Risk-off continues in Asia, but moves have been less dramatic European market jittery but stable Implied rates now pricing in a full Fed cut by September The UK will announce its decision on Huawei’s access to the country’s 5G network The dollar is slightly stronger against most major currencies, so DXY continues on its very gradual grind higher. The index is up 1.6% since the start of the year. Of note, the Australian dollar is down 0.3% reaching at 3-month low at %excerpt%.6750. In the EM space, the Korean won is down 0.7%, catching up from the last two days in which it didn’t trade. The Thai baht continues to underperform, down 0.6% on the day and 3.0% on the year. The 10-year treasury yield is down 3 bps overnight, falling for the sixth consecutive session to 1.581%

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Risk-off continues in Asia, but moves have been less dramatic

- European market jittery but stable

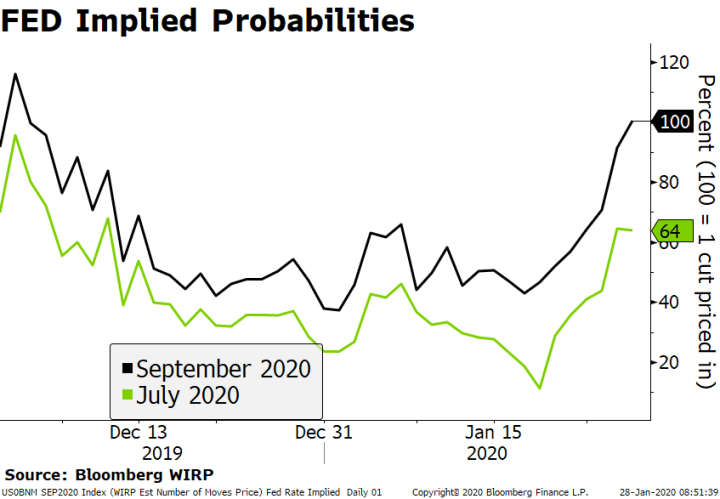

- Implied rates now pricing in a full Fed cut by September

- The UK will announce its decision on Huawei’s access to the country’s 5G network

| The dollar is slightly stronger against most major currencies, so DXY continues on its very gradual grind higher. The index is up 1.6% since the start of the year. Of note, the Australian dollar is down 0.3% reaching at 3-month low at $0.6750. In the EM space, the Korean won is down 0.7%, catching up from the last two days in which it didn’t trade. The Thai baht continues to underperform, down 0.6% on the day and 3.0% on the year.

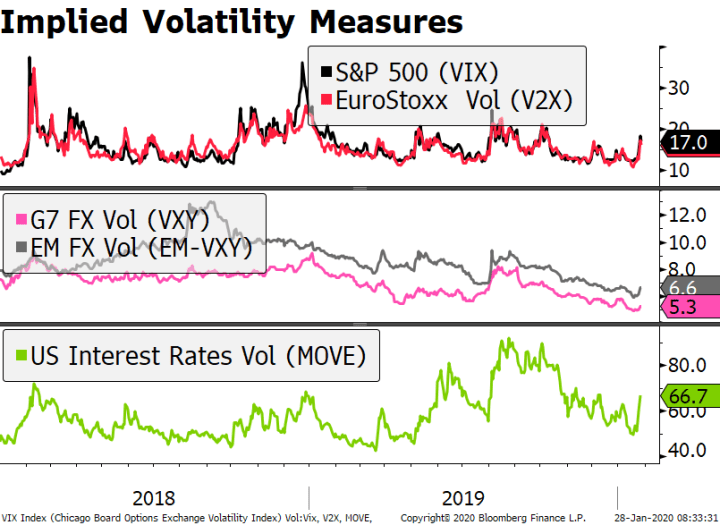

The 10-year treasury yield is down 3 bps overnight, falling for the sixth consecutive session to 1.581% (from 1.919% at the start of the year). Similarly, the 10-year German bund yield continues to decline, now at -0.4% (from -0.19% at the start of the year). After a small risk-rebound head fake, European equity indices are largely flat. This follows continued declines in Asia, albeit less dramatic (Nikkei -0.6%; Australia’s ASX -1.4%, after being closed yesterday). US futures are up 0.4% this morning, but yesterday saw its worst decline since August, with the S&P 500 erasing all the year’s gains. The sharp moves in risky assets came along with a notable pickup in measures of implied volatility. The Vix reached 19 yesterday, a level not seen since October last year. Implied volatility in the Treasury markets (MOVE index) also picked up sharply, while the moves in the FX space were relatively more subdued for both EM and DM crosses. Virus Update: China has reported that deaths caused by the virus has now surpassed 100 and confirmed infections are around 4,500. |

