In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market. The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak global growth picture and ongoing trade policy uncertainty. We see the Fed remaining particularly sensitive to the weak global manufacturing picture, even if there is potentially some progress on the US-China trade front. Powell particularly noted the tariff increases on Chinese imports announced in

Topics:

Thomas Costerg considers the following as important: 2.) Pictet Macro Analysis, 2) Swiss and European Macro, Featured, Macroview, newsletter, US Federal Reserve, US monetary policy, US rate cuts, US repo rates

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market. The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak global growth picture and ongoing trade policy uncertainty. We see the Fed remaining particularly sensitive to the weak global manufacturing picture, even if there is potentially some progress on the US-China trade front. Powell particularly noted the tariff increases on Chinese imports announced in August. From media reports, Powell does not seem to have alluded to a potential trade ‘truce’ as bilateral talks restart in early October. |

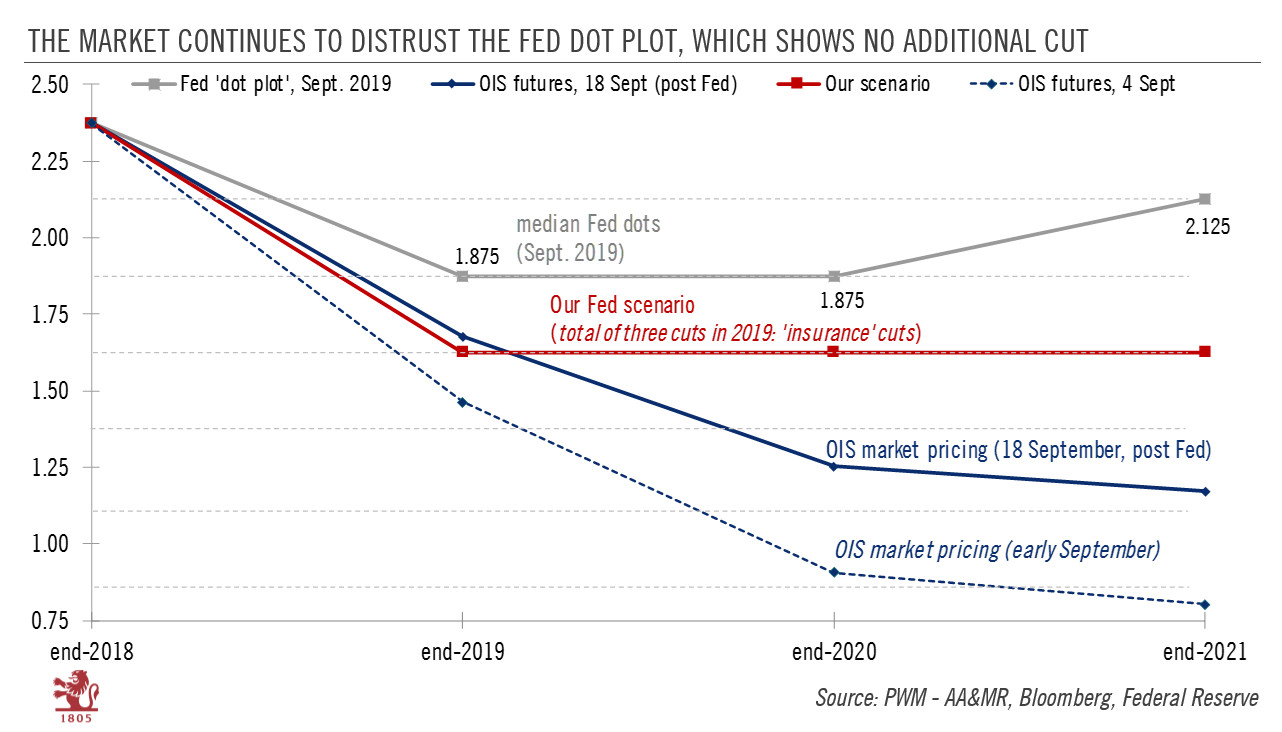

The Market Continues to Distrust the FED Dot Plot, Which Shows no Additional cut, 2018-2021 |

The Fed remained confident about the US growth outlook, however, and still sees no recession. Powell underscored that the US economy has performed “roughly as expected” since the last meeting in July. Implicitly, he downplayed the very weak manufacturing ISM survey for August, as well as the recent softening in monthly job growth.

Several Fed policymakers (but not the majority) expected a third rate cut before year’s end. Indeed, Powell, referring to the “successful” insurance rate cuts pushed through by then Fed chairman Alan Greenspan in the 1990s, who explained at the time that cutting rates would help to boost the economy via “higher asset prices”. This why we think Powell may go for a third rate cut at the next Fed meeting on 30 October.

President Trump’s interference continues to pile pressure on the Fed to cut rates further, although Powell underscored that the central bank remained independent from political influence.

Powell sounded dismissive of the recent tumult in the overnight repo market, saying that the recent stress had “no implication” for US monetary policy or the growth outlook. Nonetheless, he opened the door to boosting the level of bank reserves at the Fed (which will likely happen via fresh Treasury purchases)—potentially as soon as the next Fed meeting if liquidity issues persist. However, the Fed chairman was careful to frame any move in this direction as mostly a technical matter rather than the beginning of ‘quantitative easting phase 4’.

Tags: Featured,Macroview,newsletter,US Federal Reserve,US monetary policy,US rate cuts,US repo rates