Dollar losses are accelerating; the virtual IMF/World Bank meetings begin Monday A big stimulus package before the election still seems unlikely; there are a fair amount of Fed speakers during this holiday-shortened week The main data event this week is September retail sales Friday; ahead of that, we get inflation readings for September; Fed manufacturing surveys for October will start to roll out The account of the ECB’s September meeting added a layer of complexity to the bank’s outlook; eurozone reports August IP Wednesday; Brexit talks continue this week in Brussels ahead of the EU summit Thursday and Friday; UK reports labor market data Tuesday Japan reports some important forward-looking data this week; Australia reports September jobs data Thursday; New

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, developed markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Dollar losses are accelerating; the virtual IMF/World Bank meetings begin Monday

- A big stimulus package before the election still seems unlikely; there are a fair amount of Fed speakers during this holiday-shortened week

- The main data event this week is September retail sales Friday; ahead of that, we get inflation readings for September; Fed manufacturing surveys for October will start to roll out

- The account of the ECB’s September meeting added a layer of complexity to the bank’s outlook; eurozone reports August IP Wednesday; Brexit talks continue this week in Brussels ahead of the EU summit Thursday and Friday; UK reports labor market data Tuesday

- Japan reports some important forward-looking data this week; Australia reports September jobs data Thursday; New Zealand holds general elections this Saturday

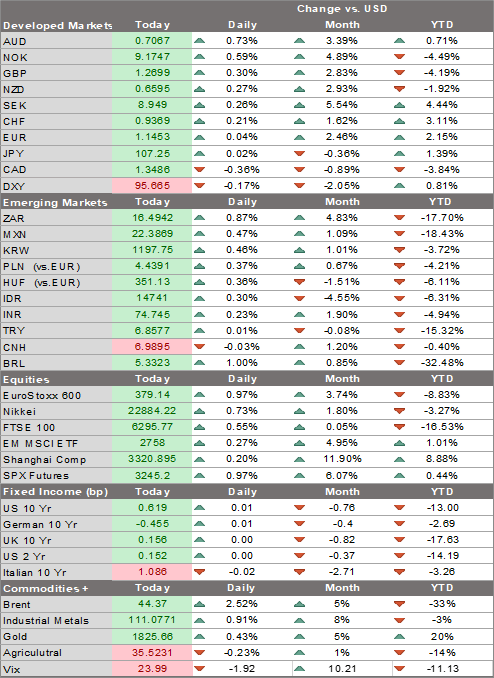

![]() Dollar losses are accelerating. Friday saw the biggest down day for DXY since August 28, which if memory serves was triggered by Powell’s Jackson Hole speech. We continue to believe that the stars remain aligned against the dollar, with data this week expected to show further loss of momentum in the US economy. Half the states are experiencing rising infection rates, with a fifth seeing record highs. The September 1 low for DXY near 91.746 is our initial target but we are getting more negative and think a test of the February 2018 low near 88.253 is possible in Q4 or Q1 2021. Similarly, we initially target $1.2010 for the euro but think the 2018 high near $1.2555 will come into focus.

Dollar losses are accelerating. Friday saw the biggest down day for DXY since August 28, which if memory serves was triggered by Powell’s Jackson Hole speech. We continue to believe that the stars remain aligned against the dollar, with data this week expected to show further loss of momentum in the US economy. Half the states are experiencing rising infection rates, with a fifth seeing record highs. The September 1 low for DXY near 91.746 is our initial target but we are getting more negative and think a test of the February 2018 low near 88.253 is possible in Q4 or Q1 2021. Similarly, we initially target $1.2010 for the euro but think the 2018 high near $1.2555 will come into focus.

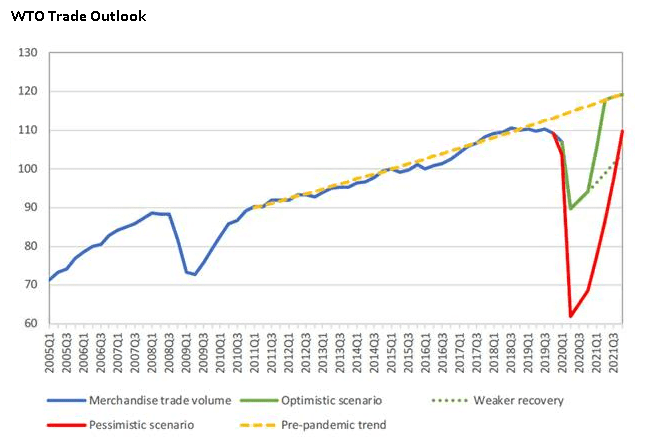

The virtual IMF/World Bank meetings begin Monday. The IMF will release its updated World Economic Outlook Tuesday. With the outlook dimming across Europe and North America, we expect the agency’s forecasts to reflect a more sober outlook for the global economy. While the rebound in China will be acknowledged, it will not be enough to offset the weaker outlook for much of the rest of the world. We also expect renewed calls for fiscal stimulus everywhere.

