The US Vice Presidential debate was a comparatively cordial affair, though the impact on the election is likely to be limited; polls continue to move in favor of Biden, including in swing states The weak dollar narrative under a Democratic sweep continues to play out; the outlook for fiscal stimulus is as cloudy as ever; FOMC minutes contained no big surprises Weekly jobless claims will be reported; like last week, there will be a quirk to this week’s initial claims; Canada reports September housing starts Markets have shrugged off the latest UK Brexit ultimatum; rising infection rates are driving government in Europe to re-impose restrictions; sovereign spreads of EU periphery countries have been trending lower. BOJ upgraded its regional assessments; business

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The US Vice Presidential debate was a comparatively cordial affair, though the impact on the election is likely to be limited; polls continue to move in favor of Biden, including in swing states

- The weak dollar narrative under a Democratic sweep continues to play out; the outlook for fiscal stimulus is as cloudy as ever; FOMC minutes contained no big surprises

- Weekly jobless claims will be reported; like last week, there will be a quirk to this week’s initial claims; Canada reports September housing starts

- Markets have shrugged off the latest UK Brexit ultimatum; rising infection rates are driving government in Europe to re-impose restrictions; sovereign spreads of EU periphery countries have been trending lower.

- BOJ upgraded its regional assessments; business sentiment in Japan continues to improve; RBNZ is setting the table for negative rates

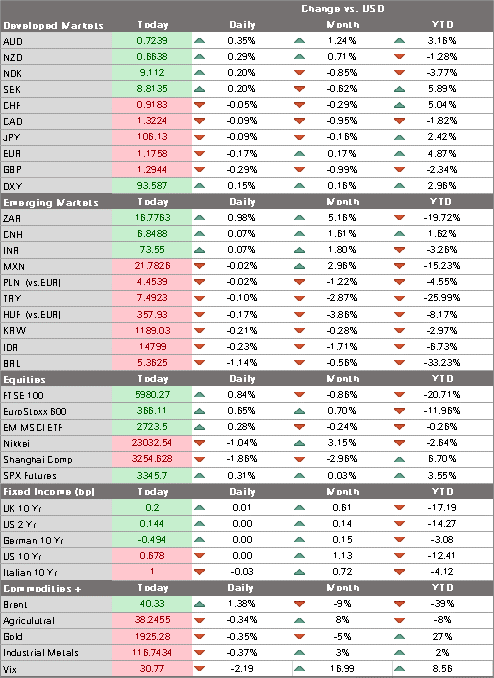

The dollar remains heavy. Despite several bouts of risk-off trading, DXY remains unable to break above 94 area and we look for further losses ahead. The euro found support just above $1.17 yesterday but has been unable to retest the $1.18 area. If our weak dollar call plays out, the euro should eventually test the September 21 high near $1.1870. Sterling continues to trade with Brexit headlines, though markets appear to be getting less sensitive to the negative ones. Lastly, USD/JPY is testing the 106 area for the first time since September 14 and a clean break sets up a test of the early September high near 106.55.

AMERICAS

The US Vice Presidential debate was a comparatively cordial affair, though the impact on the election is likely to be limited. Still, here are a few takeaways. First, a CNN poll gave Harris the victory over Pence 59% to 38%. Second, some interpreted Harris’ criticism of Trump’s trade war policy as a possible sign of a softer approach to China by a Biden administration. Our view is that a Biden administration will have a different emphasis (less commercial and more political and human rights focused) and one that is more multilateral (WTO) and a less bilateral (tariffs). This approach would not necessarily be softer, just different. Harris also reinforced the Democrat’s existing views on greater emphasis on a green/ESG agenda.

