Global stocks lower on virus fears, yen appreciates, and yield curves flatten Oil prices continue to fall while gold rises Italian assets outperform on favorable election results for ruling coalition German IFO survey disappoints, trimming nascent green shoots The dollar is mixed against DM and broadly stronger against EM. On the former, the yen is outperforming (+0.4%), heading to the sixth day of consecutive appreciation, now back below the ¥109.0 level. AUD and NZD are underperforming, down around 0.7%. In the EM space, ZAR and MXN are underperforming, down around 1%, while THB (-0.5%) is down the most in EM Asia. Global equity markets are taking a hard hit with the EuroStoxx 600 falling 2.0% and US futures down 1.4%. In Asia, the Nikkei was down 2.0%. Yields

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Global stocks lower on virus fears, yen appreciates, and yield curves flatten

- Oil prices continue to fall while gold rises

- Italian assets outperform on favorable election results for ruling coalition

- German IFO survey disappoints, trimming nascent green shoots

The dollar is mixed against DM and broadly stronger against EM. On the former, the yen is outperforming (+0.4%), heading to the sixth day of consecutive appreciation, now back below the ¥109.0 level. AUD and NZD are underperforming, down around 0.7%. In the EM space, ZAR and MXN are underperforming, down around 1%, while THB (-0.5%) is down the most in EM Asia. Global equity markets are taking a hard hit with the EuroStoxx 600 falling 2.0% and US futures down 1.4%. In Asia, the Nikkei was down 2.0%. Yields are broadly lower, falling 4 bps in Germany and as much as 8 bps in the US.

| Virus, elections, geopolitical risk, and protectionism. There is a lot going on at the start of this week. Virus: The latest death count stands at 80, plus some 2,700 confirmed cases across 15 countries. The US has two confirmed cases. Elections: Italy’s local elections not only brought back some stability to the governing coalition but also strengthen the hand of its more moderate member, the PD. Geopolitics: The US embassy in Baghdad was hit by missiles on Sunday by Iran-linked militia, with several reported injuries. Protectionism: US has maintained pressure on the UK ahead of tomorrow’s decision on the extent of Huawei’s presence in the country’s 5G network. Meanwhile, the EU is offering to ease restrictions on US shellfish imports to pacify the US and avoid tariffs on cars. The US is now turning its focus on the EU’s plan for a carbon tax, yet another irritant on top of the digital tax plan.

Oil prices have taken a hard hit given the expected lower demand for travel with Brent down 2.3%, trading below $60.0 per barrel for the first time since October. Saudi Arabia’s energy minister said they have seen “very limited impact” on demand so far, but the price action speaks for itself. Gold, in contrast, has benefited from the risk aversion move, rising about 1.5% since the virus scare began. |

Oil and Gold Divergence, 2017-2019 |

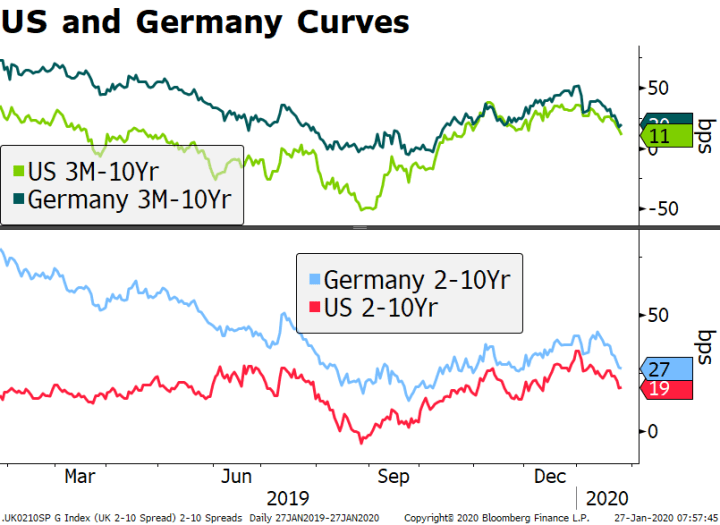

| Risk-off sentiment has derailed curve steepening trade in core markets in play since around Q4 last year. For example, the 3-month to 10-year curves are flattest since last October for both the US (11 bps) and Germany (20 bps). For now, we think the curve flattening is due more to flight to safety than a downgrade to the global economy. But of course, the downside tail risks have just gotten a lot fatter and both investors and central banks will take note. |

