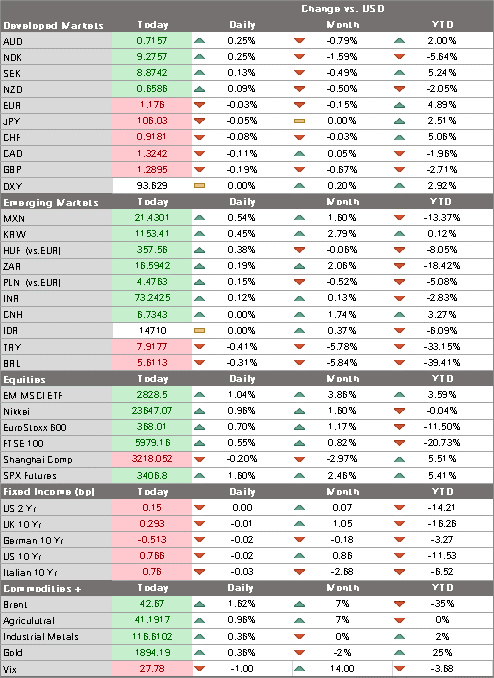

Markets have a bit of a risk-off feel today; the dollar bleeding has been stanched for now; IMF releases its updated World Economic Outlook A stimulus package before the election appears doomed; Fed’s Barkin and Daly speak; a big data week for the US kicks off with September CPI today UK jobs data came in decidedly downbeat even though the furlough scheme has not yet ended; BOE Governor Bailey said that the bank is not yet ready to implement negative rates Japan will unveil a fiscal stimulus package before year-end; China reported strong September trade data; Chinese regulators scrapped the 20% deposit rule on FX forwards; Indonesia kept rates steady at 4.0%, as expected Markets have a bit of a risk-off feel today. Yesterday’s US-tech driven risk on rally has lost

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Markets have a bit of a risk-off feel today; the dollar bleeding has been stanched for now; IMF releases its updated World Economic Outlook

- A stimulus package before the election appears doomed; Fed’s Barkin and Daly speak; a big data week for the US kicks off with September CPI today

- UK jobs data came in decidedly downbeat even though the furlough scheme has not yet ended; BOE Governor Bailey said that the bank is not yet ready to implement negative rates

- Japan will unveil a fiscal stimulus package before year-end; China reported strong September trade data; Chinese regulators scrapped the 20% deposit rule on FX forwards; Indonesia kept rates steady at 4.0%, as expected

Markets have a bit of a risk-off feel today. Yesterday’s US-tech driven risk on rally has lost steam on the back of negative vaccine headlines. A Johnson & Johnson clinical trial has been halted “due to an unexplained illness in a study participant.” It’s hard to read much into this given the scarcity of information. On the virus front, the UK started its 3-tier system of restrictions (see below) and the Czech Republic imposed strict restrictive measures (including school closures). US infections continue to rise, with half the states experiencing rising infection rates and a fifth seeing record highs.

