Perhaps even PhD economists notice that manic-mania bubbles always burst–always. Just a friendly heads-up to all the Bulls bowing and murmuring prayers to the Golden Idol of the Federal Reserve: the Fed just slashed its balance sheet–yes, reduced its assets. After panic-printing 0 billion in a few months, a billion decline isn’t much, but it does suggest the Fed might finally be worrying about the reckless, insane bubble it inflated: August 28, 2019: .760 trillion December 25, 2019: .165 trillion January 1, 2020: .173 trillion January 9, 2020: .149 trillion There are two noteworthy items here. One is of course the panic-printing of 0 billion between September 1, 2019 and January 1, 2020 as the Fed’s assets zoomed from .760 trillion to .173

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

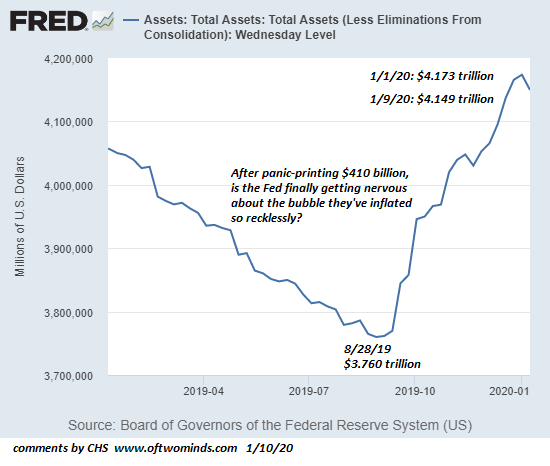

Perhaps even PhD economists notice that manic-mania bubbles always burst–always. Just a friendly heads-up to all the Bulls bowing and murmuring prayers to the Golden Idol of the Federal Reserve: the Fed just slashed its balance sheet–yes, reduced its assets. After panic-printing $410 billion in a few months, a $24 billion decline isn’t much, but it does suggest the Fed might finally be worrying about the reckless, insane bubble it inflated: August 28, 2019: $3.760 trillion December 25, 2019: $4.165 trillion January 1, 2020: $4.173 trillion January 9, 2020: $4.149 trillion There are two noteworthy items here. One is of course the panic-printing of $410 billion between September 1, 2019 and January 1, 2020 as the Fed’s assets zoomed from $3.760 trillion to $4.173 trillion in a mere 17 weeks. But also note that the Fed only added a paltry $8 billion in the final week of 2019. Given the hundreds of billions of expansion being promised, this works out to a monthly run-rate of around $30 billion–not quite the $60 billion promised as a baseline, or the $100 billion per month panic-printed in Q4 2019. |

Assets: Total Assets, 2019-2020 |

Bu-bu-but wait–the Fed promised us $100 billion a month forever! Buying the SPX at 3,280 and Apple at $312 only makes sense if the Fed promised us SPX 3,500, 4,000 and 5,000, and AAPL $350, $400 and $500.

While all the faithful were busy bowing to the Fed’s mesmerizing Golden Idol, maybe the mortals in the Fed awakened from their dreams of omnipotence and realized that their “insurance against a recession” panic-printing had inflated the mother of all manic-mania bubbles.

Perhaps even PhD economists notice that manic-mania bubbles always burst–always. And just before they burst, devastating all those worshiping the Fed’s Golden Idol, pundits always declare “this time it’s different,” “the Fed has our back,” “stocks have reached a permanently high plateau,” “stocks have plenty of room to run higher,” and other platitudes mumbled by the Fed faithful.

Blinded by their own hubris, the Fed’s economists refuse to accept the impossibility of gently deflating the bubble they so recklessly inflated, and so their plan is to real quiet-like reduce the balance sheet, hoping nobody notices.

Perhaps they imagine they can lock the S&P 500 in at a permanently high plateau around 3,250, and that will be enough to banish the demons of a business/credit-cycle recession.

Maybe, maybe not. Can a Golden Idol control not just the stock market but the karmic consequences of hubris and false idolatry? The curtain just opened and the second act of the tragedy is just beginning.

Tags: Featured,newsletter