AMERICAS

Despite all the back and forth, a big stimulus package before the election still seems unlikely. President Trump claimed Friday to want an even larger package than the $2.2 trln that the House Democrats are offering, with reports suggesting Treasury Secretary Mnuchin was authorized to offer $1.8 trln. The problem here is that Senate Republicans are not on board with anything much above the $500 bln skinny bill they passed last month. Indeed, Majority Leader McConnell threw cold water on the whole process Friday when he said that a bill was unlikely before the election. Other senior Senate Republicans questioned the need for another large package. Talks are said to continue this week but we remain pessimistic that a deal will be reached.

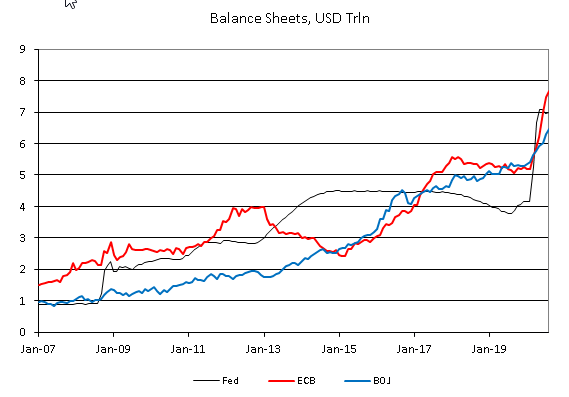

There are a fair amount of Fed speakers during this holiday-shortened week. Barkin and Daly speak Tuesday, while Clarida, Quarles, and Kaplan speak Wednesday. Bostic, Quarles, Kaplan, and Kashkari speak Thursday, followed by Williams Friday. Last week, Fed officials kept pressure on Congress and the White House to provide more fiscal stimulus. For now, that appears unlikely. And markets shouldn’t expect the Fed to come to the rescue. Indeed, one could posit that monetary policy in the US has effectively reached its limits. The Fed can keep rates low but it simply cannot replace the lost income for the tens of millions still unemployed and collecting benefits.

The main data event this week is September retail sales Friday. Headline sales are expected to rise 0.8% m/m vs. 0.6% in August, while ex-autos are expected to rise 0.4% m/m vs. 0.7% in August. The so-called control group used for GDP calculations is expected to rise 0.3% m/m vs. -0.1% in August. All in all, the data are likely to show continued restraint in consumption as the labor market remains under stress and a resumption of enhanced unemployment benefits nowhere to be seen. We see weaker than expected consumption turning out to be a considerable drag on the US economy in Q4.

Ahead of that, we get inflation readings for September. CPI will be reported Tuesday, with headline expected to rise a tick to 1.4% y/y and core inflation expected to remain steady at 1.7% y/y. PPI will be reported Wednesday, with headline and core inflation expected to accelerate to 0.2% y/y and 0.9% y/y, respectively. If price pressures continue to accelerate, this could provide further fuel to the recent curve steepening trade by hurting demand for USTs.

The other side of the curve steepening trade comes from UST supply. As such, the September budget statement could provide some more clues. Consensus sees a deficit of -$124 bln. If so, this would push the 12-month total above -$3 trln for the first time ever. The total for FY2020 ended September 30 would be less than the Congressional Budget Office’s most recent forecast of -$3.3 trln. The CBO also said the debt to GDP ratio is likely to rise above 100% in FY2021 and will continue climbing to 109% in FY2030.

Fed manufacturing surveys for October will start to roll out. Empire survey will be reported Thursday and is expected at 14.0 vs. 17.0 in September. Philly Fed business outlook will also be reported Thursday and is expected at 14.0 vs. 15.0 in September. These are the first snapshots for October and will help set the tone for other manufacturing data. September IP will be reported Friday and is expected to rise 0.6% m/m vs. 0.4% in August.

Weekly jobless claims will be reported Thursday. Initial claims are expected at 825k vs. 840k the previous week, while continuing claims are expected at 10.4 mln vs. 10.976 mln the previous week. This week’s initial claims data will have California reporting again after a two-week hiatus to clear a backlog and implement fraud prevention technology. The past two weeks will be revised, and given the negative impact of the wildfires as well as the potential surge from the backlog, we see upside risks to those revisions.

