The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report no longer considers China a currency manipulator. The underlying message is that the Trump administration will continue to use an ad hoc “carrot and stick” approach to improve US access to the domestic markets of its major trading partners. This suggests there will still be many minor trade skirmishes this year. RECENT DEVELOPMENTS The latest US Treasury FX report no longer names China as a currency manipulator. Recall that China was named a manipulator in August despite being cleared in the previous semiannual report in May. The reports are usually released in April and October, but the trade war has clearly disrupted this cycle and the

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, developed markets, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report no longer considers China a currency manipulator. The underlying message is that the Trump administration will continue to use an ad hoc “carrot and stick” approach to improve US access to the domestic markets of its major trading partners. This suggests there will still be many minor trade skirmishes this year.

| RECENT DEVELOPMENTS

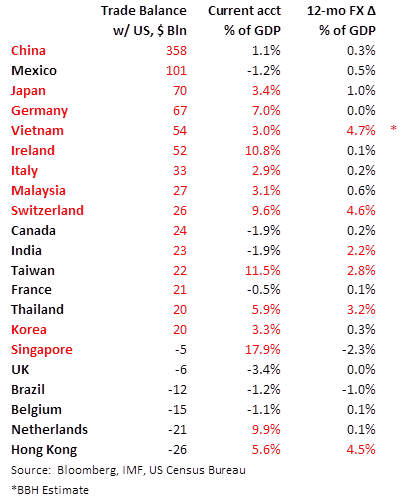

The latest US Treasury FX report no longer names China as a currency manipulator. Recall that China was named a manipulator in August despite being cleared in the previous semiannual report in May. The reports are usually released in April and October, but the trade war has clearly disrupted this cycle and the intra-report designation of currency manipulation was made when US-China tensions were at their worst last summer. The unprecedented decision was made despite China only meeting one of the three criteria needed. Press reports back in August suggested that President Trump made the choice to name China, leaving it to his staff to complete his directive. Treasury did so officially by citing the Omnibus Trade and Competitiveness Act of 1988. This unilateral decision seemed to supersede the three objective criteria set forth in section 701 of the Trade Facilitation and Trade Enforcement Act of 2015 (see A Brief History Lesson below). Indeed, Treasury addressed this seeming inconsistency in this current edition. It noted that “Because the standards and criteria in the 1988 Act and the 2015 Act are distinct, an economy could be found to meet the standards identified in one of the Acts without being found to have met the standards identified in the other.” More specifically, “As a further measure, this Administration will add and retain on the Monitoring List any major trading partner that accounts for a large and disproportionate share of the overall US trade deficit even if that economy has not met two of the three criteria from the 2015 Act.” There are some other points of interest to note in the latest report. These include 1) the return of Switzerland to the monitoring list for having “increased markedly” its FX purchases, 2) Thailand and Taiwan are close to breaching the thresholds to being listed, and 3) Vietnam got a pass again as it “credibly conveyed” that its outsized FX purchases were required for re-building reserves. The Monitoring List is now made up of China, Japan, Korea, Germany, Italy, Ireland, Singapore, Malaysia, Vietnam, and Switzerland. Yet our work using more timely data suggests that both Taiwan and Thailand will be designated currency manipulators as they now meet all three criteria. Their rolling trade surpluses with the US have both breached $20 bln in the twelve months through November 2019 and their FX purchases have surged to nearly 3% of GDP. Elsewhere, India should be added to the monitoring list as its FX purchases have moved above 2% of GDP and it now fulfills two of the three criteria. Korea was moving towards eventual exclusion from the list, but its trade surplus has moved back above the $20 bln threshold. As such, Korea will likely remain on the Monitoring List for now. Lastly, note that Hong Kong now meets two of the criteria due to its surging FX purchases as required by the currency board. Yet HKD is by definition a manipulated (pegged) currency and so this really tells us nothing new. |

FX Report |

A BRIEF HISTORY LESSON

The Treasury FX report to Congress was mandated by the “Omnibus Trade and Competitiveness Act of 1988.” This legislation originally stemmed from an amendment proposed by Representative Dick Gephardt that would require the US to examine the policies of countries that had large trade surpluses with the US. To put it bluntly, the legislation was a response to the deteriorating trade position of the US. Many politicians blamed foreign trade barriers rather than domestic factors for this deterioration.