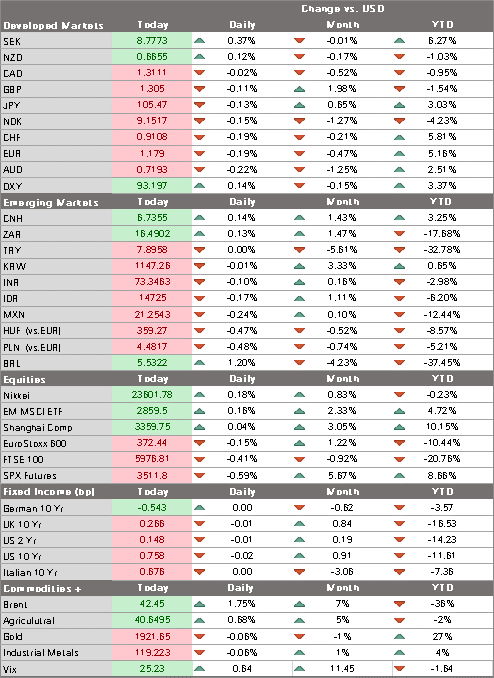

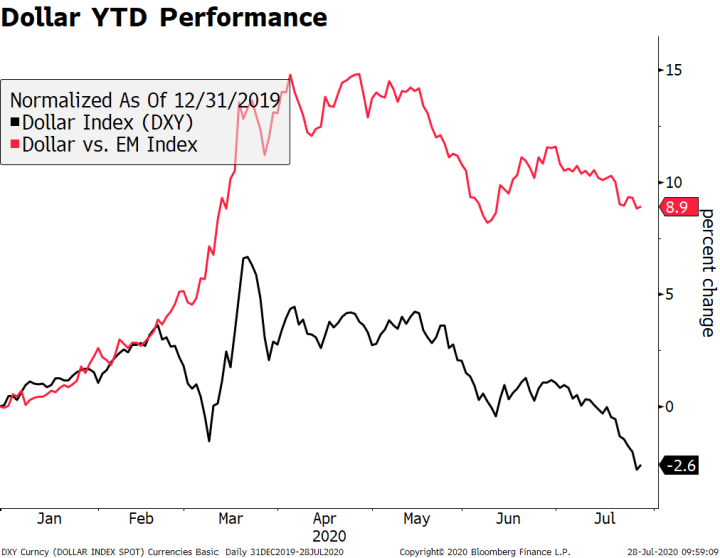

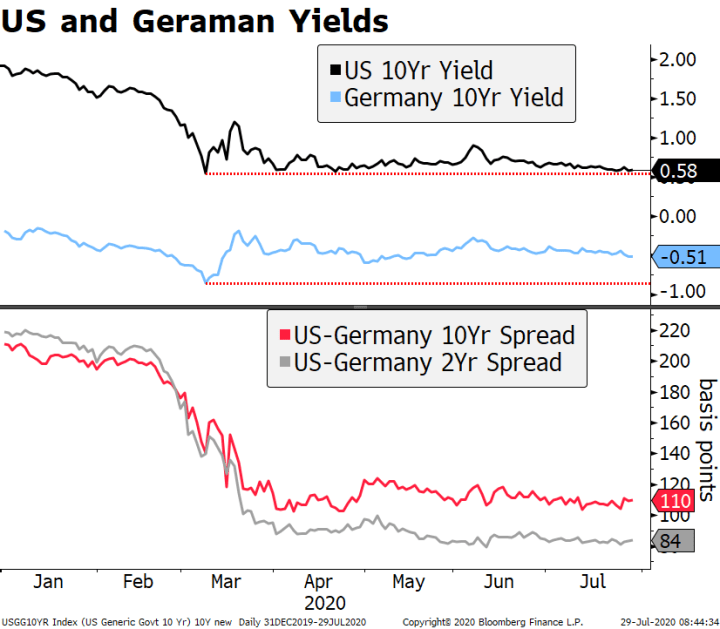

The dollar bleeding has been stanched for now. Friday saw the biggest down day for DXY since August 28, but it has since stabilized near the 93 area. With the economic outlook remaining weak, the September 1 low for DXY near 91.746 remains our initial target. The euro is finding some support just below $1.18 and we still target the September higher near $1.2010. Despite lack of progress on a Brexit deal, sterling is holding above $1.30.

