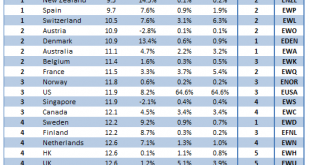

Developed equity markets remain near the highs despite mounting concerns about the impact of the coronavirus MSCI World made a new all-time high last week near 2435 and is up 2.5% YTD Our 1-rated grouping (outperformers) for Q1 2020 consists of Ireland, Israel, New Zealand, Spain, and Switzerland Our 5-rated grouping (underperformers) for Q1 2020 consists of the Italy, Germany, Portugal, Japan, and Greece Since our last update on November 19, our proprietary DM...

Read More »Dollar Firm as Risk-Off Sentiment Picks Up Again

Negative news on the coronavirus has kept risk appetite subdued across the board; the dollar rally continues During the North American session, we will get some more clues to the state of the US economy; FOMC minutes were largely as expected UK January retail sales came in firm; ECB releases the account of its January 23 meeting Australia reported firm January jobs data; China commercial banks cut lending rates; Indonesia cut rates 25 bp to 4.75%, as expected The...

Read More »The World Is Awash in Oil, False Assurances, Magical Thinking and Complacency as Global Demand Careens Toward a Cliff

This collapse of price will manifest in all sorts of markets that are based on debt-funded purchases of desires rather than a warily prudent priority on needs. Since markets are supposed to discover the price of excesses and scarcities, it’s a mystery why everything that is in oversupply is still grossly overpriced as global demand slides off a cliff: oil, semiconductors, Uber rides, AirBNB listings and many other risk-on / global growth stories are still priced as...

Read More »Drivers for the Week Ahead

We get the first February data from the US manufacturing sector this week; the US economy remains strong; FOMC minutes will be released Wednesday Canada reports some key data this week Preliminary eurozone February PMI readings will be reported Friday; UK has a busy data week Japan has a busy data week; Australia reports January jobs data Thursday Concerns about the coronavirus are likely to keep risk sentiment under pressure, as the ultimate impact is still...

Read More »The Fed Has Created a Monster Bubble It Can No Longer Control

The Fed must now accept responsibility for what happens in the end-game of the Moral-Hazard Monster Bubble it created. Contrary to popular opinion, the Federal Reserve didn’t set out to create a Monster Bubble that has escaped its control. Also contrary to popular opinion, the Fed will be unable to “never let stocks fall ever again–ever!” for the simple reason that the monster it has created– a monster mania of moral hazard in which all risk has vanished...

Read More »Virus Concerns Resurface

Markets are reacting badly to upward revisions to coronavirus cases in China The euro fell to the weakest level since mid-2017 against the dollar UK housing data adds to relatively upbeat figures since the December elections Malaysia’s government is joining in the counter-cyclical fiscal effort The dollar is mixed on the day. The yen is 0.3% stronger, briefly trading above the ¥110.0 level on negative headlines about China’s coronavirus infections. The euro and...

Read More »China’s Fatal Dilemma

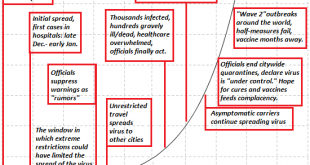

Ending the limited quarantine and falsely proclaiming China safe for visitors and business travelers will only re-introduce the virus to workplaces and infect foreigners. China faces an inescapably fatal dilemma: to save its economy from collapse, China’s leadership must end the quarantines soon and declare China “safe for travel and open for business” to the rest of the world. But since 5+ million people left Wuhan to go home for New Years, dispersing throughout...

Read More »Controlling the Narrative Is Not the Same as Controlling the Virus

Are these claims even remotely plausible for a highly contagious virus that spreads easily between humans while carriers show no symptoms? It’s clear that the narrative about the coronavirus is being carefully managed globally to minimize the impact on global sentiment and markets. Authorities are well aware of the global economy’s extreme fragility, and so Job One for authorities everywhere is to scrub the news flow of anything that doesn’t support the implicit...

Read More »Drivers for the Week Ahead

Risk-off sentiment intensified last week; the dollar continues to climb This is another big data week for the US; the US economy remains strong Fed Chair Powell testifies before the House Tuesday and the Senate Wednesday; the Senate holds confirmation hearings for Fed nominees Shelton and Waller Thursday President Trump will unveil his budget proposal for FY2021 beginning October 1 this Monday Eurozone and UK have heavy data weeks Riksbank meets Wednesday and is...

Read More »Dollar Firm Ahead of US Jobs Report

The number of confirmed coronavirus cases and deaths continue to rise; the dollar continues to climb The January jobs data is the highlight for the week; Canada also reports jobs data The Fed submits its semiannual Monetary Policy Report to Congress today; Mexico and Brazil report January inflation data The downdraft in eurozone industrial data continues; Russia cut rates 25 bp to 6.0% and signaled more easing ahead RBA upbeat but Governor Lowe warns of “significant...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org