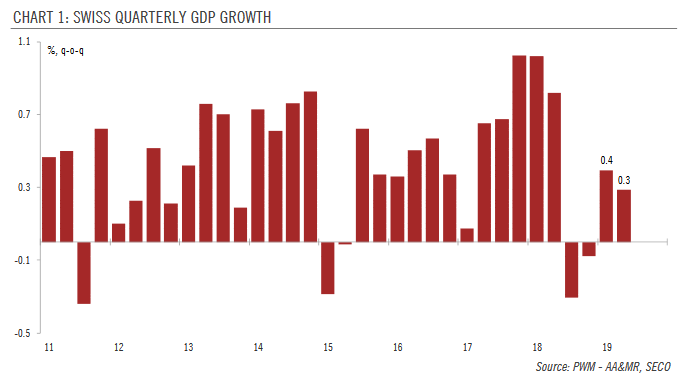

We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings. Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy. Previous quarters were revised down and now show that Switzerland was in a technical recession in H2 2018. Unlike other European countries, manufacturing contributed positively to growth in Switzerland in Q2—but the devil is in the detail. The solid performance of manufacturing was mainly due to one segment—chemicals and pharmaceuticals, which is less sensitive to exchange rate movements

Topics:

Nadia Gharbi considers the following as important: 2.) Pictet Macro Analysis, 2) Swiss and European Macro, Featured, Macroview, newsletter, Swiss GDP, Swiss National Bank

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings. Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy. Previous quarters were revised down and now show that Switzerland was in a technical recession in H2 2018. Unlike other European countries, manufacturing contributed positively to growth in Switzerland in Q2—but the devil is in the detail. The solid performance of manufacturing was mainly due to one segment—chemicals and pharmaceuticals, which is less sensitive to exchange rate movements and the economic cycle than others. Other industry sectors, specifically machinery and metals, reported declining turnover. The escalation of trade tensions led us to revise down our euro area GDP growth forecast this summer. As a small and open economy, Switzerland is particularly affected by weakening global demand and geopolitical uncertainties. Hence, we are also lowering our Swiss GDP forecast—to 0.8% for 2019 from 1.3%. The downgrade in part reflects the downward revision of GDP growth in prior quarters, which mechanically lowers annual 2019 GDP growth. |

Swiss Quarterly GDP Growth, 2011-2019 |

Given slowing growth and a strong currency, the Swiss National Bank (SNB) will be facing high expectations of a policy rate cut at its next monetary policy assessment meeting on 19 September. But we believe that the SNB will be reluctant to cut rates in direct response to ECB easing, especially if the ECB rate cut widely expected this week is only 10 basis points (bps), as per our baseline scenario. Instead, we believe that the SNB could respond to upward pressure on the CHF through foreign exchange interventions rather than through a policy rate cut.

Since mid-July, the Swiss franc’s appreciation has prompted the SNB to intervene repeatedly in the forex market, leading to a large increase in commercial banks’ sight deposits held at the SNB (an indicator of the central bank’s forex interventions). This may have reduced the need for a rate cut. Nonetheless, it is a close call whether the SNB goes for a rate cut at the 19 September meeting, especially if the ECB cuts the rate on its deposit facility by more than 10 basis points.

Tags: Featured,Macroview,newsletter,Swiss GDP,Swiss National Bank