US and Germany Curves, 2019-2020 |

| AMERICAS

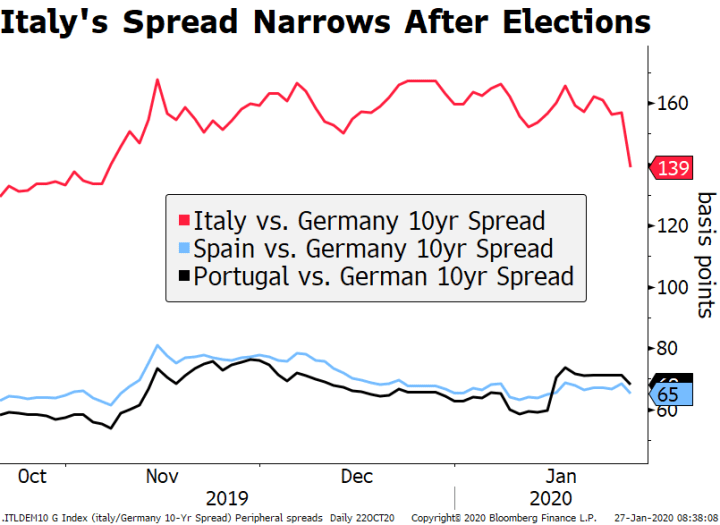

Regional Fed manufacturing surveys continue to roll out this week with Dallas Monday and Richmond Tuesday. For Dallas, a reading of -1.6 is expected vs. -3.2 in December while for Richmond, a reading of -3 is expected vs. -5 in December. So far, the readings suggest some recovery in 2020. Empire manufacturing surprised on the upside at 4.8. It’s clear that the manufacturing sector is still struggling in some areas. January Chicago PMI will be reported Friday and it is expected at 48.9 vs. a revised 48.2 (was 48.9) in December. Brazil reports December current account and FDI data Monday. Central government budget data will be reported Wednesday, followed by consolidated budget data on Friday. The economy remains sluggish, with the CDI market looking for one more potential 25 bp cut in this cycle to 4.25%. Next COPOM meeting is February 5. As the economy picks up, the external accounts should worsen while the fiscal accounts improve. EUROPE/MIDDLE EAST/AFRICA Asset prices in Italy are the clear outperformer on the day after a surprise strong performance of the Democratic Party in this weekend’s elections. The center-left DP, part of the governing coalition with the M5S, is set to win 51% of the votes, compared to the Salvini’s Lega with 44%. The result of the Emilia-Romagna local elections should help quell concerns about a collapse of the governing coalition, leading to snap elections. There is one more market-friendly interpretation to the results: M5S—ostensibly the more important member of the coalition—garnered only 5% of support, confirming its declining popularity and suggesting a rebalancing of power in the government in favor of the PD. PD is, of course, the more moderate member. The 10-year spread between Italy and German bonds has narrowed to 139 bps from over 160 bps before the elections, and the country’s banking sector (+1.1%) is outperforming. |

Italy Spread Narrows After Elections, 2019-2020 |

On the data front, the German IFO survey disappointed in January. The business climate came in at 95.9 with the expectations component at 92.9, both lower than expected and then the previous month’s readings. Still, the assessment of current conditions improved to 99.1, in line with forecasts. The IMF institute president characterized the mood as “cautious,” which sounds about right to us. Yes, there are some green shoots, but nothing to get overly excited, in our view.

ASIA

The spread of the coronavirus continues and is likely to weigh on risk assets and EM. Most markets in Emerging Asia are closed for all or part of this week due to the Lunar New Year holiday. China has extended the holiday until February 2 as it struggles to contain the virus. The Asian region is just starting to recover from the global trade tensions, and now it must cope with what is likely to be a sharp drop-off in tourism. Policymakers in the region may have to tilt more dovish this year if the economic impact becomes significant. Thai assets have been one of the biggest victims of the virus-driven sell-off, given the importance of Chinese tourism for the country. The local equity index is fell nearly 3% overnight while baht has depreciated 0.5%.

Tags: Articles,Daily News,Featured,newsletter