The initial report to Congress on “International Economic and Exchange Rates Policy” was meant to fulfill the process set forth in the legislation. Under Section 3004 of that act, “The Secretary of the Treasury shall analyze on an annual basis the exchange rate polices of foreign countries, in consultation with the IMF, and consider whether countries manipulate the rate of exchange…..for purposes of preventing effective balance of payments adjustment or gaining unfair competitive advantage in international trade.”

At that time, Treasury examined five areas of concern to decide if a country was guilty of currency manipulation: 1) external balances, 2) exchange restrictions and capital controls, 3) exchange rate movements, 4) changes in international reserves, and 5) macroeconomic trends.

The Treasury FX report was later amended by section 701 of the Trade Facilitation and Trade Enforcement Act of 2015. “The 2015 Act requires that Treasury undertake an enhanced analysis of exchange rates and externally‐oriented policies for each major trading partner that has: (1) a significant bilateral trade surplus with the United States, (2) a material current account surplus, and (3) engaged in persistent one‐sided intervention in the foreign exchange market.” Treasury noted that “Because the standards and criteria in the 1988 Act and the 2015 Act are distinct, it is possible that an economy could be found to meet the standards identified in one of the Acts without being found to have met the standards identified in the other.”

In the April 2016 report on “Foreign Exchange Policies of Major Trading Partners of the United States,” Treasury laid out the specific thresholds for the three new criteria regarding currency manipulation: “(1) a significant bilateral trade surplus with the United States is one that is at least $20 bln; (2) a material current account surplus is one that is at least 3% of gross domestic product (GDP); and (3) persistent, one-sided intervention occurs when net purchases of foreign currency are conducted repeatedly and total at least 2% of an economy’s GDP over a 12-month period.”

No trading partner was found to satisfy all three criteria in that April 2016 report and so none were named currency manipulators. However, Treasury created a Monitoring List of the countries that fulfilled any two of the three criteria. This list initially contained China, Japan, Korea, Taiwan, and Germany. The October 2016 report added Switzerland, while the October 2017 report dropped Taiwan. Lastly, India was added to the monitoring list in the April 2018 report.

Starting with the May 2019 Treasury report, the US assessed all trading partners whose bilateral trade with the USD exceeds $40 bln per annum. Before, Treasury assessed the 12 largest trading partners plus Switzerland. Using 2018 data, this new group contains 21 countries that account for more than 80% of US goods trade. The eight new countries assessed are Ireland, Vietnam, Malaysia, Thailand, Singapore, Belgium, the Netherlands, and Hong Kong. They join the previous group of thirteen that included China, Mexico, Japan, Germany, Italy, India, Korea, Canada, Taiwan, France, the UK, Brazil, and Switzerland.

In May 2019, Treasury also adjusted the criteria for being named a manipulator. The threshold for the current account surplus was lowered from 3% of GDP to 2%. The criteria for persistent, one sided intervention was also modified. A country will now be flagged if net purchases are conducted in at least 6 out of 12 months (vs. 8 previously) and these net purchases total more than 2% of GDP over a 12-month period.

INVESTMENT OUTLOOK

We believe that these adjustments reflected the growing clout that the trade hawks have within the Trump administration. With the May 2019 Treasury report, the US basically put all of its trading partners on notice that scrutiny on trade imbalances will get even stronger. As it noted, “Treasury’s goal in adjusting the coverage of the Report and these thresholds is to better identify where potentially unfair currency practices or excessive external imbalances may be emerging that could weigh on US growth or harm US workers and businesses.”

With the August intra-report move on China and now the intra-report reversal, US trade policy is getting more unpredictable. The Treasury FX report can no longer be viewed as an objective arbiter. Instead, it has become a cudgel that can be used in a discretionary manner against the major trading partners. While US-China tensions have eased, it seems that the US will trade tensions with its other trading partners are likely to pick up.

Which countries are likely to come under the spotlight? As noted earlier, the Monitoring List is now made up of China, Japan, Korea, Germany, Italy, Ireland, Singapore, Malaysia, Vietnam, and Switzerland and our work suggest both Taiwan and Thailand will be designated currency manipulators as they now meet all three criteria. Elsewhere, India should be added to the monitoring list as its FX purchases have moved above 2% of GDP and it now fulfills two of the three criteria. Korea was moving towards eventual exclusion from the list, but its trade surplus has moved back above the $20 bln threshold and so will likely remain on the Monitoring List for now. While the large-scale trade war with China appears to have cooled, smaller skirmishes are likely to break out with some of these other major trading partners. That argues for some caution going forward, as further actions by the US on trade risks harming an already soft outlook for global trade growth in 2020.

Tags: Articles,developed markets,Emerging Markets,Featured,newsletter