Implied Volatility Measures, 2018-2019 |

| AMERICAS

One of the most notable developments of the recent price action was the sharp increase in implied probability of Fed easing this year. According to the Bloomberg model, a rate cut is fully priced in by the September meeting. This is up from about a 35% probably priced in at the start of the year. We understand that the virus poses a new tail risk, which should be taken into account. But on balance, we still think the US economy is holding up well and that most of the big negative factors have receded. Markets might have moved a bit ahead of themselves here. In terms of data, durable goods orders are up next (0.4% expected) followed by Richmond Fed manufacturing index. The latter is expected to recover to -3, up from -5 in December. Mexico reports December trade data today. Markets expect a $2.5 bln surplus, a big pickup from the November reading of $0.79 bln. More importantly, Q4 GDP will be reported Thursday, with the economy expected to contract -0.5% y/y vs. -0.3% in Q3. The economy remains weak and so the central bank is likely to continue its easing cycle. Next policy meeting is February 13 and another 25 bp cut to 7.0% is expected. |

FED Implied Probabilities, 2019-2020 |

| EUROPE/MIDDLE EAST/AFRICA

The UK will announce today its decision on Huawei’s access to the country’s 5G network. The already turbulent trade relationship with the US is at stake, especially after the disagreement over the digital tax. Reports suggest that Huawei will be given limited access to the network (i.e. no “critical national infrastructure”) and have a cap on market share. Separately, the EU’s Brexit negotiator, Michel Barnier, continues to drive the point that a complete trade deal is unrealistic within the 11-month time frame. He said that the two sides will need “much more” time in light of the UK’s government insistence on “divergence” from EU rules. National Bank of Hungary announces its decision soon and is expected to keep policy steady. CPI rose 4.0% y/y in December, the highest since December 2012 and right at the top of the 2-4% target range. However, there are signs that that economy is slowing and so we see steady policy this year. |

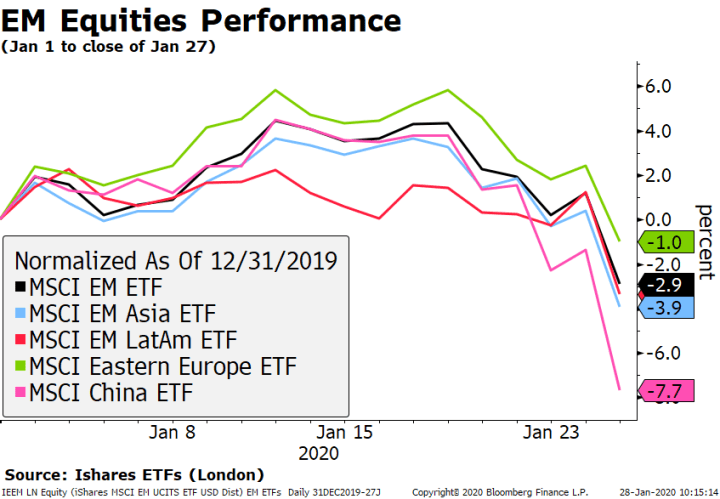

EM Equities Performance, 2020 |

| ASIA

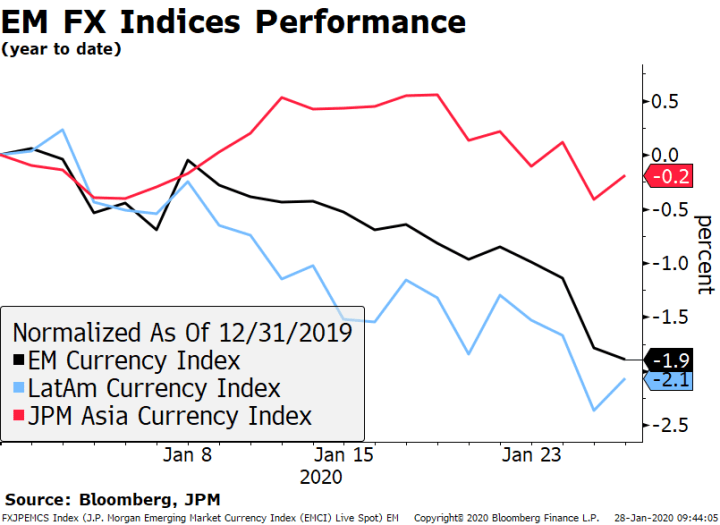

EM Asia equity markets continue to bear the brunt of the selloff, but Latin American markets are not too far behind. Using London listed ETFs as a proxy (since so many markets in Asia are closed), MSCI EM Asia has declined nearly 4%, not far from its Latin America counterpart (-3.3%) as of yesterday’s close. Needless to say, China ETF has been the worst hit, down 7.7% so far this year. In contrast, the moves in EM Asian currencies have been far more subdued compared to those in Latin America. The Asia Pacific currency index is essentially flat for the year and depreciated some 0.5% since the outbreak started dominating headlines (though a few currencies haven’t yet traded due to holidays). In contrast, the Latin America currency index is off over 2.0%, even underperforming during the last few weeks. |

EM FX Indices Performance, 2020 |

Tags: Articles,Daily News,Featured,newsletter