Swiss Franc The Euro has risen by 0.05% to 1.0737 EUR/CHF and USD/CHF, January 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new week is off to a quiet start as the US celebrates Martin Luther King’s birthday, and investors look for a fresh focus. Hong Kong and Indian markets were suffered modest declines while most of the other large Asia Pacific markets edged higher. European stocks are trading a little lower, and the Dow Jones Stoxx 600 is threatening to end a four-session advance. Most benchmark bond yields around half a basis point in one direction or the other. Of note, despite China’s Loan Prime Rate unexpectedly unchanged, the 10-year benchmark yield slipped a few basis points to 3.05%, its

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, Bank of England, Bank of Japan, China, Currency Movement, Featured, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.05% to 1.0737 |

EUR/CHF and USD/CHF, January 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The new week is off to a quiet start as the US celebrates Martin Luther King’s birthday, and investors look for a fresh focus. Hong Kong and Indian markets were suffered modest declines while most of the other large Asia Pacific markets edged higher. European stocks are trading a little lower, and the Dow Jones Stoxx 600 is threatening to end a four-session advance. Most benchmark bond yields around half a basis point in one direction or the other. Of note, despite China’s Loan Prime Rate unexpectedly unchanged, the 10-year benchmark yield slipped a few basis points to 3.05%, its lowest level in three months. The US dollar is firmer against the major currencies, with sterling taking the brunt of the pressures, and traded down to nearly $1.2960 (last week’s low was near $1.2955). The greenback is also trading higher against most of the emerging market currencies, with the liquid accessible EM currencies (e.g., ZAR, TRY, HUF, MXN) are all lower. The Chinese yuan also began stronger but yielded in the face of the dollar’s strength. Gold prices are a little higher, while supply shocks (Libya and Iraq) lifted oil prices, with the March WTI to almost $59.80 before moving back within the pre-weekend range. |

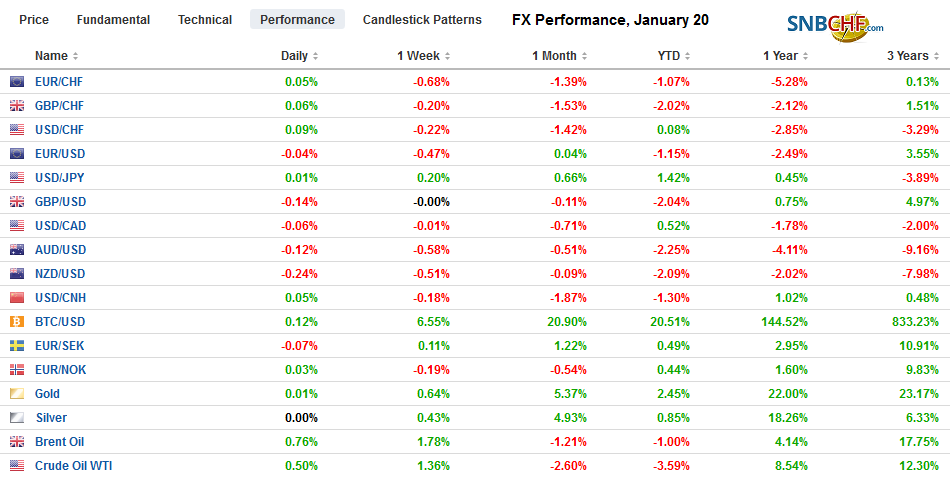

FX Performance, January 20 |

Asia Pacific

There are two developments from China to note. First, defying expectations for a small decline, the Loan Prime Rate (set on the 20th of each month based on a lending survey from major banks), it was left unchanged at 4.15% (one-year) and 4.80% (five-year). The obvious implication is that officials are not in a hurry to ease policy. Second, a new SARS-like virus appears to have emerged, with at least 200 cases now reported and in at least four countries (China, Japan, Thailand, and South Korea.

A brief calm in Hong Kong ended with a new escalation of the conflict. The demonstrators’ demand for universal suffrage was explicitly rejected by Chief Executive Lam. Hong Kong equities underperformed. Separately, but not unrelated, Hong Kong reported that its December unemployment rate rose to 3.3% from 3.2% in November and 2.8% in December 2018.

