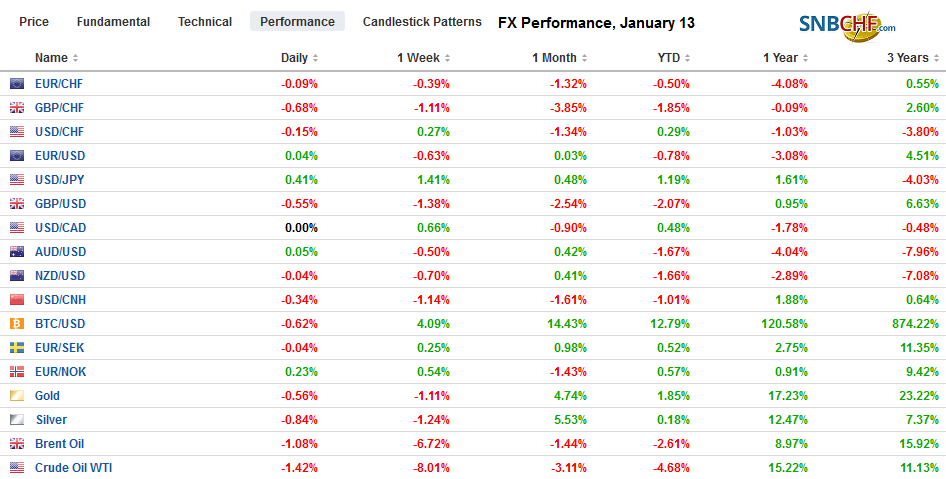

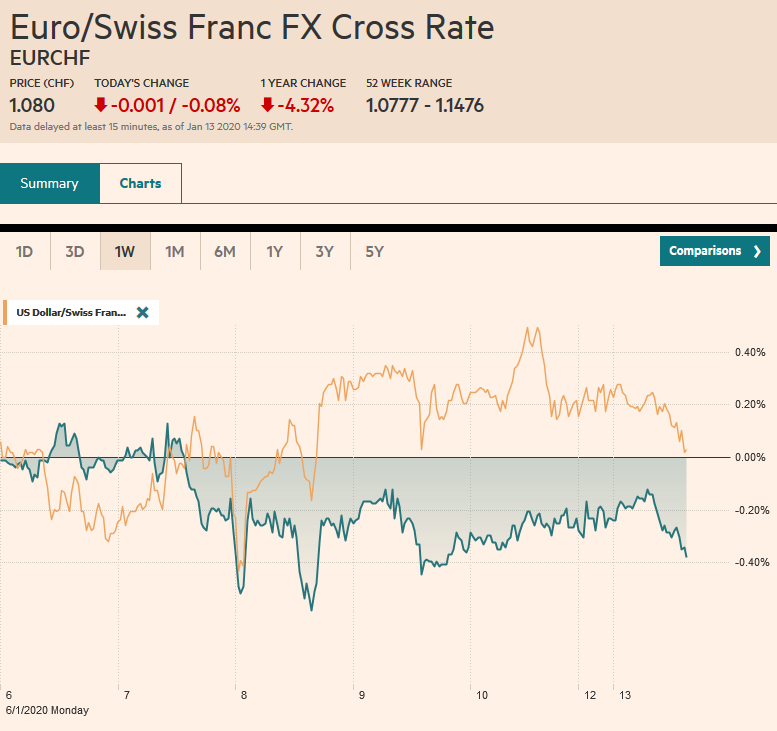

Swiss Franc The Euro has fallen by 0.08% to 1.080 EUR/CHF and USD/CHF, January 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There are two big stories today. The first is the large scale protests in Iran after the government admits to accidentally shooting down the commercial airliner amid the fog of war. The market impact seems minimal but fueling speculation that this, coupled with the economic hardship related to the US embargo, could topple the regime. Second, the UK reported that the economy unexpectedly contracted in November. With the backdrop of recent dovish commentary by a few officials, including BOE Governor Carney, sterling has suffered while UK interest rates have fallen as the market

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of England, China, Currency Movement, Featured, newsletter, Taiwan, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.08% to 1.080 |