There will be some other minor US data out. September real average earnings will be reported Tuesday. Import/export prices will be reported Thursday. August business inventories and preliminary October University of Michigan consumer sentiment will be reported Friday.

EUROPE/MIDDLE EAST/AFRICA

The account of the ECB’s September meeting added a layer of complexity to the bank’s outlook. It seems there was much more concern about the exchange rate than Lagarde was letting on in her presser. This explains the pushback from other ECB officials afterward who were clearly not as sanguine as Lagarde. That said, not much that jawboning can do to impact the exchange rate in a significant way.

Eurozone reports August IP Wednesday. A gain of 0.7% m/m is expected vs. 4.1% in July. The economic outlook has weakened a bit as the second wave of viral infections spreads across Europe in September and October. As such, there will be pressure on the ECB to provide more stimulus. We see an increase to its PEPP before year-end. Next meeting is October 29 but we suspect the bank will wait until the December 10 meeting to move, as new macro projections will be released then.

Brexit talks continue this week in Brussels ahead of the EU summit Thursday and Friday. UK Prime Minister Johnson has threatened to walk away this Thursday if he sees no chance of a deal. Most, including the EU, see this as bluster and so serious talks are likely to continue. In all fairness to Johnson, France is also playing a game of brinksmanship, saying no deal is better than a bad one on fisheries. Johnson spoke with German Chancellor Merkel over the weekend, spurring speculation that she will try to broker a compromise in the coming days. Stay tuned.

UK reports labor market data Tuesday. Employment for the three months ended in August is expected at -30k vs. -12k for the three months ended in July, leading the unemployment rate to rise a couple of ticks to 4.3%. The real sector data reported Friday was simply awful, with GDP, IP, services, and construction all coming in at a fraction of consensus. With the jobs furlough program ending this month, Chancellor Sunak has come under great pressure to extend these benefits into next year. He has already been forced to announce emergency measures last week that would pay two thirds of the wages of workers in companies hurt by tighter virus restrictions set to be announced this week. This is lower than the 77% of wages paid under the previous plan and will likely to lead to weaker consumption. However, it is nonetheless welcome.

The Bank of England is growing more concerned. Last week, Governor Bailey warned that the economy is at risk of stalling and vowed to add more stimulus to limit any damage from a second wave of infections. Next policy meetings are November 5 and December 17. We favor an increase in its asset purchases at the November meeting, when the bank updates its quarterly macro forecasts. It was criticized for being too upbeat in its August projections, and the recent downside misses in the data suggest that criticism was correct. That said, we downplay talk of negative rates, at least for this year.

ASIA

Japan reports some important forward-looking data this week. August core machine orders and September machine tool orders will be reported Monday. Core machine orders are expected to fall -15.6% y/y vs. -16.2% in July. PPI will also be reported Monday and is expected to remain steady at -0.5% y/y. Final august IP will be reported Wednesday. August tertiary index, which captures the service sector, will be reported Thursday. For now, the Bank of Japan is on hold. Another slug of fiscal stimulus is expected before year-end from new Prime Minister Suga.

Australia reports September jobs data Thursday. Employment is expected to fall -35k vs. +111k in August. If so, it would be the first drop since May and would reflect the impact of the lockdowns in Victoria. The unemployment rate is expected to rise three ticks to 7.1% even as the participation rate is expected to rise a tick to 64.9%.

Policy in Australia is becoming more expansive. The government announced a fairly aggressive budget that moved forward planned tax cuts. At the same time, the Reserve Bank of Australia delivered a dovish hold as the bank said that it “continues to consider how additional monetary easing could support jobs as the economy opens up further.” The RBA is not as close to the lower bound as other central banks are and it still has several levers to pull on, including the Term Funding Facility. A cut at the next meeting November 3 is getting more likely at this point, with futures markets implying nearly a 75% chance, according to the Bloomberg WIRP model.

New Zealand holds general elections this Saturday. Polls show Prime Minister Ardern’s Labour Party and its coalition partner Green Party likely to win. It’s clear that Ardern has done great job controlling the virus and she should be rewarded with another term in power. This would mean continuity in fiscal policy as well as in pandemic policy. New Zealand has been one of the most successful countries in controlling the virus and this gives the economy a leg up in reopening.

On the monetary side, the RBNZ just delivered a dovish hold and appears to be setting the table for negative rates. Next policy meeting is November 11 and the bank is set to release new details of its term lending scheme for commercial banks. This is widely seen as a precursor to negative rats and so it would be at that November meeting that the RBNZ sets out a clearer timetable for negative rates in 2021. Currently, markets are pricing in negative rates possibly at the February 24 meeting and then fully by the April 14 meeting.

Tags: Articles,developed markets,Featured,newsletter