Japan’s new parliamentary session opened with a speech from Prime Minister Abe. It was said to be the first such speech that Abe did not even mention deflation. Japan has not reported deflation (negative CPI) for three-years, though inflation itself remains subdued. Core CPI, which excludes fresh food and is the targetted rate, has not been above 1% since April 2015. Abe, like the US, announced the formation of a space defense unit. Last month’s budget approved by the Cabinet and requires parliamentary approval, earmarked almost JPY51 bln (~$460 mln) to the program.

The dollar has not traded below JPY110.00 or above JPY110.25 through the European morning. The pre-weekend high was almost JPY110.30. We suspect the dollar’s recovery from the geopolitical worries that saw it trade down to JPY107.65 on January 8 is nearly over. A move back below JPY109.80 could be the first sign. The BOJ meeting concludes tomorrow, and policy is expected to be held steady. Some optimism may be expressed as the economy appears to be absorbing the tax shock and the typhoon disruption. There is an option for about $430 mln at JPY110 that will be cut today. The Australian dollar has fallen for the past three weeks and has begun the fourth on a soft tone. It was sold through last week’s lows to reach about $0.6865 and appears headed for a test on this year’s lows near $0.6850, and a break signals a move toward $0.6820. Meanwhile, Australia’s stocks extended their run for a fifth consecutive session and new record highs. The ASX 200 is up almost 6% this year. The US dollar reversed higher after approaching CNY6.84 and finished the mainland session near CNY6.8645. We have been looking for the dollar to bottom, and this could be a preliminary indication.

Europe

The focus this week is the ECB meeting and the flash PMI readings. With the ECB’s policy in place, the interest will be in Lagarde’s press conference and the discussion about the parameters of the strategic review that is being launched. The preliminary estimates of the January PMI are expected to show a little rebound in manufacturing. However, it will remain below the 50 boom/bust level, which should help lift the composite reading, even if the service PMI is flat.

The adjustment in UK rate expectations has run their course for the time being. Although the UK reports employment and CBI trends, some observers see the rate decision as now dependent on the preliminary PMI at the end of the week. Economists forecast as in both manufacturing and services, which would lift the composite back above 50 for the first time since last August. The market has about 2/3 of a rate cut next week discounted, judging from the overnight index swaps.

The euro fell by about 0.5% in the previous two sessions and is extended its losses today. The brief look above $1.11 provided the selling opportunity as the euro fell back toward $1.1080. There are 1.4 bln euros in options struck between $1.1100 and $1.1105 that expire today. The next nearby area of support is seen near $1.1065, the lows from just before Christmas. Sterling initially gapped lower, but the gap was quickly closed, and sterling was sold back off to almost $1.2960 in early Europe. A close back above $1.3000, where an expiring GBP320 mln option is found, and ideally $1.3010 would help stabilize the tone.

America

The US stock and bond markets are closed today. It is a light economic calendar week, and the main feature may be the flash PMI at the end of the week, ahead of the FOMC meeting on January 29. Data at the end of last week prompted many models to shave Q4 19 GDP forecasts. Atlanta Fed’s GDP tracker was cut to 1.8%, the lowest in a month. The NY Fed’s model sees 1.2% in Q4 and 1.7% in Q1 20. Economists at several banks also pared forecasts. At the same time, the composition of US growth likely changed–a little less consumption and more residential investment, for example, and less of a drag from trade.

The week’s highlights for North America are to be found in Canada. The December CPI will be reported on Wednesday shortly before the Bank of Canada meeting concludes. A change in rates is highly unlikely, and massaging its neutral message is the more likely course. Ahead of the weekend, Canada reports November retail sales, and a strong bounce is expected after October’s weakness.

The US dollar forged a base near CAD1.3035 last week. The upper end of its narrow near-term range is seen around CAD1.3080. However, the cap a little above CAD1.3100 is the key to the outlook. The technical indicators favor a test on this ceiling. Mexico’s high yield and the attractiveness for carry-trades also encourage short-term players to participate in the ride, and the net long speculative positioning in the futures market is a record. The gross longs are largely flat in recent weeks, but it is the covering of short positions (the gross short position has been halved in the past two months) that has driven the net position. The next significant support area for the US dollar is seen near MXN18.50. The Dollar Index is testing the 200-day moving average (~97.70) for the first time this year. The next targets are near 98.00 and then 98.40-98.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of Canada,Bank of England,Bank of Japan,China,Currency Movement,Featured,newsletter