Asian markets hit by a further outbreak of the coronavirus US steps up trade rhetoric against EU and pushes back against UK digital tax plan AUD stronger on solid Australian jobs report and pricing out of RBA easing CAD weaker on dovish BOC communication yesterday Norges Bank and Bank Indonesia keep rates on hold, as expected ECB meeting concludes shortly, markets await kickoff of strategic review The dollar is mixed against major currencies but mostly stronger against EM ones. AUD is outperforming (+0.4%) after strong jobs date reduced the odds of easing by the RBA. In contrast, CAD is underperforming after a decidedly dovish statement by the BOC yesterday. The yen and Swiss franc are stable despite the prevailing nervousness over the virus, but the Chinese yuan

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Asian markets hit by a further outbreak of the coronavirus

- US steps up trade rhetoric against EU and pushes back against UK digital tax plan

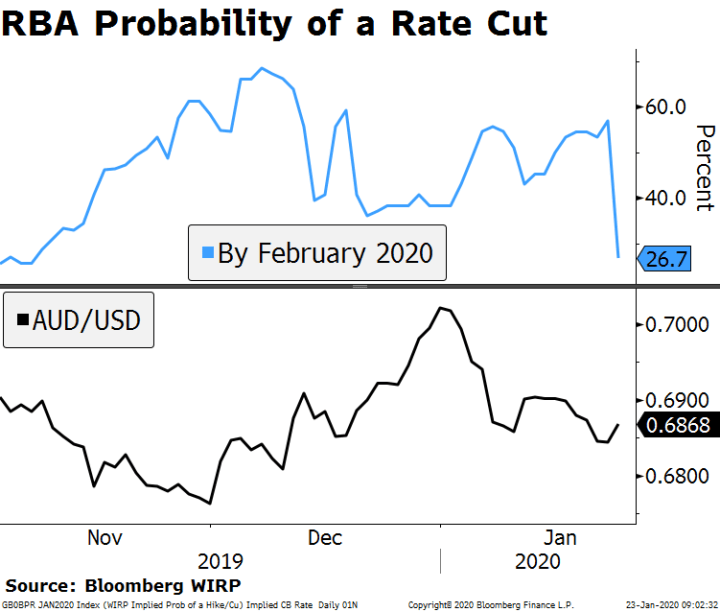

- AUD stronger on solid Australian jobs report and pricing out of RBA easing

- CAD weaker on dovish BOC communication yesterday

- Norges Bank and Bank Indonesia keep rates on hold, as expected

- ECB meeting concludes shortly, markets await kickoff of strategic review

| The dollar is mixed against major currencies but mostly stronger against EM ones. AUD is outperforming (+0.4%) after strong jobs date reduced the odds of easing by the RBA. In contrast, CAD is underperforming after a decidedly dovish statement by the BOC yesterday.

The yen and Swiss franc are stable despite the prevailing nervousness over the virus, but the Chinese yuan has depreciated by 0.4% overnight, declining by the fourth consecutive session. Asian equity markets were hit on signs of further outbreak with China’s Shanghai Comp -2.7% and ChiNext -3.5%, while the Nikkei fell 1%. European equity markets are slightly lower, but US futures are flat. Of note, the VIX ticked up to almost 13 from close to 12 last Friday. Treasury yields are only slightly lower. Spreads are stable in Italy after Di Maio stepped down as leader of the M5S; regional elections this weekend will be the next test for the ruling coalition. The mysterious coronavirus has now claimed nearly 20 lives and the infected count has risen to several hundred people, many outside of China. The Chinese government has quarantined the city of Wuhan, where the virus was first detected. The WHO said it needed more time before determining whether this constitutes an international health emergency. |

