EM has been able to get some traction as markets basically shrugged off the risk-off sentiment after the Iran attacks. This week’s planned signing of the Phase One trade deal should help boost EM further, but we remain cautious. The Iran situation is by no means solved, and we see periodic bouts of risk-off sentiment coming from smaller skirmishes. The World Bank also sounded a warning bell last week with its downward revisions to its global growth forecasts....

Read More »The Fed Can’t Reverse the Decline of Financialization and Globalization

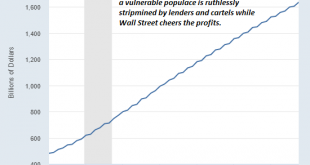

The global economy and financial system are both running on the last toxic fumes of financialization and globalization. For two generations, globalization and financialization have been the two engines of global growth and soaring assets. Globalization can mean many things, but its beating heart is the arbitraging of the labor of the powerless, and commodity, environmental and tax costs by the powerful to increase their profits and wealth. In other...

Read More »Dollar Builds on Gains as Iran Tensions Ease

Markets have reacted positively to President Trump’s press conference yesterday, while the dollar continues to gain traction The North American session is quiet in terms of US data Mexico reports December CPI; Peru is expected to keep rates steady at 2.25% German November IP was slightly better than expected but still tepid; sterling took a hit on dovish comments by outgoing BOE Governor Carney Israel is expected to keep rates steady at 0.25% China reported December...

Read More »Is This “The Top”?

Parabolic moves end when the confidence that the parabolic move can’t end becomes the consensus. The consensus seems to be that the stock market is on its way to much higher levels, and soon. The near-term targets for the S&P 500 (SPX, currently around 3,235) range from 3,500 to 4,000, with longer-term targets reaching “the sky’s the limit.” The consensus reasoning goes like this: — Central banks can print a lot more money — Stocks rise when central banks...

Read More »EM Preview for the Week Ahead

While the global economic backdrop remains favorable for EM, rising geopolitical risks will be a growing headwind. The EM VIX surged above 18% Friday as Iran tensions escalated, the highest since early December. With these tensions likely to persist, EM may remain under some pressure for the time being. High oil prices are positive for the exporters in Latin America and the Middle East but negative for the importers in Asia and Eastern Europe. AMERICAS Chile reports...

Read More »The Two Charts You Need to Ignore or Rationalize Away in 2020 (Unless You’re a Bear)

If you believe you’ve front-run the herd, you’re now in mid-air along with the rest of the herd that has thundered off the cliff. We’re awash in financial charts, but only a few crystallize an entire year. Here are the two charts that sum up everything you need to know about the stock market in 2020. Put another way–these are the two charts you need to ignore or rationalize away–unless you’re a Bear, of course, in which case you’ll want to tape a printed copy next to...

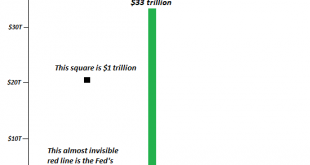

Read More »The Fed’s “Not-QE” and the $33 Trillion Stock Market in Three Charts

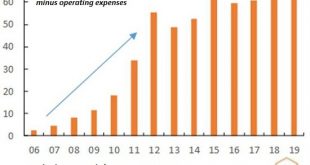

One day the stock market ‘falcon’ will no longer hear the Fed ‘falconer’, and the Pavlovian magical thinking will break down as the market goes bidless. The past decade has shown that when the Federal Reserve creates trillions of dollars out of thin air (QE), U.S. stocks rise accordingly. The correlation is very nearly perfect. This has given rise to the belief that buyers of stocks will always be rewarded because “the Fed has our backs.” The evidence for this...

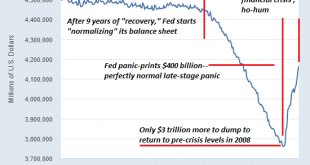

Read More »The Hour Is Getting Late

After 11 years of “the Fed is the market” expansion, the Fed has now reduced its bloated balance sheet by 6.7%. This is normal, right? So here we are in Year 11 of the longest economic expansion/ stock market bubble in recent history, and by any measure, the hour is getting late, to quote Mr. Dylan: So let us not talk falsely now the hour is getting late Bob Dylan, “All Along the Watchtower” The question is: what would happen if we stop talking falsely? What would...

Read More »EM Preview for the Week Ahead

EM FX was broadly firmer last week, taking advantage of the dollar’s soft tone as well as another wave of risk-on sentiment. Bullishness on the global economy is quite strong, whilst we are perhaps a bit more skeptical given ongoing weakness in the UK, Japan, and the eurozone. Dollar bearishness may also be overdone given our more constructive outlook on the US economy, but technical damage has been done that must now be repaired. AMERICAS Brazil reports November...

Read More »Is Social Media the New Tobacco?

If we set out to design a highly addictive platform that optimized the most toxic, destructive aspects of human nature, we’d eventually come up with social media. Social problems arise when initially harmless addictions explode in popularity, and economic problems arise when the long-term costs of the addictions start adding up. Political problems arise when the addictions are so immensely profitable that the companies skimming the profits can buy political influence...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org