There is little doubt that the Federal Reserve will ease monetary policy at the conclusion of the FOMC meeting on July 31. We never thought the chances of a 50 bp move were anything but negligible, though even at this late stage, the market appears to be pricing in about a one-in-five chance. Although a minority, and maybe worth a dissent or two (Rosengren? George?), we are sympathetic to those Fed officials that do not...

Read More »BREXIT UNCERTAINTY TO WEIGH ON YIELDS

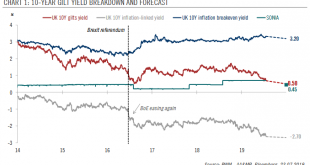

We expect the BoE to cut rates in November, even if a Brexit deal is reached by October. UK sovereign bond (gilts) yields have fallen this year, with the 10-year yield dropping by 59 basis points (bps) to 0.69%1, in concert with other core sovereign bond yields. The Brexit saga, along with the global slowdown forcing many central banks to turn dovish, are the main factors behind this steep fall. Taking stock of this...

Read More »BREXIT UNCERTAINTY TO WEIGH ON YIELDS

We expect the BoE to cut rates in November, even if a Brexit deal is reached by October.UK sovereign bond (gilts) yields have fallen this year, with the 10-year yield dropping by 59 basis points (bps) to 0.69%1, in concert with other core sovereign bond yields. The Brexit saga, along with the global slowdown forcing many central banks to turn dovish, are the main factors behind this steep fall.Taking stock of this context, we now expect the Bank of England (BoE) to cut rates by 25 bps at its...

Read More »FX Weekly Preview: What to Watch if Fed and ECB are Committed to Easing

There is little doubt after the Federal Reserve Chairman Powell’s testimony last week and the FOMC minutes that a rate cut will be delivered at the end of the month. Similarly, after comments by several ECB officials and the record of their recent meetin.g confirms it too is prepared to adjust policy. The timing of the ECB’s move is more debatable, an adjustment at the July 25 meeting appears to have increased. While a...

Read More »The Bank of England Welcomes Fintech

In the FT, Chris Giles, Caroline Binham, and Delphine Strauss report about plans of the Bank of England to let fintech companies bank at Threadneedle Street and thereby offer payments systems on a level playing field with commercial banks. The editorial board of the FT welcomes the plans; it seems to have in mind not only competition but also “synthetic” CBDC: By offering fintech companies access to the BoE’s vaults, the governor may inject much-needed competition into the sector. What...

Read More »FX Daily, June 20: Doves Rules the Roost Except in Oslo

Swiss Franc The Euro has fallen by 0.48% at 1.1104 EUR/CHF and USD/CHF, June 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The prospect of “lower for longer” continues to fuel the bond and stock rally. The initial US equity response to the Fed was positive but not strong and closed about 0.3% higher. Asia Pacific equities followed suit with mostly modest...

Read More »FX Daily, May 02: Dollar Consolidates Fed-Inspired Recovery

Swiss Franc The Euro has risen by 0.07% at 1.1402 EUR/CHF and USD/CHF, May 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is consolidating yesterday’s post-Fed rally, and this is giving it a slightly heavier tone today. Equities are mostly lower and Europe’s Dow Jones Stoxx 600 is off about 0.5% in late morning turnover, which if sustained would...

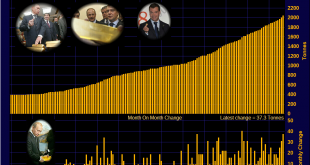

Read More »Does the recent spate of Central Bank gold buying impact demand and price?

There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the...

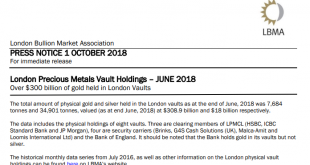

Read More »LBMA Clearing and Vaulting data reveal the absurdity of the London ‘Gold’ Market

The first day of each month sees the reporting of a number of statistics about the London Gold Market by the bullion bank led London Bullion Market Association (LBMA). These statistics focus on clearing data and vault holdings data and are reported in a 1 month lag basis for clearing activity and a 3 month lag basis for vault holdings data. Therefore the latest clearing data just published is for the month of August,...

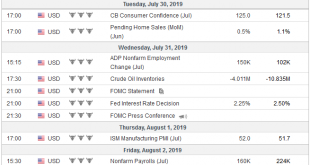

Read More »FX Weekly Preview: Three Central Bank Meetings and US Jobs data

The week ahead sees three major central bank meetings and the US employment report. It will likely be the most important work before a hiatus that runs through the end of August. Of course, and perhaps more than ever, market participants are well aware that the US President’s communication and penchant for disruption is a bit of a wild card. That said, the equity market has learned to take individual company references...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org