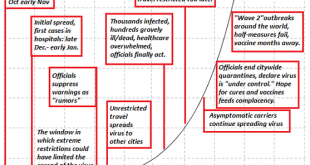

Will we wonder, what were we thinking? and marvel anew at the madness of crowds? When we look back on this moment from the vantage of history, what will we think? Will we think how obvious it was that the coronavirus deaths in China were in the tens of thousands rather than the hundreds claimed by authorities? Will we think how obvious it was that the virus would spread around the globe, wreaking havoc on the global economy and social order, even as the authorities...

Read More »Dollar Firm as Markets Await Fresh Drivers

China cut tariffs on $75 bln of US imports by half, while the US said it could reciprocate in some way The dollar continues to climb; during the North American session, only minor data will be reported; Brazil cut rates 25 bp Germany reported very weak December factory orders; all is not well in the German state of Thuringia Czech expected to keep rates steady; Philippines cut 25 bp; India remained on hold Australia reported December trade and retail sales The dollar...

Read More »Dollar Mixed as Some Risk Appetite Returns

The dollar continues to climb; one of side-effects of the virus has been a swelling of the amount of negative yielding debt globally The US primary season got off to a rocky start for the Democrats During the North American session, December factory orders will be reported; the US economy remains strong The UK reported January construction PMI The RBA held rates at 0.75%, as expected; Korea January CPI came in hot at 1.5% y/y The dollar is mixed against the majors as...

Read More »Brace for Impact: Global Pandemic Already Baked In

If we accept what is known about the virus, then logic, science and probabilities all suggest we brace for impact. Here’s a summary of what is known or credibly estimated about the 2019-nCoV virus as of January 31, 2019: 1. A statistical study from highly credentialed Chinese academics estimates the virus has an RO (R-naught) of slightly over 4, meaning every carrier infects four other people on average. This is very high. Run-of-the-mill flu viruses average about...

Read More »EM Preview for the Week Ahead

EM remains vulnerable to deteriorating risk sentiment as the coronavirus spreads. China announced a series of measures over the weekend to help support its financial markets, but this may not be enough to turn sentiment around yet. China markets reopen Monday after the extended Lunar New Year holiday and it won’t be pretty. AMERICAS Brazil reports January trade Monday. December IP will be reported Tuesday, which is expected to fall -0.8% y/y vs. -1.7% in...

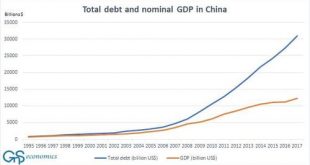

Read More »Second-Order Effects: The Unexpectedly Slippery Path to Dow 10,000

Dow 30,000 is “unsinkable,” just like the Titanic. A recent Barrons cover celebrating the euphoric inevitability of Dow 30,000 captured the mainstream zeitgeist perfectly: Corporate America is firing on all cylinders, the Federal Reserve’s god-like powers will push stocks higher regardless of any other reality, blah blah blah. While the financial media looked elsewhere for its amusement, the coronavirus epidemic in China just poured fentanyl in the Dow 30,000...

Read More »Dollar Firm Ahead of BOE Decision

The World Health Organization called an emergency meeting today; the dollar continues to climb The FOMC meeting was a non-event; US advance Q4 GDP will be reported Risk-off sentiment has derailed curve steepening trades Implied rates still suggest that today’s BOE meeting is a coin toss Turkish central bank released its quarterly inflation report; Asian markets got hit hard again with rising virus concerns The dollar is broadly firmer against the majors ahead of the...

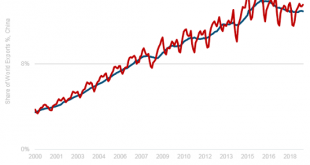

Read More »Could the Coronavirus Epidemic Be the Tipping Point in the Supply Chain Leaving China?

Everyone expecting a quick resolution to the epidemic and a rapid return to pre-epidemic conditions would be well-served by looking beyond first-order effects. While the media naturally focuses on the immediate effects of the coronavirus epidemic, the possible second-order effects receive little attention: first order, every action has a consequence. Second order, every consequence has its own consequence. So the media’s focus is the first-order consequences: the...

Read More »Tentative Stabilization

Risk-off continues in Asia, but moves have been less dramatic European market jittery but stable Implied rates now pricing in a full Fed cut by September The UK will announce its decision on Huawei’s access to the country’s 5G network The dollar is slightly stronger against most major currencies, so DXY continues on its very gradual grind higher. The index is up 1.6% since the start of the year. Of note, the Australian dollar is down 0.3% reaching at 3-month low at...

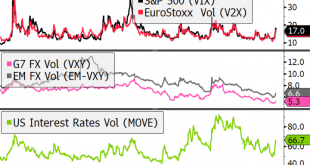

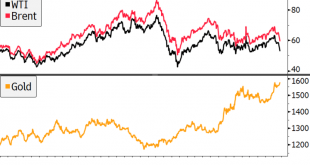

Read More »Sharp Sell-Off on Virus Concerns

Global stocks lower on virus fears, yen appreciates, and yield curves flatten Oil prices continue to fall while gold rises Italian assets outperform on favorable election results for ruling coalition German IFO survey disappoints, trimming nascent green shoots The dollar is mixed against DM and broadly stronger against EM. On the former, the yen is outperforming (+0.4%), heading to the sixth day of consecutive appreciation, now back below the ¥109.0 level. AUD and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org