In a CEPR discussion paper Christian Bayer, Chi Kim, Alexander Kriwoluzky analyze redenomination risk during the European debt crisis and how the European Central Bank’s interventions affected this risk. They conclude that the risk fell in the case of Italy but increased for France and Germany. From the abstract: … first estimate daily default-risk-free yield curves for French, German, and Italian bonds that can be redenominated and for bonds that cannot. Then, we extract the compensation...

Read More »Currency Denomination Risk in the Euro Area

In the FT (Alphaville), Marcello Minnena explains what type of currency denominations of Euro area sovereign debt constitute credit events; and how markets assess the risk of such denominations. After the Greek default in 2012 new ISDA standards entered into force: contracts made since 2014 protect against euro area countries redenominating their debt into new national currencies [unless the debt is redenominated] into a reserve currency: the US dollar, the Canadian dollar, the British...

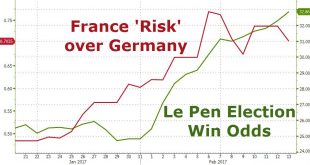

Read More »Here Are The Best Hedges Against A Le Pen Victory

On Friday, after it emerged that as part of Marine Le Pen’s strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would “amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012,...

Read More »Re-Denomination Risk in France and Italy

On the FT Alphaville blog, Mark Weidemaier and Mitu Gulati argue that re-denomination risk in the Euro zone is most prominent in France and Italy. Bonds with CACs trade at higher prices. Most French and Italian [but not Greek] debt is governed by local law. … the governments could pass legislation redenominating their bonds from euros to francs or lira. … [But] some French and Italian bonds — bonds issued after January 1, 2013, with maturities over a year — have Collective Action Clauses...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org