Swiss Franc The Euro has risen by 0.01% to 1.0893 EUR/CHF and USD/CHF, December 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is risky to read too much into the price action in holiday-thin markets, but inflation fears are beginning to surface. The price of January WTI is around , having tested a barrel in Q3. The CRB Index made new highs for the year yesterday and is up almost 9% for the year. The US yield curve (2-10 year) has been steepening after being inverted for a few days in August, and now at nearly 29 bp, also is new highs for the year. The US trade deal with China risks pushing up domestic US prices. Separately, Canada reported the highest (median) core CPI in a decade in November of

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of England, Bank of Japan, Currency Movement, Featured, newsletter, Norges Bank, Riksbank, USD, WTO

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

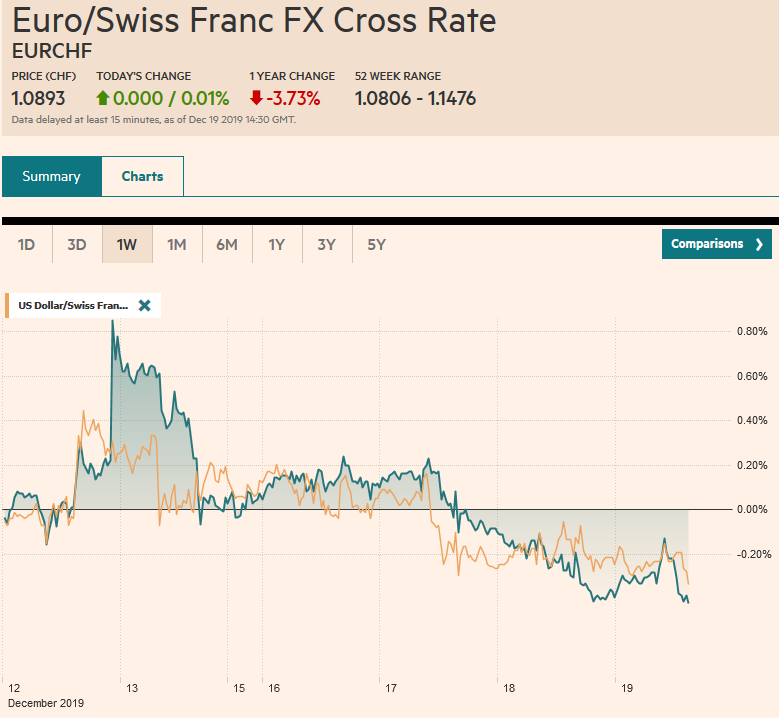

Swiss FrancThe Euro has risen by 0.01% to 1.0893 |

EUR/CHF and USD/CHF, December 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