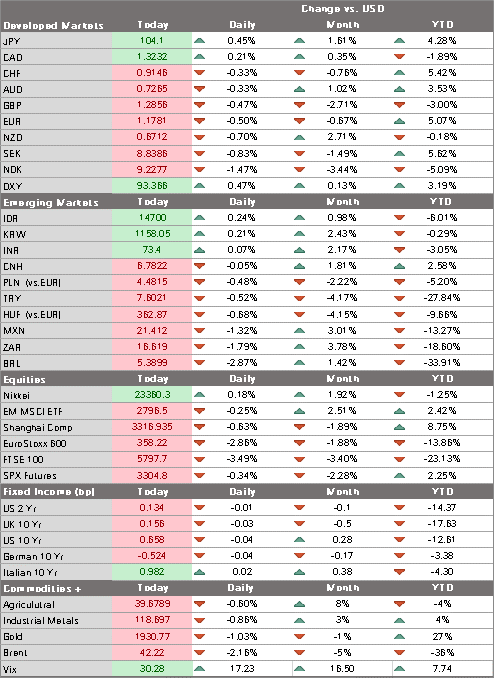

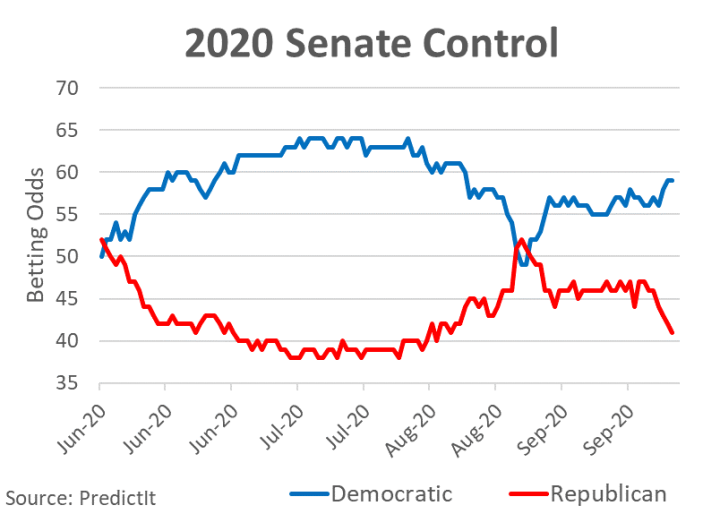

More broadly, polls continue to move in favor of Biden, including in swing states. The Quinnipiac University poll shows Biden’s advantage in Pennsylvania widened to 13 ppts, 5 ppts in Iowa, and 11 ppts in the key state of Florida. The Real Clear Politics poll averages for these states are now giving Biden an advantage of 7.1 ppts, 1.4 ppts, and 4.5 ppts (chart). What’s amazing is that Biden is also competitive in typically red states that went big for Trump in 2016, which include Arizona, Ohio, North Carolina, and Georgia. This spells trouble for all the down-ticket Republican candidates, which is feeding into notions of a Democratic sweep. Note that the betting odds still have a Biden with over 60% chance of winning.

The weak dollar narrative under a Democratic sweep continues to play out. The thinking goes that such an outcome would lead to massive fiscal stimulus, massive UST issuance, and a commensurate increase in the Fed’s balance sheet to help absorb this issuance. Since the late September move higher in Biden’s odds of winning as well as the Senate flipping, the DXY index has been on a steady downward trend. The index declined in all but two session since the start of last week, down about 1% from its recent high. That said, the index is still nearly 2% stronger from its recent lows in August.

For now, the outlook for fiscal stimulus is as cloudy as ever. After calling off talks with the Democrats, President Trump appears to have had a slight change of heart and is calling for passage of specific bills to aid airlines and provide another round of $1200 stimulus checks. House Speaker Pelosi has refused to consider a piecemeal approach in the past, but she is now signaling willingness to an airline relief bill but not one for stimulus checks. Pelosi reportedly reminded Treasury Secretary Mnuchin that the Republicans blocked the DeFazio bill just last week, which was designed to be a standalone bill that would extend aid to the airline industry for another six months.

FOMC minutes contained no big surprises. The most noteworthy tidbit was that “some participants also noted that in future meetings it would be appropriate to further assess and communicate how the committee’s asset-purchase program could best support” the Fed’s objectives. This would seem to suggest some willingness to adjust its QE to add more stimulus. One other tidbit was that even though there were only two official dissents, others voiced objection as “Several participants noted that while they agreed it was appropriate to incorporate key elements of the consensus statement into the post-meeting statement, they preferred to retain forward guidance similar to that provided in recent FOMC statements.” They simply felt that with policy already expansive, there was no need for enhanced forward guidance at this juncture. Rosengren and Bostic speak today.

Weekly jobless claims will be reported. Initial claims are expected at 820k vs. 837k the previous week, while continuing claims are expected at 11.4 mln vs. 11.767 mln the previous week. Adding regular and PUA initial claims shows about 1.5 mln are still filing for unemployment every week and that’s not so good. Elsewhere, adding regular and PUA continuing claims show that around 24 mln are still collecting benefits. Overall, this still points to a stalled labor market. Friday’s jobs data was on the soft side, with the 661k gain smaller than expected and the drop in the unemployment rate to 7.9% due in large part to lower labor force participation.

Like last week, there will be a quirk to this week’s initial claims data. Last week, California announced a two-week pause in its initial claims processing to clear a backlog and implement fraud prevention technology. California reported the level from the previous week and will do so again this week before revising these numbers after the pause. Some fraudulent claims may be eliminated. However, given the negative impact of the wildfires as well as the potential surge from the backlog, we see upside risks to those revisions.

Canada reports September housing starts. Yesterday, the Ivey PMI fell sharply to 54.3 from 67.8 in September. This is the lowest reading since May and suggest the economy is decelerating sharply. A second wave of virus infections is hitting the province of Ontario, leading to expanded restrictions in the large urban areas of Ottawa, Toronto, and Peel. This will surely weigh further on the economy in Q4 and bears watching.

