While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic. All it took was a Powerpoint presentation,...

Read More »Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic. All it took was a Powerpoint presentation, some computer programming expertise and a “research” report,...

Read More »Is The Swiss National Bank A Fraud?

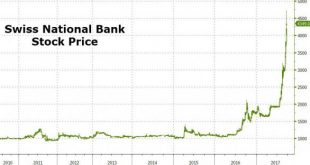

The price of shares in The Swiss National Bank is up 11 days in a row, soaring 150% in the last two months. SNB Stock Price, 2010 - 2017(see more posts on Swiss National Bank Stock, ) - Click to enlarge That sounds like a ‘tulip’ bubble-like ‘fraud’… Bitcoin and SNB, 2013 - 2017(see more posts on Bitcoin, Swiss National Bank Stock, ) - Click to enlarge The SNB is up over 120% in Q3 so far – more than double...

Read More »Here Are The Best Hedges Against A Le Pen Victory

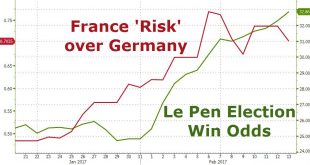

On Friday, after it emerged that as part of Marine Le Pen’s strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would “amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012,...

Read More »Davos Elite Eat $40 Hot Dogs While “Struggling For Answers”, Cowering in “Silent Fear”

For those unfamiliar with what goes on at the annual January boondoggle at the World Economic Forum in Davos, here is the simple breakdown. Officially, heads of state, captains of industry, prominent academics, philanthropists and a retinue of journalists, celebrities and hangers-on will descend Tuesday on the picturesque alpine village of Davos, Switzerland, for the World Economic Forum. Unofficially, it’s the world’s...

Read More »Credit Suisse Settles With DOJ For $5.3 Billion; Will Pay $2.5 Billion Civil Penalty

Shortly after last night’s news that Deutsche Bank had settled with the DOJ for $7.2 billion, of which it would pay $3.1 billion in a civil penalty, far lower than the $14 billion number initially speculated (the stock popped as much as 4% before settling just over 2% higher currently), Credit Suisse likewise closed the books on its pre-crisis RMBS fraud when the largest Swiss bank agreed to pay $5.28 billion to...

Read More »Negative Consumer Financing Rates in Germany, Soon More Negative in Switzerland?

Negative Consumer Financing Rates in Germany Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one’s means. Curiously, it was just a month ago when an...

Read More »Global Stocks Slide, S&P Set To Open Red For The Year As Hawkish Fed Ignites “Risk Off”

After yesterday's algo-driven mad dash to close the S&P green both for the day and for the year following Fed minutes that came in shocking hawkish, the selling has continued overnight, led by the commodity complex as rate hike fears have pushed oil back down some 2% from yesterday's 7 month highs, which in turn has dragged global stocks lower to a six-week low, while pushing bond yields higher across developed nations as the market suddenly reprices the probability of a June/July rate...

Read More »Japan Banks May Soon Pay Borrowers To Take Out Loans

Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one's means. Curiously, it was just a month ago when an offer was spotted in Germany offering a negative -1% rate on small consumer loans issued by Santander Bank. ...

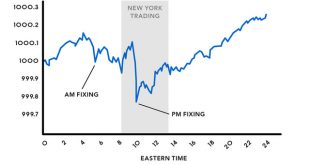

Read More »Every Single Bloody Market Is Manipulated … See For Yourself

Gold and Silver Are Manipulated Deutsche Bank admitted today that it participated with other big banks in manipulating gold and silver prices. In 2014, Switzerland’s financial regulator (FINMA) found “serious misconduct” and a “clear attempt to manipulate precious metals benchmarks” by UBS employees in precious metals trading, particularly with silver. Reuters reported: Swiss regulator FINMA said on Wednesday that it found a “clear attempt” to manipulate precious metals benchmarks during...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org