. After an estimated 1.2% in 2019, we expect GDP growth of 1.0% in the euro area in 2020. Country wise, we expect more manufacturing-intense countries to underperform more domestically driven ones. Thus, we project weak growth of 0.7% in Germany and 0.4% in Italy in 2020, while we expect France and Spain to remain relatively resilient, growing by 1.2% and 1.7%, respectively. Domestic demand, particularly household consumption, is expected to remain the main growth...

Read More »Currencies: do it with style

Our scenario of ongoing global growth moderation and elevated political uncertainties should, we believe, support defensive currencies. We consider a currency ‘defensive’ if it is likely to remain resilient should global risk appetite falter. Among major currencies, the US dollar, the Japanese yen and the Swiss franc are usually considered as defensive. Indeed, the structural current account surplus and large net foreign assets of both Japan and Switzerland make...

Read More »Steady euro area growth and rise in core inflation

According to Eurostat’s preliminary figures, euro area GDP grew by 0.2% quarter on quarter in Q3, the same pace as in Q2 and in line with our expectations. Country wise, France, Italy and Spain grew at the same pace in Q3 as in Q2. In particular, household and investment spending grew at a solid pace in both France and Spain. The preliminary GDP figure for Germany will not be released until 14 November. But based on the country data released so far and assuming...

Read More »MMT, la nouvelle théorie en vogue à Washington

L’influence du ‘Modern Monetary Theory’ est susceptible d’augmenter dans les milieux économiques et politiques américains. La nouvelle théorie monétaire (Modern Monetary Theory/MMT), théorie macroéconomique défendue par des économistes hétérodoxes, commence à faire son chemin aux Etats-Unis. Cette théorie adopte une approche expérimentale de l’économie, basée sur la conviction fondamentale que la monnaie est créée par le gouvernement à travers les dépenses...

Read More »Euro/USD: things look pretty stable

Competing forces mean the two currencies could remain in a holding pattern for a while. The euro has remained relatively stable relative to the US dollar in the wake of the European Central Bank (ECB) and US Federal Reserve (Fed) September policy meetings. Growth and interest rate differentials, two key drivers for the EUR/USD rate, suggest things could stay this way. The growth differential (based on leading indicators) has barely budged since March after a sharp...

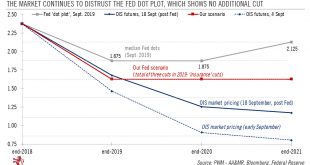

Read More »Powell plays the ‘insurance’ card again

In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market. The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak...

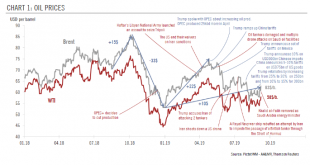

Read More »Oil prices and the global economy

Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down. Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment. Then, as uncertainty lasts, investments are postponed. Indeed, we are currently seeing a progressive decline in...

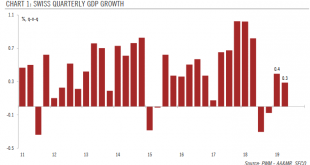

Read More »Swiss National Bank – Between a rock and a hard place

We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings. Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy. Previous quarters were revised down and now show that Switzerland was in a technical...

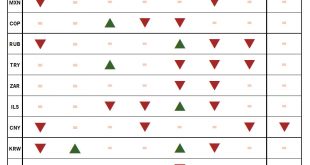

Read More »Brazilian real stands out in EM currency scorecard

Prospects for emerging-market currencies look cloudy. The currencies of countries with sound external buffers and limited exposure to global trade should fare relatively better than others. In recent months, the global environment has become more challenging for EM currencies. Trade tensions have increased and are weighing on economic activity. Commodity prices have also fallen. Such developments tend to weigh on global appetite for relatively risky EM assets. More...

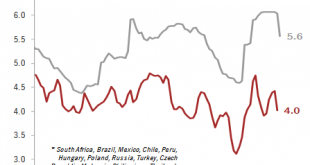

Read More »Emerging market sovereign debt update: yields are falling

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward. Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org