What happens on the 18th floor of the main tower at Centralbahnplatz 2 in Basel, stays on the 18th floor of the main tower at Centralbahnplatz 2. That’s because this is where every other month the world’s central bankers meet in complete secrecy – no minutes are ever kept – to discuss the global economy completely unfettered of any concerns of accountability, and decide on what monetary policies they will implement to...

Read More »IIF Chief Warns “Brexit Bigger Threat To Global Economy Than Lehman”

As Brexit appears to gathering pace among British voters, Bloomberg Briefs interviews Hung Tan, executive managing director at the Institute of International Finance in Washington, DC., to understand the global impact of a decision by Britain to leave The EU… Q: What would happen if Britain voted to leave the EU? A: It is not Lehman in the short term in terms of markets being in a panic or chaotic mood, because the...

Read More »Central Banks & Governments and their gold coin holdings

Within the world of central bank and government gold reserves, there is often an assumption that these gold holdings consist entirely of gold bullion bars. While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves. These...

Read More »With Daily Record Lows: Chart of German Bund Yields Since 1977

The German Bund chart is very important for us, because the Swiss franc is negatively correlated to German government bond yields. The lower Bund yields, the stronger the Swiss Franc. When European governments and the ECB are ready to pay higher interest rates, then CHF depreciates. 10-year Gilt yield, Close on 06/12 Whether it is due to rising, or receding, fears of Brexit, earlier today UK Gilts joined the global...

Read More »Frontrunning: May 31

Major Bourses on Course to End Month Sharply Higher (WSJ) Brent crude lower on strong Middle East oil output (Reuters) Treasuries Lose Their Lead Over Shares as Fed Moves Toward Shift (BBG) Lost Decade for Value Stocks Tests Faithful Who Say End is Nigh (BBG) Iraqi army pause at southern edge of Falluja as IS fights back (Reuters) Risky Reprise of Debt Binge Stars U.S. Companies Not Consumers (BBG) The Untold Story Behind Saudi Arabia’s 41-Year U.S. Debt Secret (BBG) Nuns With Guns: The...

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

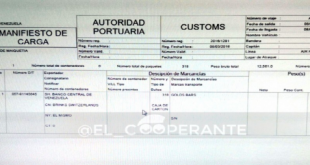

Read More »This Is How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8, 2016 Via Paris

Submitted by Ronan Manly of Bullionstar Blogs Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga. It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another 12.5...

Read More »This Is How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8, 2016 Via Paris

Submitted by Ronan Manly of Bullionstar Blogs Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga. It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another...

Read More »Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly in the Yuan's stronger fixing overnight) at the expense of Europe and Japan, both of which want the USD much stronger. ECB, BOJ don't want a weak dollar; China does not want a strong dollarFed sides with China for now — zerohedge (@zerohedge)...

Read More »The Big Central Bank Split

What central banks do – and how their policies diverge from one another – will continue to drive financial markets in 2016, impacting fixed income markets and creating opportunities for equity investors in places where policy is easing, according to the 2016 Investment Outlook from Credit Suisse’s Private Bank. The Federal Reserve seems almost certain to raise interest rates for the first time since 2006 in December – and, Credit Suisse believes it will raise them three more times in 2016....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org