The IMF will release its updated World Economic Outlook today. This coincides with the virtual IMF/World Bank meetings being held this week. With the outlook dimming across Europe and North America, we expect the agency’s forecasts to reflect a more sober outlook for the global economy. While the rebound in China will be acknowledged, it will not be enough to offset the weaker outlook for much of the rest of the world. We also expect renewed calls for fiscal stimulus everywhere.

| AMERICAS

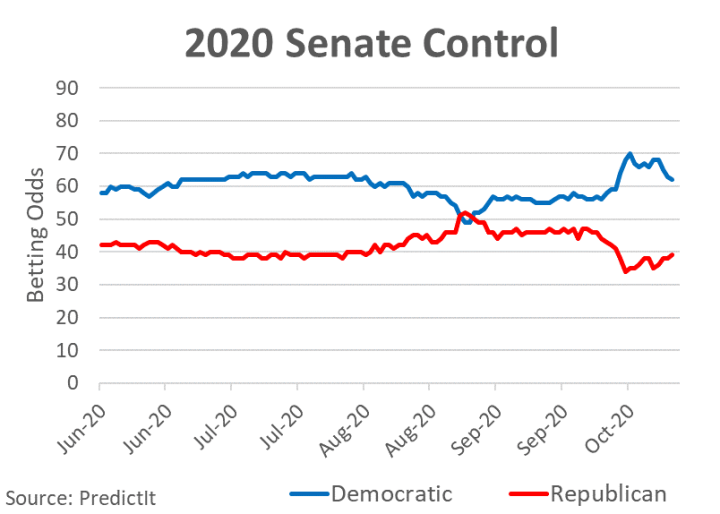

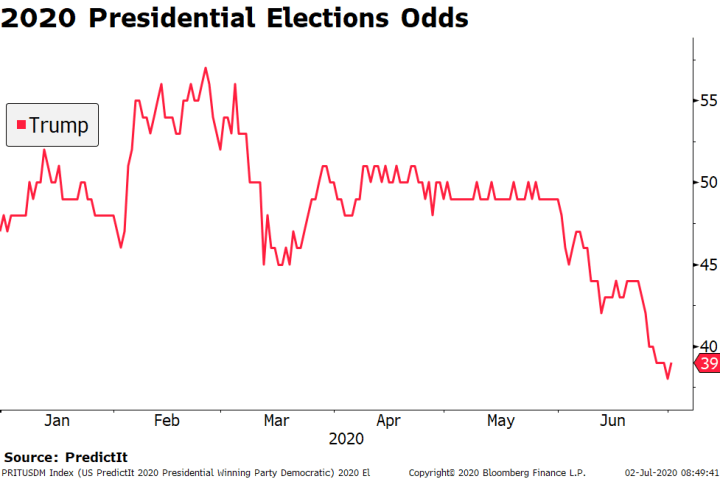

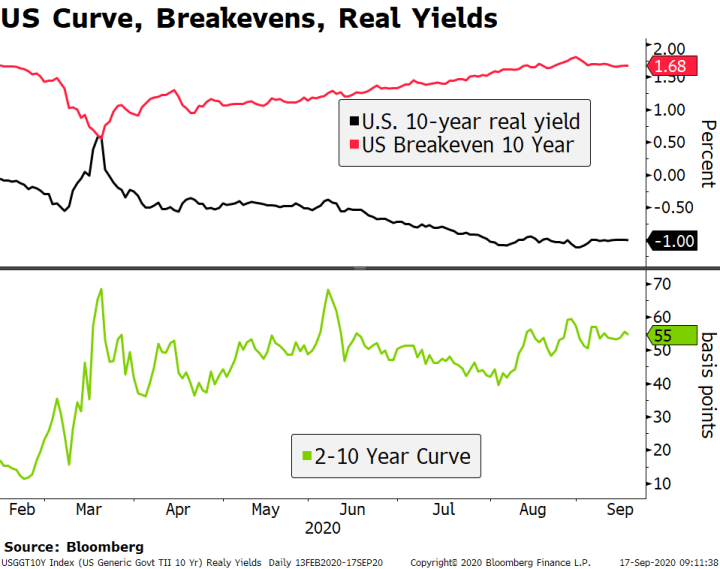

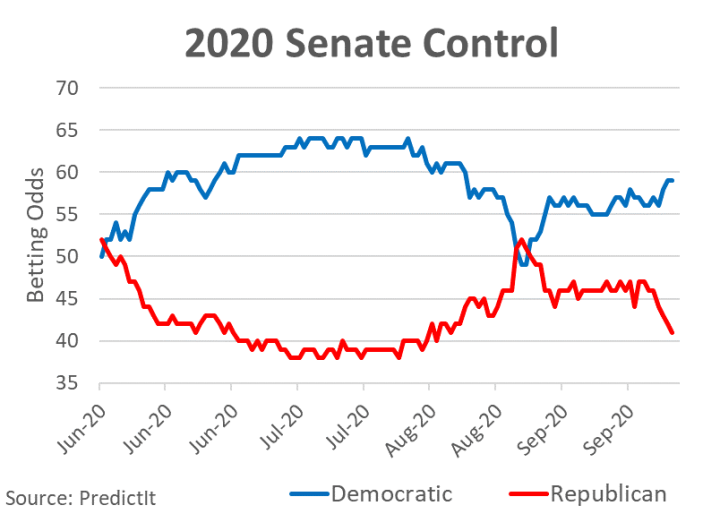

Despite efforts by some key players, a stimulus package before the election appears doomed. House Democrats were told not to expect any vote this week and comes after Senate Republicans rebuffed President Trump’s call for an even larger package than the $2.2 trln that the House Democrats are offering. As we expected, Senate Republicans remain unwilling to offer anything more than the $500 bln skinny bill they passed last month. As such, any compromise reached between the House Democrats and the White House will be rendered moot. Talks between Pelosi and Mnuchin are said to continue this week but we remain pessimistic that any workable deal will be reached. With a Biden victory now accepted as the base case for most observers, the Senate has become the greatest source of uncertainty. As it stands, betting markets are ascribing odds of just over 60% for a Democratic takeover, down from near 70% a couple of weeks ago. Biden’s odds of victory are still over 65% according to betting markets. To state the obvious, a Republican-led Senate would likely stymie many initiatives put forth by the Democrats, including aggressive fiscal stimulus. This would not be taken well by the markets. The Fed’s Barkin and Daly speak. Last week, Fed officials kept pressure on Congress and the White House to provide more fiscal stimulus. For now, that appears unlikely and markets shouldn’t expect the Fed to come to the rescue. Indeed, one could posit that monetary policy in the US has effectively reached its limits. The Fed can keep rates low but it simply cannot replace the lost income for the tens of millions still unemployed and collecting limited benefits. A big data week for the US kicks off with September CPI today. Headline is expected to rise a tick to 1.4% y/y while core inflation expected to remain steady at 1.7% y/y. PPI will be reported tomorrow, with headline and core inflation expected to accelerate to 0.2% y/y and 0.9% y/y, respectively. If price pressures continue to accelerate, this could provide further fuel to the recent curve steepening trade. September real average earnings will also be reported today. |