Implied Volatility Measures, 2019-2020 |

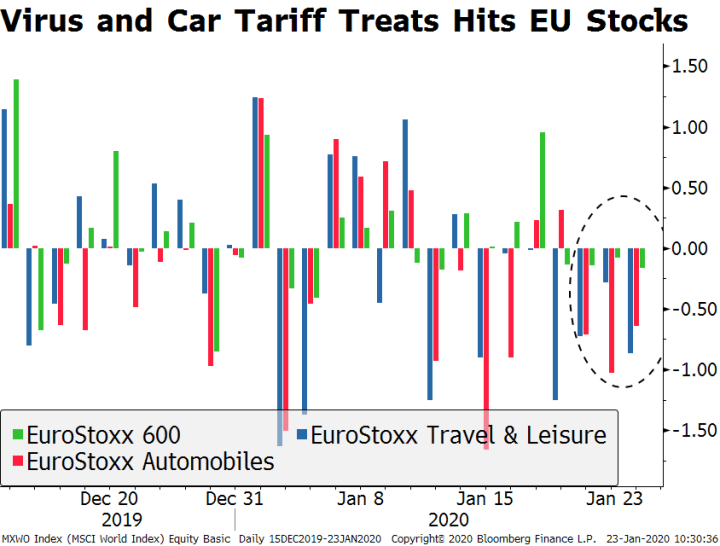

| The US, EU, and the UK seem to be caught up in a triangle of trade tensions. After the US reached a tentative compromise with France to halt plans for a digital tax, the UK said it will go ahead with a similar plan. Moreover, UK Chancellor of the Exchequer Javid said the government will prioritize an agreement with the EU, but as we know, that’s not without acrimony either.

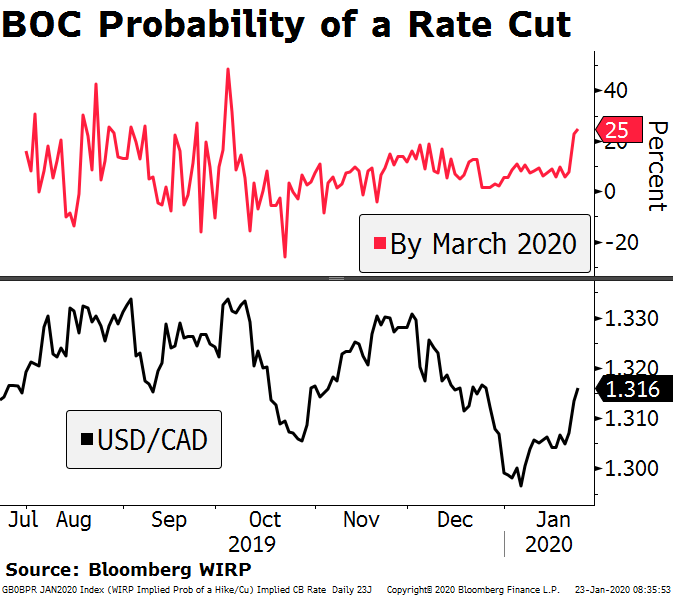

In response to the UK, the US Treasury is threatening to impose tariffs on car exports. Meanwhile, on the US-EU front, Trump has upped his rhetoric and pressure to strike a deal with the block before the elections—ideally with meaningful concessions by the EU on the farming sector, which doesn’t seem likely. As in the case of the UK, Trump’s main stick against the EU seems to be auto tariffs. AMERICAS Bank of Canada kept rates on hold yesterday at 1.75%, as expected, but the communique was well on the dovish side. Most importantly, the statement removed the description of rates as “appropriate” and sounded downbeat on the economic outlook. It stated that ” global economic conditions have been affecting Canada’s economy to a greater extent than was predicted,” and shaved off 0.4 ppts from its 1Q2020 GDP forecast, now at 1.3% q/q. This is consistent with recent comments by Governor Poloz in which he warned that damage to the global economy from global trade tensions will likely be permanent. This description could prove a bit overly pessimistic in light of the recent progress in the US-China relationship, but implied rates are now pricing a nearly 25% chance of a cut in Q1, to bring the BOC rate more in line with that of the Fed. |

BOC Probability of a Rate Cut, 2019-2020 |

| Weekly jobless claims is due later today. This reading will be for the BLS survey week containing the 12th of the month and is expected at 214k. Claims fell last week to 204k for the week ending January 11. This is just above the cycle low of 203k in late January. If sustained, this drop supports our view that the US labor market remains strong.