EUR/CHF and USD/CHF, January 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: There are two big stories today. The first is the large scale protests in Iran after the government admits to accidentally shooting down the commercial airliner amid the fog of war. The market impact seems minimal but fueling speculation that this, coupled with the economic hardship related to the US embargo, could topple the regime. Second, the UK reported that the economy unexpectedly contracted in November. With the backdrop of recent dovish commentary by a few officials, including BOE Governor Carney, sterling has suffered while UK interest rates have fallen as the market begins to price in a greater chance of easier monetary policy. With Japanese markets closed for a local holiday and the Philippines markets closed due to volcanic activity, the MSCI Asia Pacific Index rose for a third consecutive session. Korea and Hong Kong markets led with more than a 1% gain. Taiwan’s Taiex gained 0.75%, led by financials and utilities following the weekend election. European shares remain firm, and the Dow Jones Stoxx 600 is hovering near record highs. US shares are trading firmer after the S&P 500 fell 0.3% at the end of last week. US and European benchmark 10-year yields are up 2-4 basis points, with UK Gilt yield falling back about three basis points. The dollar is little changed, but mostly firmer against the major currencies. Sterling and the yen are notable exceptions. Sterling is off for the fifth consecutive session and saw its lowest level (~$1.2960) since Boxing Day. The yen is also weaker as the dollar approached JPY110. Emerging market currencies are mostly edging higher against the US dollar. Gold continues to unwind its recent surge. It is lower for the third session of the past four and has been pushed below $1550 support. March WTI is stabilizing after falling for the previous four sessions. |

FX Performance, January 13 |

Asia Pacific

The more things change, the more things remain the same. After a confrontational couple of years, the Trump Administration is returning to the status quo ante. For the last couple of years, Beijing has offered to step up its purchases of US goods to reduce the trade imbalance. Now the US is willing to accept its offer. China has, on its own accord, slowed, if not stopped its direct intervention in the foreign exchange market, and enacted market-opening measures on its own timetable. As part of its “do the opposite of the Obama Administration phase,” the Trump Administration ended the semi-annual talks with China that had actually begun under Bush. Reports indicate that regularly scheduled talks will resume separate from the trade talks. Meanwhile, many observers did not think Beijing’s actions met the definition of currency manipulation, and expect it to be lifted soon. The yuan is trading near five-month highs.

Tsai Ing-wen was easily re-elected President of Taiwan. The landslide victory may embolden the critic of Beijing’s slogan of “one country, two systems.” Even if China’s record on human rights and personal liberty was significantly better, Taiwanese nationalism would likely remain a powerful force. Here too, the status quo has been preserved. The market has long anticipated her victory, so today’s modest response is not that surprising. Taiwan’s stock market was up about 23% over the past year, and the Taiwanese dollar rose 2.3% since the beginning of last year.

The dollar is at 7.5-month highs against the Japanese yen, having reached JPY109.90 in the European morning with Tokyo markets closed for a national holiday. There does not appear to be any large options struck at JPY110, but stops are thought to lie there. The closest important option that is expiring today is struck at JPY110.55 for $430 mln. Support is now is pegged near JPY109.45. The Australian dollar reached $0.6920, meeting the (38.2%) retracement objective of the decline since New Year’s Eve, before slipping on profit-taking. Look for support ahead of $0.6880. There is an A$1.2 bln option at $0.6905 that expires tomorrow. The Chinese yuan continues to re-value higher and stands at five-month highs today. Christmas Eve was the last time the dollar closed above CNY7.0. Today, it slipped through CNY6.90.

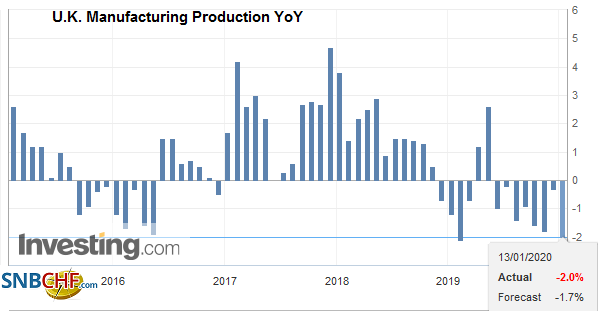

EuropeThe pendulum of market sentiment is being pulled by the doves at the Bank of England. In recent days, two MPC members, Tenreyro and Vlieghe, seemed to lean toward the two other members of the Monetary Policy Committee who has dissented at the past two meetings in favor of an immediate cut. While Carney and Tenreyro did not seem poised endorse a rate cut at the January 30 meeting, Vlieghe clear was, and his bar seemed low no immediate and significant improvement in the economic data. Before the weekend, the market has a little less than a 25% chance of cut discounted for this month and about a 33% chance of a reduction discounted for the next meeting in March. The dismal economic reports today, no doubt skewed by the preparation for Brexit, boost the chances of a cut to a little more than 50% here in Q1. The UK’s industrial output fell 1.2% compared with economists’ expectations for a flat report. Manufacturing fell a sharp 1.7% compared with median forecasts for 0.2% slippage. |

U.K. Manufacturing Production YoY, November 2019(see more posts on U.K. Manufacturing Production, ) |

