According to Eurostat’s preliminary figures, euro area GDP grew by 0.2% quarter on quarter in Q3, the same pace as in Q2 and in line with our expectations. Country wise, France, Italy and Spain grew at the same pace in Q3 as in Q2. In particular, household and investment spending grew at a solid pace in both France and Spain. The preliminary GDP figure for Germany will not be released until 14 November. But based on the country data released so far and assuming stable growth for other euro area countries that have not yet published their Q3 estimates, we think German GDP was broadly flat in Q3. Risks are nevertheless tilted to the downside and even if Germany avoids a ‘technical recession’ (two consecutive quarters of negative growth), the country’s economy is

Topics:

Nadia Gharbi considers the following as important: 2.) Pictet Macro Analysis, 2) Swiss and European Macro, Eurozone Gross Domestic Product, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

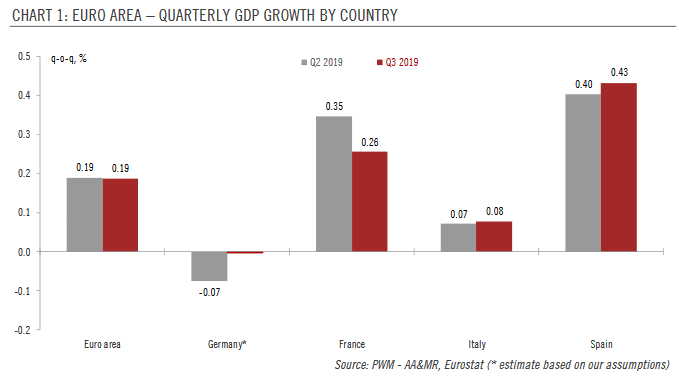

| According to Eurostat’s preliminary figures, euro area GDP grew by 0.2% quarter on quarter in Q3, the same pace as in Q2 and in line with our expectations.

Country wise, France, Italy and Spain grew at the same pace in Q3 as in Q2. In particular, household and investment spending grew at a solid pace in both France and Spain. The preliminary GDP figure for Germany will not be released until 14 November. But based on the country data released so far and assuming stable growth for other euro area countries that have not yet published their Q3 estimates, we think German GDP was broadly flat in Q3. Risks are nevertheless tilted to the downside and even if Germany avoids a ‘technical recession’ (two consecutive quarters of negative growth), the country’s economy is undoubtedly sagging. Looking ahead, surveys painted a relatively gloomy picture of the euro area economy at the start of Q4. The more domestically focused service sector remains resilient and the main driver of euro area expansion, but countries more reliant on manufacturing continue to be hit hard by geopolitical uncertainties, Brexit and trade frictions. Nevertheless, there are some encouraging signs that the deterioration in manufacturing is tailing off. |

Euro Area Quarterly GDP growth by Country |

Although we rule out any immediate recession, risks to our GDP growth forecast of 1.0% in 2019 and 1.1% in 2020 are tilted to the downside. The resilience of domestic demand has prevented the economy from slipping into a more severe downturn so far, but we are seeing increasing signs of spillover from the industrial slump into domestic services and jobs. Counterbalancing this are the European Central Bank’s (ECB) accommodative monetary stance and the modest fiscal stimulus planned by a majority of euro area governments.

While core inflation in the euro area surprised to the upside in October, we do not see it picking up significantly ahead. We forecast headline inflation to average 1.2% in 2019 and 1.4% in 2020, with core inflation at 1.0% and 1.2%, respectively. However, downside risks to our inflation outlook have risen.

On the monetary policy front, given the slow recovery in underlying inflation, we expect the ECB’s QE programme to continue for at least two years, and negative rates to be normalised towards the second half of Christine Lagarde’s term.

Tags: Eurozone Gross Domestic Product,Featured,newsletter