2020 Senate Control |

| EUROPE/MIDDLE EAST/AFRICA

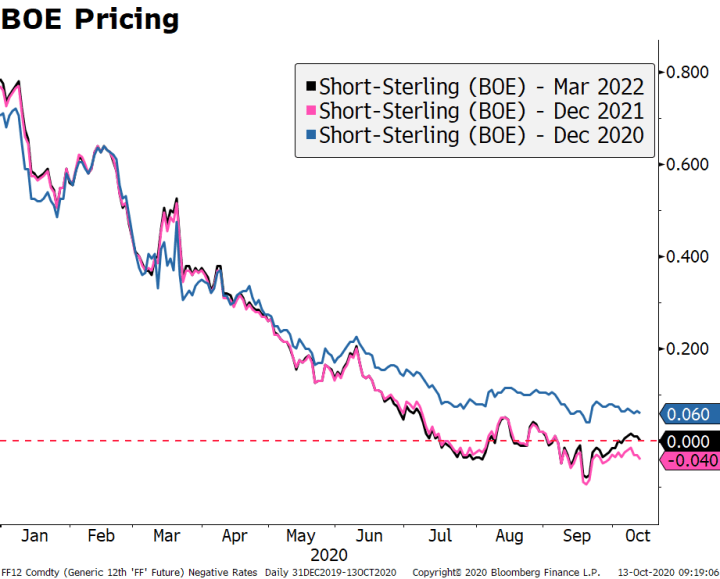

UK jobs data came in decidedly downbeat even though the furlough scheme has not yet ended. The 3-month unemployment rate through August rose to 4.5% and employment declined by -153K, both much worse than expected. The numbers still reflect the life-support measures for the UK economy, meaning that the country should brace itself for an even sharper worsening of the jobs markets in the months ahead. The new wage subsidy program should help, with the government covering two-thirds of wages in firms forced to shut down due to Covid restrictions (mostly in the hospitality sector). But this will be offset by increasingly stronger restrictions imposed by the government’s new three-tier plan for local lockdowns. Separately, BOE Governor Bailey said that the bank is not yet ready to implement negative rates. This is in line with our firm conviction that only a major new shock would tip the balance in favor of implementing negative rates. Last week, Governor Bailey warned that the economy is at risk of stalling and vowed to add more stimulus to limit any damage from a second wave of infections. As such, we still think that more easing in the form of asset purchases is likely at the November 5 meeting. Much of the September excitement about negative rates in the UK has been priced out, in line with our view, but not entirely. German ZEW survey plunged in October. Expectations fell to 56.1 vs. 72.0 expected and 77.4 in September, while current situation came in at -59.5 vs. -60.0 expected and -66.2 in September. Eurozone expectations also plunged to 52.3 from 73.9 in September, which along with the German expectations reading are the lowest since May. Clearly, the rise in the virus numbers is taking a toll on confidence in the region. We fully expect the ECB to add more monetary stimulus. The bigger question is whether we can expect more fiscal stimulus as well. |

BOE Pricing, 2020 |

| ASIA

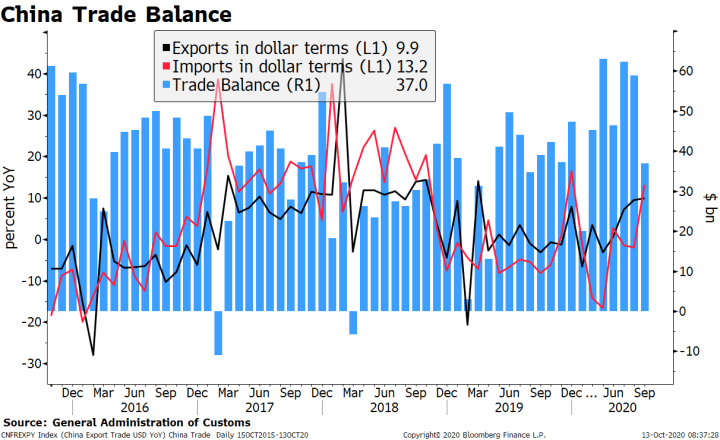

Press is reporting that Japan Prime Minister Suga will instruct his administration to compile a fiscal stimulus package before year-end. The measures will reportedly focus on boosting tourism and restaurant industries that have slumped due to the pandemic. These measures would be financed by a third supplemental budget that will be submitted to parliament in the session that starts in January. There’s no denying the economy would benefit from more stimulus. However, Suga’s popularity has been tumbling and so the stimulus package has likely taken on more urgency. Some speculate that his falling popularity may lead Suga to call for election sooner rather than later. China reported strong September trade data. Exports rose 9.9% y/y while imports rose 13.2% y/y, both much stronger than expected and continuing the string of strong economic data. The surprisingly high import levels brought down the trade surplus to $37 bln for the month, well below the near $60 bln in the last two months but around the 5-year average. That said, some of the strong import performance could be due to stockpiling by the telecommunications sector ahead of further sanctions by the US. Indeed, imports from Taiwan rose by 36%. On the export side, medical equipment continues to be an important source of growing trade volume.

