The spread of the coronavirus continues and is likely to weigh on risk assets and EM. Most markets in Emerging Asia are closed for all or part of this week due to the Lunar New Year holiday. China has extended the holiday until February 2 as it struggles to contain the virus. The Asian region is just starting to recover from the global trade tensions, and now it must cope with what is likely to be a sharp drop-off in tourism. Policymakers in the region may have...

Read More »The Future of What’s Called “Capitalism”

The psychotic instability will resolve itself when the illusory officially sanctioned “capitalism” implodes. Whatever definition of capitalism you use, the current system isn’t it so let’s call it “capitalism” in quotes to indicate it’s called “capitalism” but isn’t actually classical capitalism. Try a few conventional definitions on for size: Capitalism allocates capital to its most productive uses. Does the current system actually do this? You must be joking....

Read More »Virus and Trade Tensions

Asian markets hit by a further outbreak of the coronavirus US steps up trade rhetoric against EU and pushes back against UK digital tax plan AUD stronger on solid Australian jobs report and pricing out of RBA easing CAD weaker on dovish BOC communication yesterday Norges Bank and Bank Indonesia keep rates on hold, as expected ECB meeting concludes shortly, markets await kickoff of strategic review The dollar is mixed against major currencies but mostly stronger...

Read More »Calling Things by Their Real Names

One does not need money to convey one’s thoughts, but what money does allow is the drowning out of speech of those without money by those with a lot of money. In last week’s explanation of why the Federal Reserve is evil, I invoked the principle of calling things by their real names, a concept that drew an insightful commentary from longtime correspondent Chad D.: Thank you, Charles, for calling out the Fed for their evil ways. We have to properly name things before...

Read More »Dollar Mixed as Risk-Off Impulses Spread from Virus

Reports that Wuhan coronavirus continues to spread hurt risk appetite overnight US President Trump and French president Macron agreed to take a step back from the digital tax dispute The dollar is taking a breather today; after last week’s huge US data dump, releases this week are fairly light The UK reported firm jobs data for November; BOJ kept policy steady, as expected Moody’s downgraded Hong Kong by a notch to Aa3 with stable outlook; data out of Asia suggest...

Read More »EM Preview for the Week Ahead

Market sentiment on EM remains positive after the Phase One trade deal was signed. Data out of China is also supportive for EM. Key forward-looking data this week are Taiwan export orders and Korea trade data for the first 20 days of January. The global liquidity story also remains beneficial for risk, with the ECB, Norges Bank, BOC, and BOJ all set to maintain steady rates this week. AMERICAS Mexico reports mid-January CPI Thursday, which is expected to rise 3.16%...

Read More »Dollar Soft Ahead of Retail Sales Data

There were no surprises in the US-China Phase One trade deal The dollar is drifting lower ahead of the key retail sales data; there are other minor US data out today Bank of England credit survey showed demand for loans fell in Q4 Turkey cut its one-week repo rate by 75 bps to 11.25%; South Africa is expected to keep rates steady at 6.5% Japan reported November core machine orders and December PPI; China’s credit numbers for December showed no big change in lending...

Read More »Instability Rising: Why 2020 Will Be Different

In 2020, increasing monetary and fiscal stimulus will be the equivalent of spraying gasoline on a fire to extinguish it. Economically, the 11 years since the Global Financial Crisis of 2008-09 have been one relatively coherent era of modest growth, rising wealth/income inequality and coordinated central bank stimulus every time a crisis threatened to disrupt the domestic or global economy. This era will draw to a close in 2020 and a new era of destabilization and...

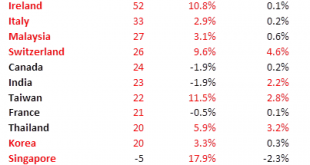

Read More »Some Thoughts on the Latest Treasury FX Report

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report no longer considers China a currency manipulator. The underlying message is that the Trump administration will continue to use an ad hoc “carrot and stick” approach to improve US access to the domestic markets of its major trading partners. This suggests there will still be many minor trade skirmishes this year. RECENT DEVELOPMENTS The latest...

Read More »Just a Friendly Heads-Up, Bulls: The Fed Just Slashed its Balance Sheet

Perhaps even PhD economists notice that manic-mania bubbles always burst–always. Just a friendly heads-up to all the Bulls bowing and murmuring prayers to the Golden Idol of the Federal Reserve: the Fed just slashed its balance sheet–yes, reduced its assets. After panic-printing $410 billion in a few months, a $24 billion decline isn’t much, but it does suggest the Fed might finally be worrying about the reckless, insane bubble it inflated: August 28, 2019: $3.760...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org