EUROPE/MIDDLE EAST/AFRICA

Markets have shrugged off the latest UK Brexit ultimatum. Prime Minister Johnson threatened yesterday to break off talks October 15 if a deal seems unlikely. The EU is calling the bluff, with top negotiator Barnier later telling EU officials that he doesn’t expect the UK to walk. Barnier added that the level playing field remains the biggest obstacle to a deal and is looking for movement from the UK. Lastly, he said that Brexit discussions at the October 15-16 EU summit will likely be a “stock-taking exercise,” meaning no breakthrough is likely to be announced then.

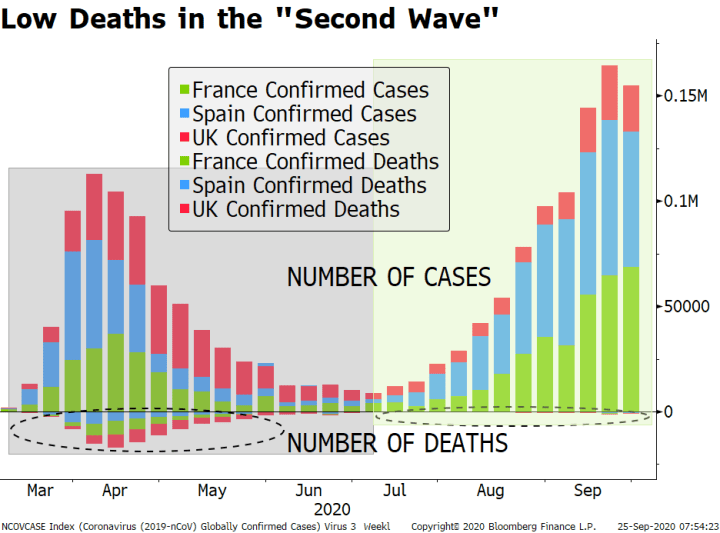

Rising infection rates are driving government in Europe to re-impose restrictions. France announced a 2-week closure of bars in Paris as hospitalization rates start to increase. Germany also announced restrictions on bars in Berlin and the Czech government is considering similar measures. Elsewhere, Germany reported August exports rose 2.4% m/m and imports rose 5.8% m/m vs. 1.5% m/m expected for both. It was the fourth straight month of gains for both series, but the rising virus numbers across Europe suggest these gains will be pared in the coming months.

Sovereign spreads of EU periphery countries have been trending lower. Greek yields reached a record low as the 10-year is now at 0.881%, benefiting from broad risk appetite, a relatively smaller impact of the pandemic, and, of course, the helping hand of the ECB and the recovery fund. Greece’s spread to German bunds has narrowed to below 150 bp for the first time since the pandemic started. Meanwhile, the Italian-German 10-year spread just broke below the pre-pandemic low and (at 127 bps) is back to level not seen since mid-2018.

| ASIA

Bank of Japan upgraded its regional assessments. Improvement was seen in eight of Japan’s nine regions in its quarterly Sakura report, which is the equivalent of the Fed’s Beige Book survey. Most regions reported activity picking up or showing signs of picking up, but conditions remaining “severe” due to the virus. It’s also worth noting that these results come after the assessments fell for all nine regions in last quarter’s Sakura report. The less pessimistic tone here suggests some modest upgrades to the BOJ’s macro projections may be seen at its next policy meeting e October 29. That said, there will be no deviation from the BOJ’s dovish policy outlook anytime soon. In related news, business sentiment in Japan continues to improve. The Cabinet Office’s Economy Watchers survey of current sentiment rose to 49.3 in September, the highest since April 2018 and the fifth straight month of improvement. A separate reading measuring the outlook sentiment also rose 48.3, the highest since February 2019. It is a diffusion index and so readings below 50 indicate that pessimists outnumber optimists. Note this survey covers store managers, barbers, taxi drivers, and others that deal directly with consumers. RBNZ is setting the table for negative rates. It gave a briefing on additional policy measures and signaled that it will take an aggressive approach to adding more stimulus. The bank said its projections show inflation and employment remaining well below target for the next three years, which Assistant Governor Christian Hawkesby said “are a very clear signal in terms of our dual mandate to be providing stimulus.” He added that more details on the Funding for Lending Program will be presented at its next meeting November 11. The RBNZ has signaled that it would likely take rates negative in combination with term funding for banks and it is clearly taking steps in that direction. WIRP is pricing in chances of a negative policy rate by April, and this has helped push down the Kiwi curve so that the 2- to 5-year portion is currently negative. |

Tags: Articles,Daily News,Featured,newsletter