|

China Trade Balance, 2016-2020 |

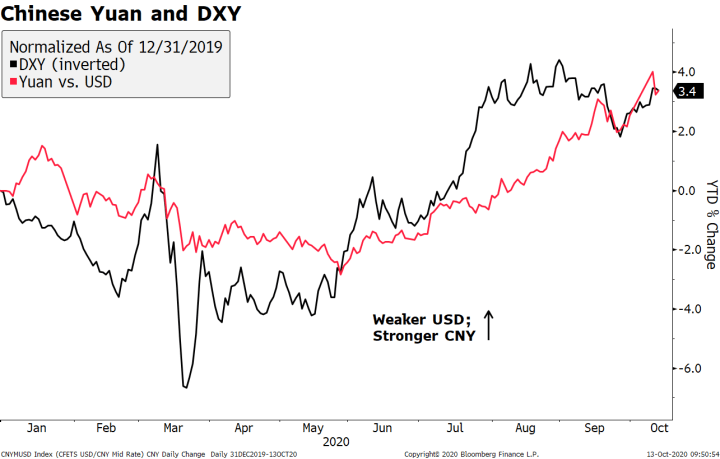

| It’s worth repeating recent news that Chinese regulators scrapped the 20% deposit rule on FX forwards. This means that is no longer as costly to buy foreign currency. It’s hard to see any other interpretation here other that signaling some discomfort and to reduce the pace of CNY appreciation, especially when combined with the PBOC’s weaker fixing. The yuan is a touch stronger today after depreciating 0.75% in the spot market Monday. Yet despite the flurry in the last few sessions, it’s important to keep in mind that CNY’s moves this year have been roughly in line with the dollar’s broad moves. |

Chinese Yuan and DXY, 2020 |

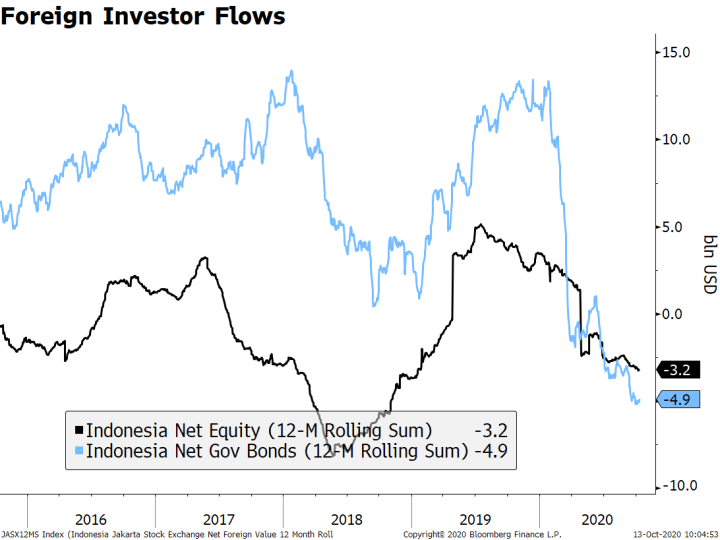

| Bank Indonesia kept rates on hold at 4.0%, as expected. A pre-emptive cut here would’ve done some severe damage to the central bank’s credibility, already under scrutiny after its bond purchase program to finance government spending. The currency has been on a steady weakening trend since early June (-6% against the USD since then), and it’s the worst performing currency in Asia by a wide margin. Unsurprisingly, investors have been pulling out funds from the country with sharp declines in holdings of both equities and government bonds. |

Foreign Investor Flows, 2016-2020 |

Tags: Articles,Daily News,Featured,newsletter