Mexico reports mid-January CPI on Thursday, which is expected to rise 3.16% y/y vs. 2.63% in mid-December. If so, this would be the highest reading since August and back above the 3% target though within the 2-4% target range. Still, Banco de Mexico is likely to continue its easing cycle to help boost the economy. Next policy meeting is February 13 and another 25 bp cut to 7.0% is expected. Brazil reports mid-January IPCA inflation Thursday and is expected to rise 4.33% y/y vs. 3.91% in mid-December. If so, this would be the highest reading since May and above the 4% target though within the 2.5-5.5% target range. With the economy showing some signs of life, we think the easing cycle is over. Next COPOM meeting is February 5 and implied rates suggest a better than 50% chance of a cut. We think the odds are smaller, especially in light of the recent currency weakness. EUROPE/MIDDLE EAST/AFRICA The Norges Bank left rates unchanged at 1.50%, as expected. The communication kept to the recent script of a “balanced” outlook, suggesting that “the policy rate will most likely remain at the present level in the coming period.” The bank ended its 4-hike tightening cycle in September. There was no reaction in NOK or local assets. The ECB announces its decision shortly, the second meeting for Madame Lagarde. The deposit rate should stay unchanged at 0.5% and purchases at €20 bn/month. At her first meeting, some ECB officials expressed concern about the side effects of its easy money policy, particularly the impact of negative rates on household. This was no surprise; hawkish resistance against Draghi was well documented. This time around, however, Lagarde may be compelled to slant the communication slightly on this hawkish direction, given that many of the big external risks have receded. Either way, we agree with implied rates indicating the ECB on hold for the foreseeable future. The focus now turns to the strategic review. Lagarde should officially kick off the review today, but the process will go on throughout the year. The combination of rising trade tensions and the outbreak of the coronavirus has had the clear sector-specific impact on EU stocks, dragging the broader index lower. The automobile sector has been underperforming the broader EuroStoxx 600 index, down some 5% since the start of last week, as the threats by the US administration become louder. The travel and leisure sector is down some 3.5% since the virus scare began. |

Virus and Car Tariff Treats Hits EU Stocks, 2019-2020 |

| ASIA

Australia reported a big upside surprise in its December jobs figures. Total employment rose by nearly 30K, well above the 10K expected. Hours worked was up a healthy 2.3% y/y and the participation rate held at 66%. The RBA puts a lot of weight on the labor market and this data point could be enough to keep them at hold in the February 3. WIRP suggests 55% odds that it cuts rates 25 bp to 0.50%, up from below 40% at the end of 2019. Bank Indonesia kept rates on hold at 5.0%, as expected. A small number of analysts were looking for a 25 bp cut to 4.75%. CPI rose 2.7% y/y in December, the lowest since March and nearing the bottom of the 2.5-4.5% target range. Bank Indonesia hiked rates 175 bp in 2018 and cut rates 100 bp in 2019. Consensus sees 25 bp of easing in 2020 but we think it could deliver more, especially if the currency continues to appreciate. Philippines Q4 GDP came in at 6.4%, right on expectations. This brings the full-year growth rate to 5.9%. The strong finish was down to solid household consumption and government spending. This would be the fastest rate since Q1 2018, but it might still not be enough momentum to hit the government’s 6.5%-7.5% target for 2020 without adding some monetary policy stimulus. Inflation is also picking up, at 2.5% y/y in December, but still in the lower half of the 2-4% target range. Easing could happen as early as next policy meeting is February 6. |

RBA Probability of a Rate Cut, 2019-2020 |

Tags: Articles,Daily News,Featured,newsletter