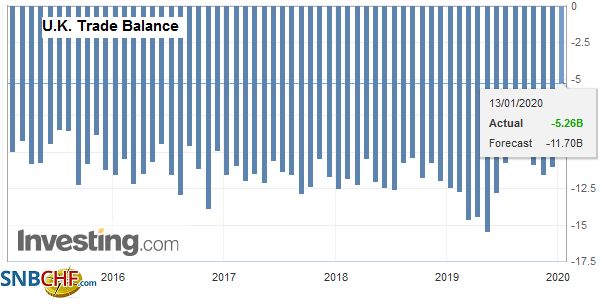

| Services contracted by 0.3%. It was expected to be unchanged. There were a couple of bright spots in the flurry of data. Construction spending jumped 1.9%, three-times more than anticipated, and the goods trade deficit was halved, with a trade surplus recorded with non-EU countries (~GBP1.73 bln) for the first time in at least 20-years. UK goods exports rose 2.2%, while imports dropped a heady 11.6%. |

U.K. Trade Balance, November 2019(see more posts on U.K. Trade Balance, ) Source: investing.com - Click to enlarge |

The euro approached its 200-day moving average just below $1.1140 before being sold in the European morning back toward $1.1110. There are two sets of expiring options that may serve to curtail the price action. There are 1.53 bln euros in options at $1.1095-$1.1100, and 1.6 bln euros in options struck between $1.1120 and $1.1130. Looking ahead to tomorrow, there are 2.9 bln euro options at $1.1100. Sterling has been sold below $1.30 on the economic news, extending its decline for the fifth consecutive session. Initial support is seen near the late December lows near $1.2900, and stronger support is seen near $1.28.

America

The US weaponization of the dollar took a new turn, according to press accounts. In response to the Iraqi Prime Minister seeking to start talks about an orderly exit of US troops, American officials have threatened to deny Iraq access to central bank account that is used for a range of state functions, including revenue from oil sales. It makes one recall the start of the Eurodollar market, the offshore market for dollars. The Soviet Union saw the way the US threatened sterling during the Suez Crisis and moved its dollar deposits from US banks to London banks. The offshore banks did not face the interest rate caps the US domestic banks did.

Some pushback, and argue, how can it be that weaponization of the dollar, which includes access to it, and the greenback remains the preeminent currency on nearly any metric one chooses? Yet it seems clear that friends and foes alike are looking for an alternative, though it most likely won’t be an international digital asset that Carney discussed recently. The move away from the dollar is hampered by the absence of a clear, compelling alternative. Still, US sanctions force countries, like Russia, to abandon the dollar in favor of gold and the yuan apparently, A decade ago Russia held about $175 bln worth of US Treasuries; today, less than $11 bln. China is the number one trade partner of many more countries than the US. It is creating incentives to trade in yuan. It seems to be politically naive to think that the US can wield a powerful stick and not prompt a reaction by those on the receiving end, and those, like Moscow, during the Suez Crisis, simply observing what could happen to them, Other functions of the dollar, such as in payment systems, can be challenged. King Dollar is not about to be supplanted, but it could be supplemented.

The market looked through the disappointing employment data, taking it in stride, and not expecting a shift in the Federal Reserve stance. The decline in the underemployment rate (6.7% from 6.9%) seemed to be widely cited as evidence of slack still in the US labor market. This week’s busy calendar begins slowly, and outside the December monthly budget statement, today’s calendar features the Fed’s Rosengren and Bostic (both are not voting members of the FOMC). Tomorrow sees the December CPI. The Bank of Canada publishes its Q4 economic outlook. Mexico’s reports November gross fixed income, and unlikely market mover in any event.

Investors did not reward the Canadian dollar for its improved job growth reported ahead of the weekend. The Bank of Canada is the next candidate after the Bank of England, among the G7, that may have to review its monetary stance. The Canadian dollar is consolidating within last Friday’s range, which was within the previous session’s range. The US dollar appears to be consolidating before taking pushing higher. The greenback has not closed above its 20-day moving average since early December. It is found near CAD1.3070 today, and a close above it would suggest the next leg has begun. On the other hand, the US dollar remains soft against the Mexican peso. It bled through MXN18.75 before the weekend and has not been above MXN18.82 today. There is little chart support ahead of MXN18.40-MXN18.50, though the technical indicators are stretched. Stronger risk appetites, coupled with the broader rally in emerging markets (for which the peso is a liquid and accessible proxy), and Mexico’s high real and nominal rates have attracted flows.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of England,China,Currency Movement,Featured,newsletter,Taiwan,U.K.