Competing forces mean the two currencies could remain in a holding pattern for a while. The euro has remained relatively stable relative to the US dollar in the wake of the European Central Bank (ECB) and US Federal Reserve (Fed) September policy meetings. Growth and interest rate differentials, two key drivers for the EUR/USD rate, suggest things could stay this way. The growth differential (based on leading indicators) has barely budged since March after a sharp decline that began in late 2017. Although we still forecast a narrowing of the gap between the US and the euro area going forward, growth should remain slightly supportive of the greenback, unlike interest rate differentials. Should global growth continue to be sluggish, we believe there is more scope

Topics:

Luc Luyet considers the following as important: 2.) Pictet Macro Analysis, 2) Swiss and European Macro, euro dollar exchange rate, euro dollar rate, Featured, Macroview, newsletter, USD weakness

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Competing forces mean the two currencies could remain in a holding pattern for a while.

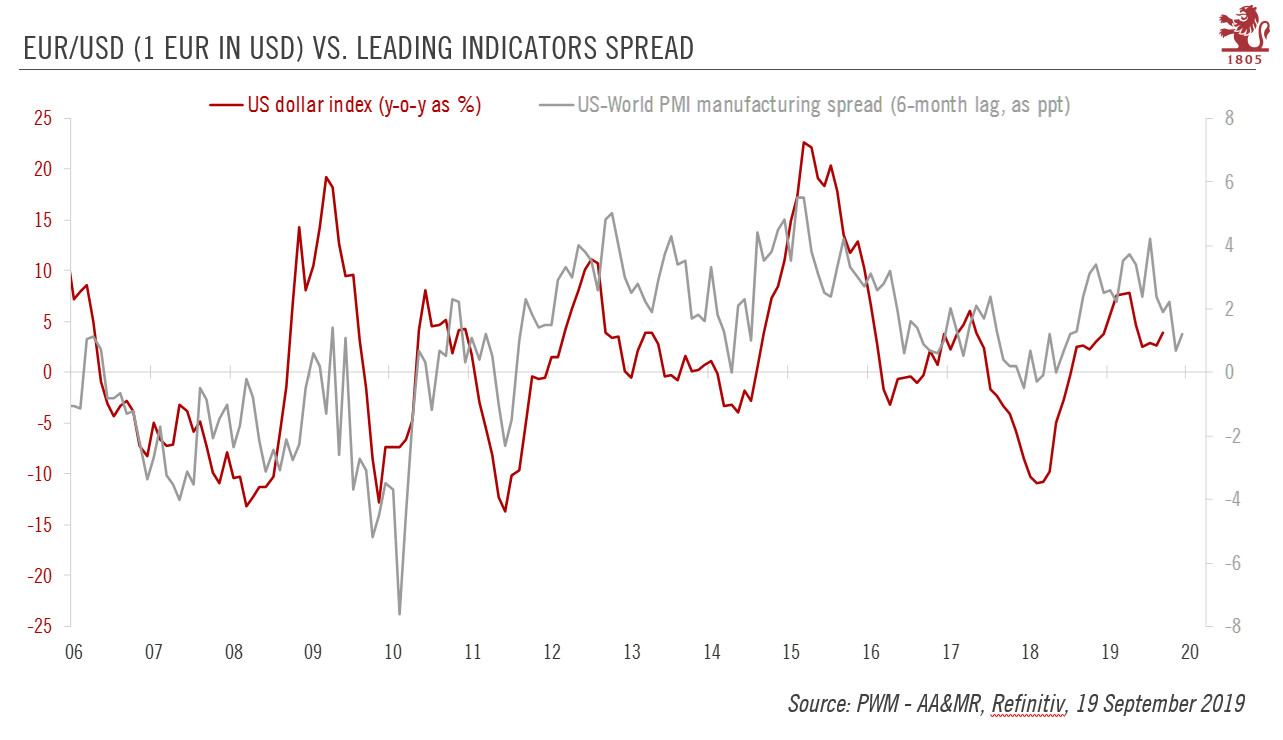

The euro has remained relatively stable relative to the US dollar in the wake of the European Central Bank (ECB) and US Federal Reserve (Fed) September policy meetings. Growth and interest rate differentials, two key drivers for the EUR/USD rate, suggest things could stay this way. The growth differential (based on leading indicators) has barely budged since March after a sharp decline that began in late 2017. Although we still forecast a narrowing of the gap between the US and the euro area going forward, growth should remain slightly supportive of the greenback, unlike interest rate differentials. Should global growth continue to be sluggish, we believe there is more scope for a decline in yields in the US given their relatively higher levels. Moreover, the ECB seems close to having exhausted all its options for easing and ECB president Mario Draghi has clearly signalled that the onus is now on fiscal measures to provide stimulus. Overall, interest rate differentials could weigh on the US dollar in the medium term. The main positive driver for the single currency remains balance of payments dynamics. The euro area’s large current account surplus and the reduction of European foreign portfolio investments are strong tailwinds for the euro. Data up to end-June show no sign that the ECB has been pushing European investors into massive buying of foreign assets. |

EUR/USD vs Leading Indicators Spread, 2006-2020(see more posts on EUR/USD, ) |

The external backdrop remains mixed for the EUR/USD rate. A potential pause in the US-China trade dispute would likely weigh on the US dollar through reduced global risk aversion. But as the euro is also increasingly seen as a global funding currency (just like the Japanese yen), the overall impact on the EUR/USD rate could be muted. Furthermore, the threat of US tariffs still looms over European goods, which could weigh on the euro.

In a nutshell, the key drivers of the EUR/USD rate point to relative stability, especially as a lot of the ‘bad news’ surrounding the euro has already been priced in. In the medium term, however, the narrowing of growth and interest rate differentials should eventually favour some modest euro appreciation against the US dollar. Fundamental valuation measures also suggest that the path of least resistance remains a decline in the US dollar

Our projections of USD1.10 (in three months), USD1.13 (in six months) and USD1.14 (in 12 months) for the euro therefore remain unchanged.

Tags: euro dollar exchange rate,euro dollar rate,Featured,Macroview,newsletter,USD weakness