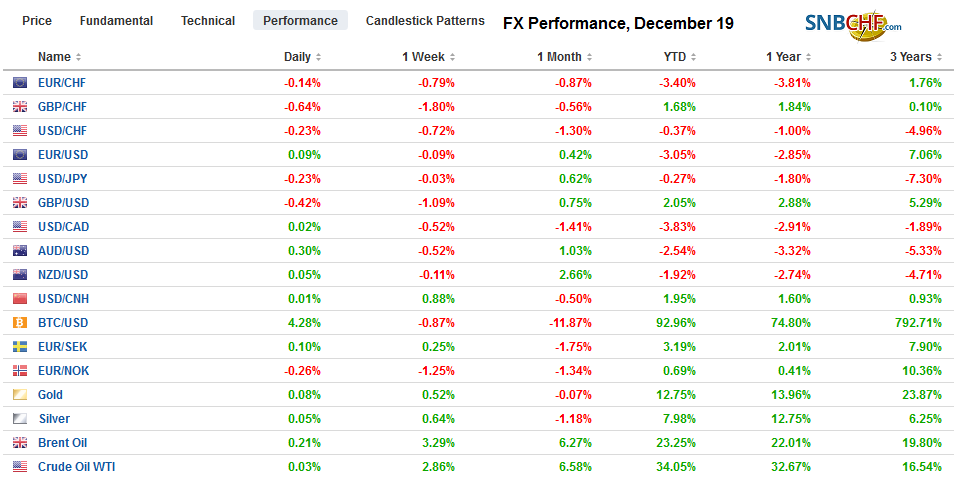

FX RatesOverview: It is risky to read too much into the price action in holiday-thin markets, but inflation fears are beginning to surface. The price of January WTI is around $61, having tested $50 a barrel in Q3. The CRB Index made new highs for the year yesterday and is up almost 9% for the year. The US yield curve (2-10 year) has been steepening after being inverted for a few days in August, and now at nearly 29 bp, also is new highs for the year. The US trade deal with China risks pushing up domestic US prices. Separately, Canada reported the highest (median) core CPI in a decade in November of 2.4%. US and EMU inflation impulses were muted at the end of 2018, and early 2019, and the base effect could also lift measured inflation in the coming months. Bond markets are selling off. The US 10-year yield is in the upper end of the where it has been in H2 and is approaching the 200-day moving average just above 2.0%. Ironically, as the US yield approaches 2%, the German 10-year Bund is approaching minus 20 bp, the upper end of its H2 range. The Japanese 10-year yield has been hovering around zero, the upper end of where it has traded since January. Benchmark yields are up mostly 2-3 bp higher today, though 5-6 bp increases are being seen in Australia, Italy, and Greece. Asia Pacific equities mostly fell, with Korea, India, and Thailand resisting the pull. European indices are edging higher after slipping in the past two sessions. US shares are flat. In the foreign exchange market, the dollar is trading a heavier bias, with the Scandis and Australian dollar leading the gainers. Emerging market currencies are more divided. The South African rand, Mexican peso, and Indian rupee are nursing loss while the Russian rouble and Korean won have firmed. Gold and oil are little changed. |

FX Performance, December 19 |

Asia Pacific

The Bank of Japan held policy at today’s meeting as widely expected. The underlying message was one of optimism. The combination of the government’s fiscal stimulus and the easing of trade uncertainty is underpinning expectations of renewed growth in the next fiscal year. Yesterday, the government projected growth in FY20 to 1.4%. This is twice the BOJ’s forecast, which is likely to be revised higher early next year.

Australia reported job growth more than twice what economists forecast. The 39.9k new jobs compare to 15k the median economist expected in the Bloomberg survey and follow a revised 24.8k loss in October (initially, a 19k decline). Although the participation rate was unchanged, the unemployment rate slipped to 5.2% from 5.3%. The one less favorable aspect of the report was that the bulk of the new jobs were part-time positions. Still, the report saw expectations for a February cut (the next meeting) scaled back. Separately, New Zealand reported its economy grew by 0.7% in Q3, which was slightly ahead of (0.5%) expectations.

The dollar is mired in a 15-tick range against the yen, according to Bloomberg (JPY109.53-JPY109.68) through the European morning. The intraday technicals seem to favor an upside extension of the range in North America. The option expirations today do not seem impactful, but note that tomorrow there are $2.7 bln in options struck at JPY109.50 that expire and $1.6 bln at JPY110. The jobs data helped lift the Australian dollar, but it is stalling, perhaps as two large expiring options come into view. There is an option for A$1.25 bln at $0.6875 and another for A$610 mln at $0.6890. The PBOC injected CNY200 bln of liquidity into the banking system today, which looks like the most since the start of the year. The dollar continues to straddle the CNY7.0 level but is set to finish the onshore session at five-day highs a little below CNY7.01.

Europe

As widely anticipated, Sweden’s Riksbank hiked the repo rate by 25 bp to zero. Two members dissented. Although the price pressures have firmed lately, the real economy appears to be struggling. The November composite PMI stood at 47.2, its lowest level in seven years. Industrial orders have fallen for five months through October. The unemployment was 6.1% at the end of last year and in November stood at 6.8%. Separately, Norway’s Norges Bank that has hiked rates three times this year held steady at 1.5%.

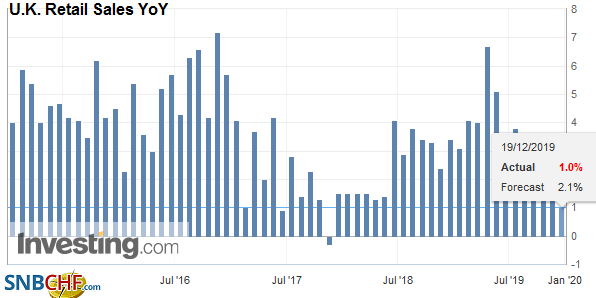

| Ahead of the Bank of England meeting, the UK reported an unexpected drop in November retail sales. The market had looked for a small gain, but instead, a 0.6% drop was recorded. UK retail sales have not risen since July. It appears to be the longest contraction since 1996 when records began. With the election possibly lifting some uncertainty, UK consumers may return for the holidays. The disappointing news, however, is unlikely to get the Bank of England to ease policy today, and fiscal support is in the pipeline. That said, at the last meeting, there were a couple of dissents in favor of an immediate cut. They may have dissented again. Sterling might respond negatively if they managed to convince anyone else. |

U.K. Retail Sales YoY, November 2019(see more posts on U.K. Retail Sales, ) Source: investing.com - Click to enlarge |

The euro is trading quietly after holding above $1.1100 and remains within yesterday’s range. Option expirations today do not seem particularly relevant, but there is a 2.7 bln euro option at $1.1150 that expires tomorrow and might discourage a move above there today. Sterling is also stabilizing after yesterday’s push to about $1.3060, the low since the election. It has traded to almost $1.3130 today, and there is an option for about GBP335 mln stuck just below there ($1.3129) and another just above there ($1.3140) that expire today.

America

The WTO has two functions, and both have ground to a halt. The first is new global trade agreements and has been dead since the failure of the Doha Round that began two months after 9/11. The second function is conflict resolution. The US has successfully blocked the appointment of new appellate judges. One (of seven remains) and three are needed to make a ruling. This is not an abstract exercise, and the US has quickly demonstrated its significance. The WTO recently found in favor of India and against the US, concluding that the US did not sufficiently change a series of improper tariffs levied on hot-rolled steel products made in India. The US formally appealed yesterday, and given that the appellate process has successfully been gutted, it is tantamount to blocking the ruling.

The US economic calendar is chock full of second-order economic reports. The December Philadelphia Fed survey is expected to have softened after nearly doubling in November to 10.4. Weekly initial jobless claims jumped to 252k in the week ending December 7. It was the highest in two years. It can be dismissed as a statistical quirk unless it does not fall back, starting with today’s report. Also on tap today are existing home sales, where a small decline is expected after a 1.9% gain in October. The US Leading Economic Indicators will be released. The index has fallen for the past three months, a rule of thumb for an economic downturn. A small gain is expected in November.

Mexico’s central bank is anticipated to deliver its fourth cut of the year today and bring the overnight target to 7.25%. The peso is the best performing Latam currency this year, with about a 3.3% gain against the greenback. Among emerging market currencies more broadly, only the Russian rouble (~11.6%), Thai baht ~(7.8%), and Philippine peso (~3.8%) have outperformed it. Mexico’s inflation rate is near 3%. Mexico’s high real and nominal interest rates provide a source of demand for the peso from the leveraged community. With a weak economy, we look for additional Banxico rate cuts next year.

Stronger than expected Canadian core inflation yesterday drove the Canadian dollar to its best level since late October. The US dollar found support near CAD1.3100 (where the lower Bollinger Band is found), and it is consolidating above there in Europe. The CAD1.3150 area that previously offered support may now be resistance. The US dollar traced out a possible key reversal against the Mexican peso yesterday, and there has been some follow-through dollar buying today. Yesterday, the dollar initially extended its losses, reaching a new five-month low before recovering to trade and then close above the previous session’s high (barely). The first resistance area is seen around MXN19.08-MXN19.10. The technical indicators are stretched, potential may extend toward MXN19.17-MXN19.20 over the slightly longer-term.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of England,Bank of Japan,Currency Movement,Featured,newsletter,Norges Bank,Riksbank,WTO